Arkham price primed for a recovery rally ahead of OpenAI’s announcement

- Arkham price eyes a potential reversal as it clears key hurdles.

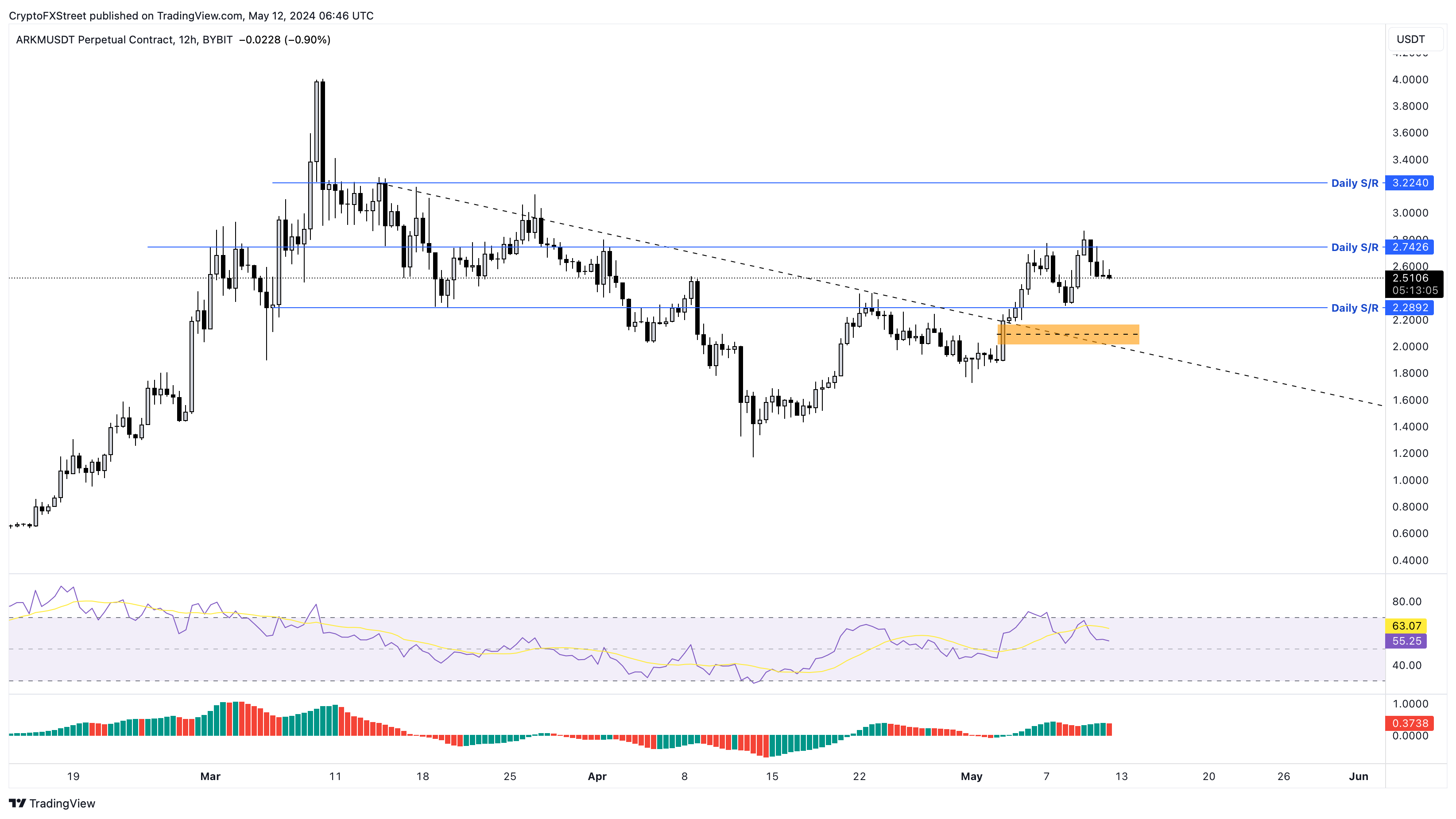

- ARKM likely to rally 27% if it can overcome $2.74 resistance level.

- A breakdown of $2.28 wil invalidate the bullish thesis for the AI-based token.

Arkham (ARKM) price could benefit from the OpenAI’s Friday tweet which suggests that the company will announce in their live stream “ChatGPT and GPT-4 updates.” Sam Altman, the CEO of OpenAI furhter clarified in a subsequent tweet that this announcement will not be related to GPT-5, as many in the industry are anticipating with bated breath.

not gpt-5, not a search engine, but we’ve been hard at work on some new stuff we think people will love! feels like magic to me.

— Sam Altman (@sama) May 10, 2024

monday 10am PT. https://t.co/nqftf6lRL1

Arkham price shows strength

Arkham price has breached the declining trend line, which represented the downtrend, indicating the start of a potential reversal. Since overcoming this declining resistance level, ARKM has shot up 32% to set up a local top at $2.86 but currently trades at $2.51.

Even before the upcoming OpenAI announcement on Twitter, Arkham price seems to have performed better than most altcoins. Therefore, if OpenAI announces a new development in the field of AI, it could positively impact AI-based altcoins like ARKM, Worldcoin (WLD), SingularityNET (AGIX) and so on.

From a technical point of view, Arkham price needs to bounce off $2.28 support level and overcome the $2.74 hurdle. If ARKM can flip the latter level into a support floor, it will open the path for a retest of $3.22, constituting a 27% gain.

The Relative Strength Index (AO) and Awesome Oscillator (AO) are both above their respective mean levels of 50 and 0, indicating a strong bullish momentum’s presence. Going forward, RSI and AO might both dip below the mean levels as seen in late April, allowing sidelined buyers an opportunity to accumulate before ARKM takes off.

Also read: Dogecoin’s dilemma offers day traders opportunity to scalp DOGE

ARKM/USDT 12-hour chart

On the other hand, if Arkham price fails to bounce off the $2.28 support level, it would indicate a disinterest in buyers at the current level. This lack of buying pressure will be the first sign of weakness and would likely be followed by a 12-hour candlestick close below $2.28, flipping the foothold into a resistance level.

Such a development will invalidate the bullish thesis and potentially trigger an 8% drop to retest the $2.00 to $2.17 imbalance. Interestingly, this zone also harbors the declining trendline and will serve as a great reversal zone, should the bulls decide to make a comeback.

Also read: Cardano Price Forecast: ADA sets the stage for a 20% rally