Ethereum sustains week-long consolidation, sees over $3 billion exodus from exchanges

- Ethereum saw increased outflows from crypto exchanges in the past seven days as investors anticipate spot ETH ETF launch.

- Ethereum funds finish second consecutive week of net inflows totaling $33.5 million.

- Ethereum will likely sustain a horizontal move until the SEC gives clarity on when spot ETH ETFs will launch.

Ethereum (ETH) sustained a week-long horizontal trend on Monday following massive exchange outflows in the past seven days, which coincided with increased ETH fund inflows.

Daily digest market movers: ETH exchange outflows

Ethereum on-chain data reveals key insights into how investors are preparing ahead of spot ETH ETFs' launch. Here are the latest news surrounding the number one altcoin:

- As the potential launch of spot ETH ETFs draw closer, exchanges are experiencing huge outflows of Ethereum, similar to that of Bitcoin when the SEC approved spot BTC. According to data from CryptoQuant, Kraken experienced outflows totaling about 572,100 ETH, equivalent to $2.15 billion. This marks the first time Kraken's ETH reserve has fallen below 1 million ETH since 2016.

CryptoQuant's exchange netflow also shows that over 850,000 ETH worth about $3 billion have left crypto exchanges in the past week. The large size indicates that the majority of the outflows may be from institutions accumulating coins in anticipation of a potential ETH rally.

- All Exchanges-638530338809178614.png)

ETH 1-week Exchange Netflow

Read more: Ethereum on-chain and derivatives data indicates bullishness following updated ETH ETF S-1s from issuers

- According to data from CoinShares, Ethereum funds recorded a second consecutive week of net inflows totaling $33.5 million as the Securities & Exchange Commission’s (SEC) positive tone shift toward the second altcoin has renewed investor confidence.

"This represents a turnaround in investor sentiment in an asset that had seen a 10-week run of outflows prior, totalling US$200m," wrote James Butterfill, Head of Research at CoinShares.

- Meanwhile, ETH liquidation data shows long liquidations sit at $34.6 million compared to $7.8 million of shorts. This indicates that the recent price movement tilts more toward bearish traders.

ETH technical analysis: Ethereum may continue consolidation

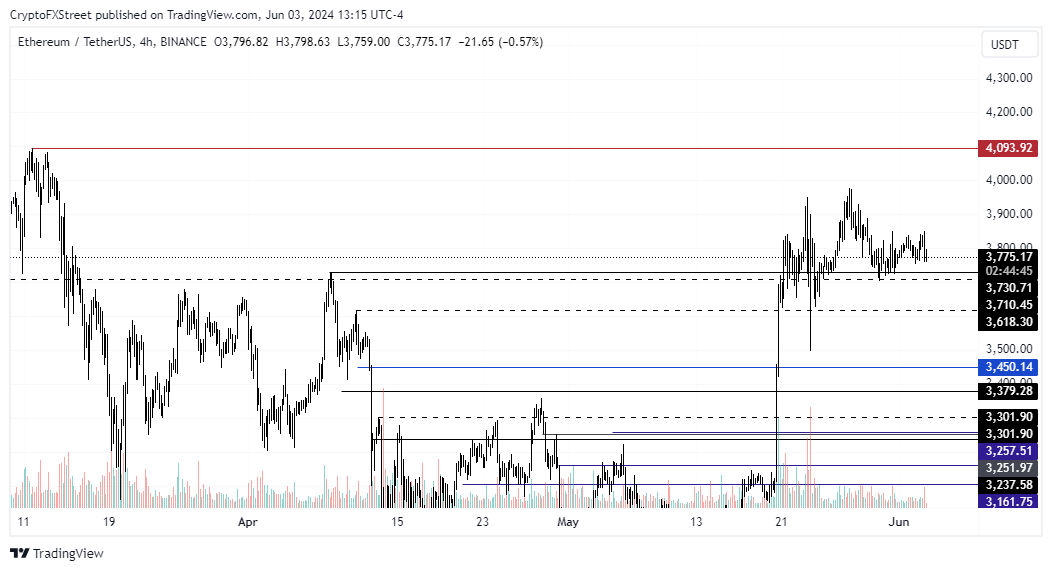

Ethereum is trading around $3,786 on Monday after a week-long sideways trend. ETH's consolidation signifies it may be gathering momentum to leap to a new high when spot ETH ETFs go live.

ETH's 30-day MVRV has also declined to 6.5%, indicating a potential buying opportunity ahead of the launch of spot ETH ETFs.

The MVRV ratio calculates the average profit or loss of all addresses holding a particular cryptocurrency. A higher ratio signifies that most addresses are in profit, while a lower ratio signifies that they're in loss.

Also read: Ethereum price lags, investors potentially reallocating capital after BlackRock's updated S-1 filing

The $3,710 support has shown strength in the past week, weathering potential dips. It could prove critical in the wait for spot ETH ETFs' launch. In the short term, ETH will likely trade sideways until the market gets a clear date for the launch.

ETH/USDT 4-hour chart

The launch could catapult ETH to break the $4,093 resistance and rally more than 29% to set a new all-time high above $4,878.

The bullish thesis will be invalidated if ETH falls below the $3,618 support.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.