Sui daily transactions reach 41 million, overtakes Solana with SUI price primed for recovery

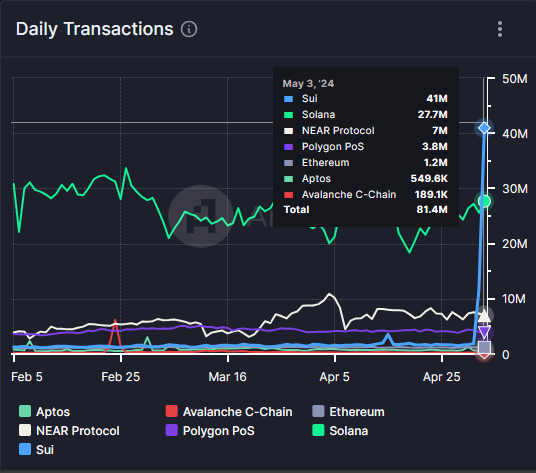

- Sui blockchain daily transactions have reached 41 million relative to 27 million recorded by Solana.

- On a normal day, SUI records 1-2 million transactions daily, while SOL ranges anywhere between 20-35 million, Artemis dashboard shows.

- SUI price could execute a bullish reversal pattern despite current bearish outlook.

Sui (SUI) price has dipped 3 % in the past 24 hours and remains down 15% in the last week. However, other metrics suggest something could be at play in the Sui ecosystem as daily transactions skyrocket.

Also Read: Sui soars nearly 12% after partnership with BytePlus

Sui daily transactions skyrocket

Despite the bearish outlook seen in the Sui price, daily transactions soared to $40.96 million. With the spike, the Sui chain has overtaken the Solana (SOL) blockchain, which remains at 27.68 million.

When daily transactions skyrocket on a blockchain, it points increased activity and usage of the network. It may indicate various factors, including but not limited to growing adoption of the token, increased trading volume, or the launch of new decentralized applications (dApps) running on the blockchain.

Blockchain daily transaction comparison

However, there are also some negative implications to a surge in daily transactions. These include:

Network congestion

It could cause delays in transaction confirmations and higher fees with users competig to have their transactions processed quickly.

Scalability concerns

Scalability issues are more common during periods of peak activity because not all blockchain networks are similar in terms of capacity to handle large volumes of transactions efficiently.

Security risks

With sudden surges in transactions, the risks of security threats tend to increase. Among them, double-spending attacks or bad actors taking advantage of network vulnerabilities.

Based on the chart below, the Sui chain records an average of 1-2 million transactions daily, while SOL ranges anywhere between 20-35 million.

Daily transactions comparison by chain

This means something could be happening on the network, but remains under the wraps, as the Sui network did not respond immediately to FXStreet request for comment.

Nevertheless, the surge comes just about two weeks after Sui partnered with BytePlus, the technology arm of ByteDance. The collaboration is intended to bring the firm’s services to Web3, potentially giving rise to innovative Web3 gaming and social apps.

@EmanAbio and Long Li, BytePlus Regional Manager, announced this new partnership onstage at Sui Connect Dubai today.

— Sui (@SuiNetwork) April 17, 2024

BytePlus will explore data warehousing, content recommendation, content generation, and augmented reality in Web3 game platforms and socialFi projects in… pic.twitter.com/hrjTQBTsqz

It also comes just under a month after Hong Kong-based first digital's $3 billion stablecoin FDUSD arrived to Sui network as part of a DeFi push. The integration is part of an effort to make the token more embedded into the decentralized finance space, First Digital's CEO Vincent Chok said in an interview.

Why SUI price could be primed for recovery

At the time of writing, the Sui price is trading for $1.0594, and while it remains in a broadly bearish technical formation, a bullish reversal could take place soon, with two fundamentals pointing to this effect.

- Sui price is almost filling a descending/falling wedge pattern, which could precede a bullish breakout.

- The Relative Strength Index (RSI) shows that SUI token is almost oversold, which precedes a correction or pullback.

SUI/USDT 1-day chart