Bitcoin Mining Cost At $86,700: Price To Surpass This Soon?

Data suggests the average cost of mining Bitcoin is standing around $86,700 right now. Here’s what history suggests could happen next for BTC.

Bitcoin Average Mining Cost Is Currently Notably Higher Than The Price

In a new post on X, analyst Ali Martinez has talked about how the average mining cost of BTC is looking like right now. The Bitcoin network runs on a consensus mechanism based on the “proof-of-work” in which validators called the miners compete against each other using computing power to get to hash the next block on the chain.

This computing power naturally has its running cost, with electricity being the most notable expense that the miners have to pay, given that it’s a perpetual cost. The incentive for spending capital on mining operations lies in the block rewards that these validators receive upon successfully adding the next block.

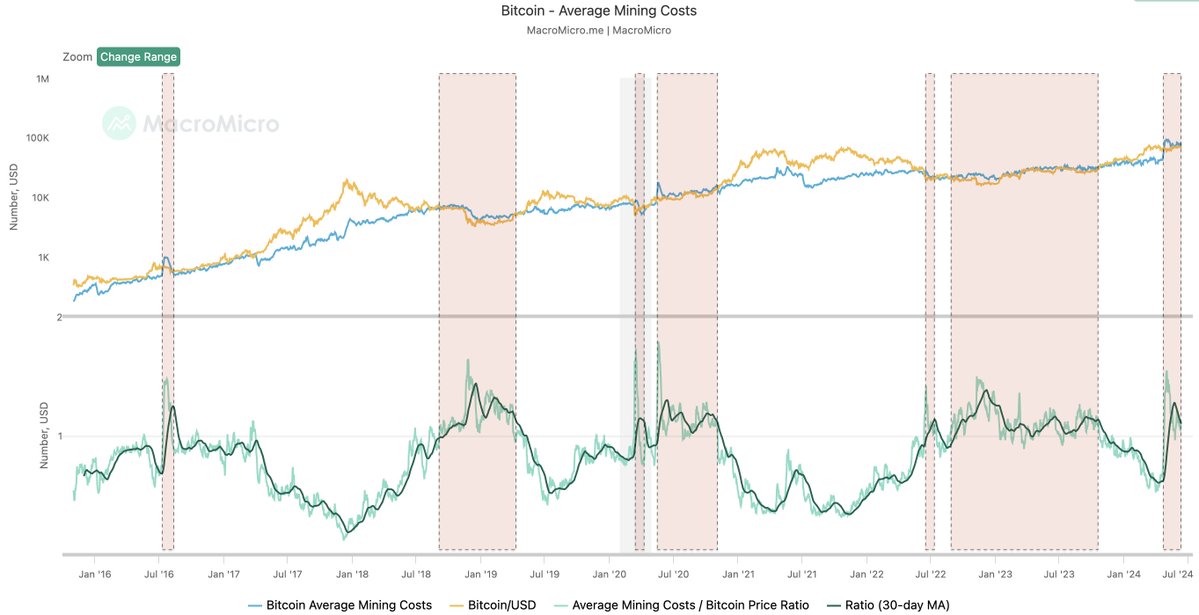

Obviously, mining expenses are different depending on location, as electricity prices aren’t the same everywhere. As such, the chart that Ali has cited from MacroMicro uses data provided by the Cambridge University on BTC electricity consumption to find out an average value.

Below is the chart in question, which shows how the average mining cost on the Bitcoin network has changed over the past few years.

As is visible in the above graph, the Bitcoin average mining cost (colored in blue) had been below the price of the cryptocurrency earlier in the year, but recently, the former’s value has spiked and has surpassed the latter’s.

The reason behind this sudden increase is that there is another variable at play when calculating the average cost of mining Bitcoin: the Issuance, or the number of tokens that the miners are minting daily.

In general, the block rewards stay fixed both in value and frequency, so the Issuance of the network, which is nothing else than the sum of the block rewards mined in a day, more or less remains fixed as well.

Specific events, however, don’t abide by this. They are the Halvings. These periodic events that take place approximately every four years permanently slash the block rewards in half.

The latest such event, the fourth ever in the cryptocurrency’s history, occurred back in April. Naturally, the Halvings mean that the cost of mining 1 BTC drastically goes up, as miners only get half as many rewards as before after doing the same amount of work.

Thus, it’s not surprising that the cost of production for the coin observed a sharp increase coinciding with the latest Halving. At present, this metric stands at $86,700, meaning that according to MacroMicro’s model, the average miner would be underwater.

Based on the past trend of the indicator, Ali has identified a pattern that Bitcoin has always followed. “Historically, BTC always surges above its average mining cost!” notes the analyst.

As such, if this pattern continues to hold for the current cycle as well, then it may only be a matter of time before Bitcoin surges past the $86,700 mark.

BTC Price

Bitcoin has gone through a drawdown of more than 5% recently, which has brought its price under the $66,000 level.