Solana meme coins rally with double-digit gains, Keith Gill sued for securities fraud

- Keith Gill, the trader popular as Roaring Kitty, is slapped with a lawsuit for allegedly orchestrating GME stock pump and dump.

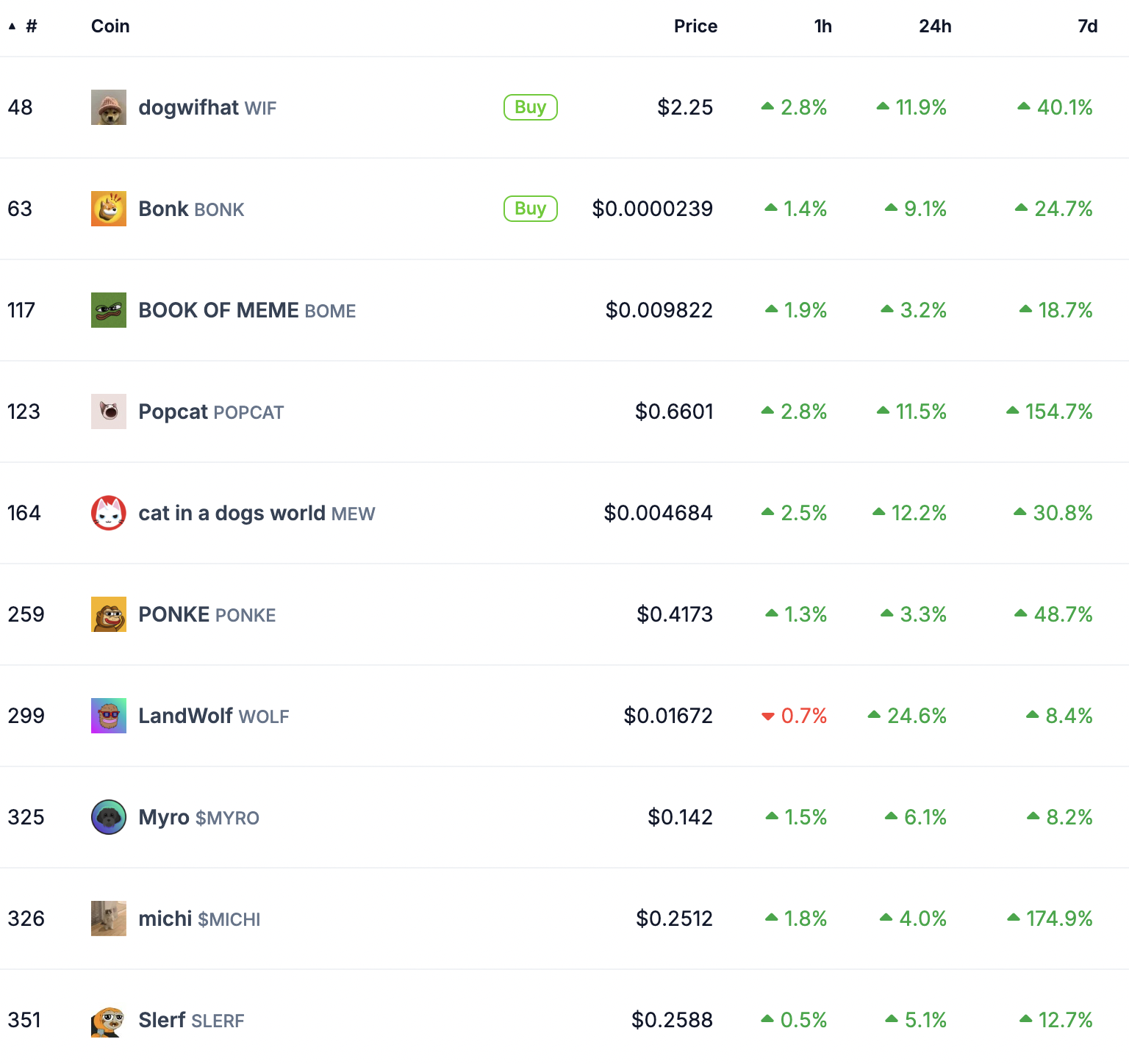

- Solana meme coins have posted double-digit gains in past 24 hours. WIF, BONK, MEW, WOLF rallied.

- Solana meme coins and large market cap meme tokens had posted gains alongside GME stock following Gill’s return to X in May.

Keith Gill, popular as Roaring Kitty, the trader behind the alleged GameStop (GME) stock pump and dump has been slammed with a class action lawsuit. The plaintiff accuses Gill of orchestrating a pump-and-dump scheme and failed to disclose his purchase and sale of GameStop options in May 2024.

The lawsuit was filed on June 28. Crypto traders are expected to closely monitor developments in the lawsuit as Solana-based and large market cap meme coins rallied alongside GME stock.

Solana-based meme coins have noted a resurgence on Monday with Dogwifhat (WIF), Popcat (POPCAT), cat in a dogs world (MEW), LandWolf (WOLF) have noted double-digit gains in the past 24 hours.

Solana meme coins rally while Roaring Kitty faces securities fraud allegations

Keith Gill is being sued for alleged “pump and dump” or manipulation of GME stock. The June 28 lawsuit was filed at the US District Court for the Eastern District of New York.

Gill faces charges of financial fraud allegedly orchestrated through a series of social media posts starting May 13. The plaintiff who filed the class action is represented by the law firm Pomerantz and alleges that he was “harmed” after purchasing 25 shares and three call options of GME in May.

The crypto community has had mixed reactions to the news. Solana-based meme coins started rallying in the past 24 hours. Several Solana-based memes have noted double-digit gains, and most others have been close to 10% higher in the past 24 hours, per CoinGecko data.

Solana-based meme coins

Attorney Eric Rosen believes the lawsuit against Gill is “unlikely to succeed.” In his analysis, Rosen argues that “the entire nature of securities fraud is that the fraudster either lies to you, misleads you by failing to disclose something, or omits to disclose something material that they are required to disclose. Here, Gill disclosed he had purchased options with a June 21, 2024 expiration date. Any reasonable person, let alone a reasonable investor, would have understood that Gill would be selling such a large position or exercising the options.”

@TheRoaringKitty was sued Friday night for securities fraud based on (ridiculous) allegations that he failed to disclose his intent to sell his call options to his Twitter and Reddit followers. Read our analysis below - we think the complaint is unlikely to succeed.…

— Eric Rosen (@ericrosenMAlaw) June 30, 2024