Binance starts monitoring these eleven tokens that are riskier than other cryptocurrencies

- Binance announced that it will add watch tags to eleven crypto tokens on July 1.

- BAL, CTXC, CVP, CVX, DOCK, HARD, IRIS, MBL, POLS, SNT, and SUN likely have higher volatility and risks than other tokens.

- Binance’s native token BNB held steady at around $585 on Monday, most of the SEC lawsuits against the exchange remain.

Binance, one of the largest crypto exchanges by trade volume, is planning to close monitoring with the risk of delisting from exchange several tokens that it deems more volatile and riskier than other cryptocurrencies. The exchange listed the tokens in an official announcement and attached a watch tag to these assets on July 1.

Binance is faced with a lawsuit by the US Securities and Exchange Commission (SEC). A bulk of the charges made against the exchange were allowed to proceed in a recent development on Friday, June 28.

BNB, the exchange’s native token, is holding steady at around $585 on Monday at the time of writing.

Binance watches “risky assets”, likely to delist these tokens

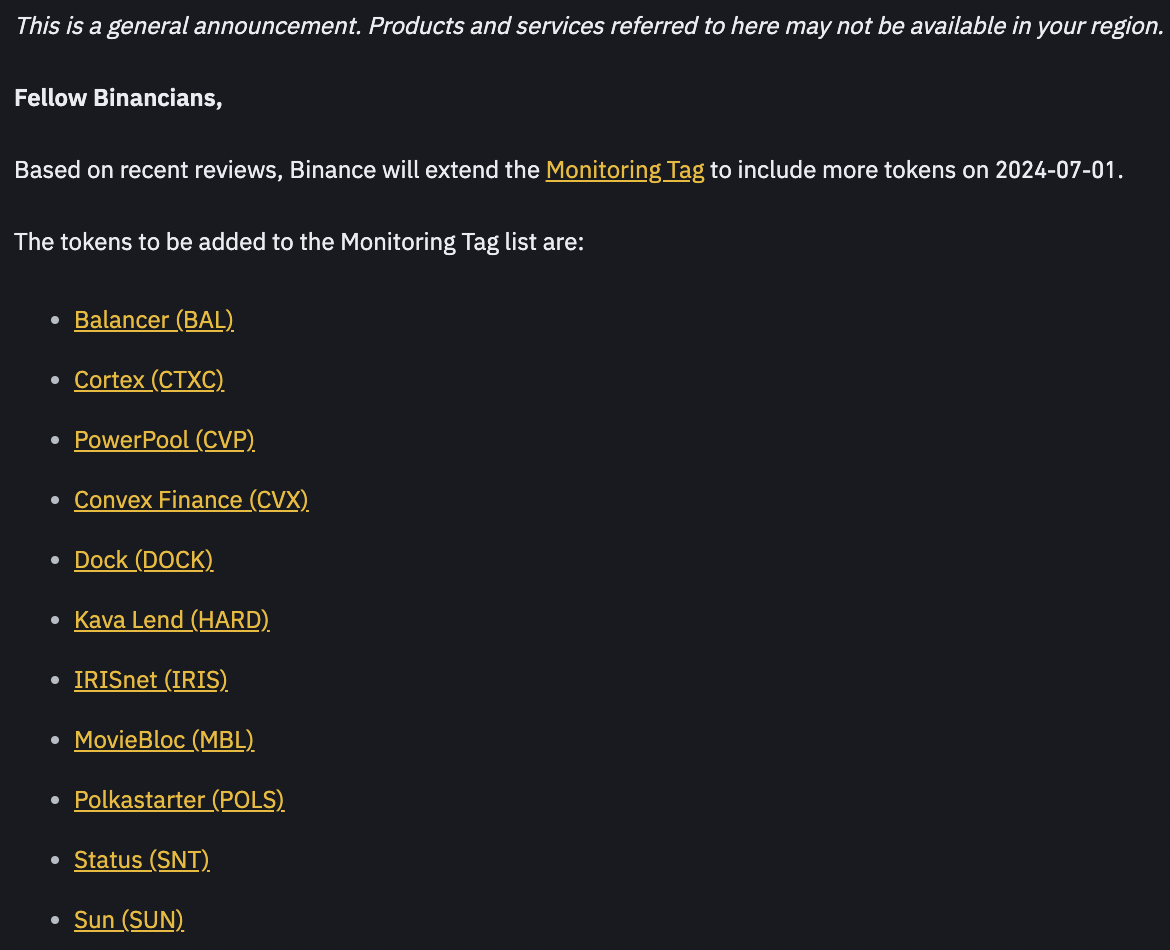

In an official announcement, Binance noted that based on its recent reviews, it will extend the monitoring tag to include more tokens on July 1:

- Balancer (BAL)

- Cortex (CTXC)

- PowerPool (CVP)

- Convex Finance (CVX)

- Dock (DOCK)

- Kava Lend (HARD)

- IRISnet (IRIS)

- MovieBloc (MBL)

- Polkastarter (POLS)

- Status (SNT)

- Sun (SUN)

The tag is attached to show that trading in these assets may be riskier and more volatile than other cryptocurrencies. The exchange could delist the tokens in the list above post-monitoring and regular reviews.

Binance informs users that tokens with a monitoring tag no longer meet the listing requirements and are, therefore, at risk of being delisted at any time.

Binance announcement on July 1

The exchange reviews the token team’s commitment, level and quality of development activity, trade volume and liquidity, stability and safety from attacks, smart contract/ network stability, among other factors, when determining whether the project is worth trading on the exchange platform.

While the exchange takes steps to ensure the safety of users trading on its platform, the crypto exchange is faced with an SEC lawsuit.

SEC vs. Binance lawsuit proceeds with bulk of charges

A Reuters report shows that a Judge at the US District Court for the District of Columbia, Amy Berman Jackson, allowed a bulk of the US financial regulator’s charges against the exchange. This adds to the woes of the exchange, which agreed in November to a $4.3 billion settlement with the US Department of Justice and the Commodity Futures Trading Commission (CFTC) on several charges.

Changpeng Zhao (CZ), Binance co-founder and former CEO of the exchange, is serving time in prison while the SEC proceeds with charges of unregistered securities trading against the platform.

BNB gains nearly 1% on Monday, with the exchange’s native token trading at $585 at the time of writing.