PEPE's on-chain metrics indicate potential rally after weeks of silence

- PEPE has struggled to see any significant price move after reaching an all-time high in May.

- Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon.

- A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

PEPE is down nearly 1% on Tuesday, as key on-chain metrics indicate the meme coin could be set for a rally after weeks of relative sideways movement.

PEPE to break out from week-long silence

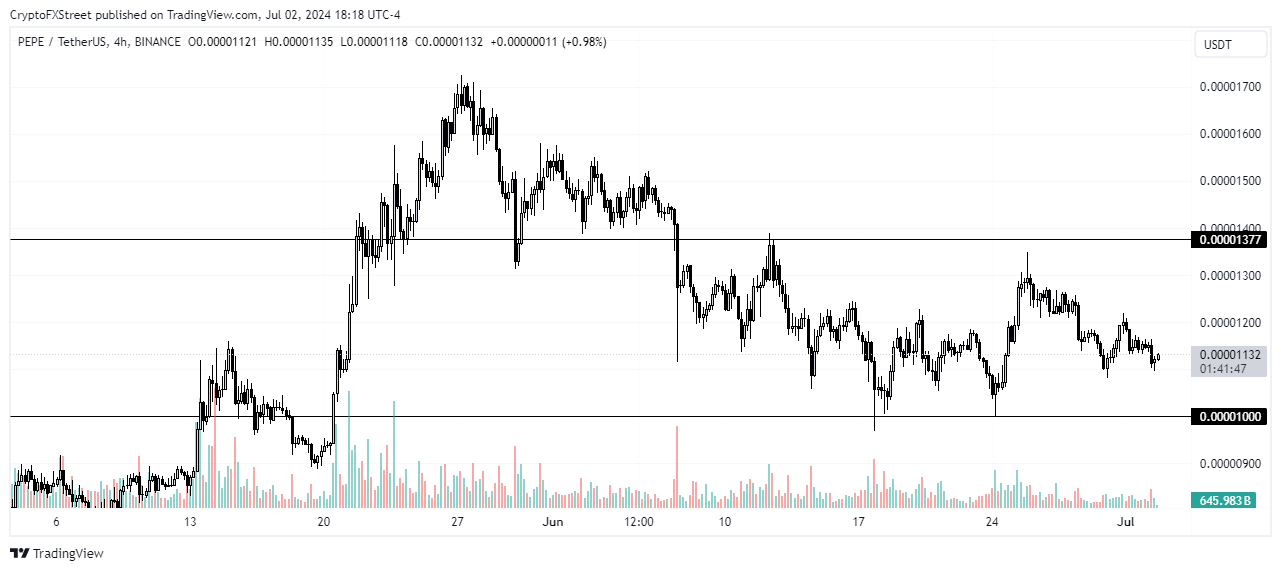

PEPE is down over 34% from its May 27 all-time high of $0.000017. In the past month, it has struggled to establish a clear price trend, having a mix of several short-term upward and downward movements.

According to data from IntoTheBlock, PEPE's NVT ratio of 56.25 also aligns with investors' uncertainty displayed in its price movement.

The network value-to-transaction (NVT) ratio helps predict whether a project is overvalued or undervalued. A spike in NVT signals overvaluation and potential correction, while a bottom in NVT is considered undervaluation and a bullish sign.

An NVT at 56.25 shows investors have mixed sentiment concerning PEPE.

PEPE's transaction volume has also been declining for more than a week. It reached $56.23 million on June 29 before recovering slightly to $81.29 million on Monday.

Low volume often indicates exhaustion from bulls and bears. This is also evident in PEPE's transaction count by size. Transactions >10K declined by about 38% in the past 30 days.

Considering that most analysts predict that the bull cycle is yet to reach its peak, PEPE's current horizontal trend may be a good buying opportunity in anticipation of a rally.

While PEPE has been relatively quiet, its new adoption rate has increased significantly in the past few days, reaching 58.49% on Monday — its highest level in the past year. In addition, PEPE's daily active addresses have increased by more than 105% in the past seven days.

The increased adoption rate and daily address while prices are relatively stagnant also indicate that PEPE may be prepping for a rally.

[23.36.14, 02 Jul, 2024]-638555581214827596.png)

PEPE Price, MVRV & DAA

PEPE's 30-day market value to realized value (MVRV) ratio at -9% per Santiment data also helps point out where prices may go. The ratio indicates that all addresses that bought the meme coin within the last 30 days have had an average loss of 9.29%. Investors consider an MVRV ratio below one as a potential buy opportunity. As we can see from the chart above, PEPE's 30-day MVRV has stayed below one for close to a month.

A notable whale activity today also supports bullish expectations for PEPE. According to Whale Alerts, someone moved 1.1 trillion PEPE worth about $14.7 million from Binance to an unknown wallet.

In the short term, PEPE may look to recover the $0.000013 price level — where investors purchased more than 34 trillion PEPE tokens — before tackling the resistance at $0.00001377.

PEPE/USDT 4-hour chart

A breach of the $0.000010 support level would invalidate the bullish thesis.