Bitcoin price dips to Bull Market Support Band, liquidates over $230 million in leveraged positions

- Bitcoin price crashes over 6% on Wednesday, slipping past pool of liquidity between $60,600 and $59,005.

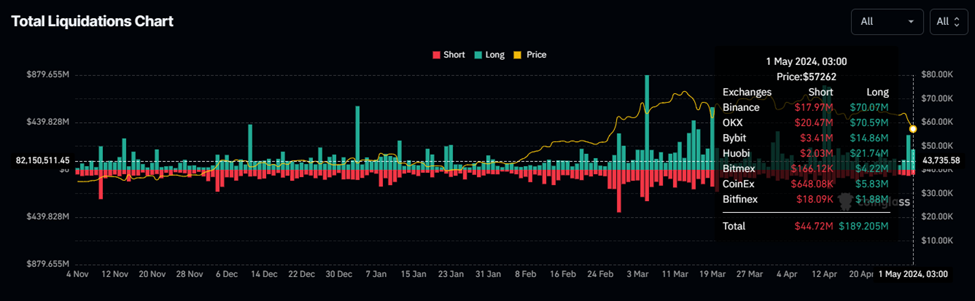

- Over $230 million worth of crypto positions have been liquidated, comprising $189 million in longs and over $40 million in short positions.

- Volatility levels are high in BTC and crypto ahead of FOMC meeting, which could turn markets.

Bitcoin (BTC) price is trading with a bearish bias, recording a steady streak of lower highs as part of a vertical chop. The dump comes ahead of the Federal Open Market Committee (FOMC) decision with markets recording surging volatility.

Also Read: Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Daily digest market movers: Bitcoin dips as liquidations soar

Bitcoin price has crashed 6% in the past 24 hours to trade for $57,495 as of press time. The dump that saw BTC slip below the pool of liquidity between $60,600 and $59,005 has caused over $230 million in total crypto positions to be liquidated across the market. This comprises $189 million in longs and $44 million in short positions. Specifically for BTC, over $80 million in longs were liquidated against $15 million in shorts.

Total liquidations

The dump comes with skyrocketing volatility attributed to a macro market event. The Federal Open Market Committee (FOMC) meeting is expected today. The best case is no change in the interest rates, but the commentary could be slightly hawkish. The Fed should be finding itself squeezed between a rock and a very hard place considering recent data showed “lack of further progress on inflation."

The April 16 reversal caught the market by surprise, considering the Fed was talking about how many rate cuts are coming this year. Now, it is a question of whether rate cuts even come at all.

The sharp crash in Bitcoin price reinforces the idea that whatever Fed Chair Jerome Powell has to say on Wednesday, it is likely priced in already.

According to Standard Chartered, however, Bitcoin could drop further to as low as $50,000. The speculation comes after the area that acted as support since early March was lost, bringing the total losses to 23.5% since the $73,777 all-time high.

❖ BITCOIN COULD DROP FURTHER TO AS LOW AS $50K, STANDARD CHARTERED SAYS

— *Walter Bloomberg (@DeItaone) May 1, 2024

Bitcoin’s (BTC) breakdown through the $60K technical level opens the way for another move lower to the $50K-$52K range, investment bank Standard Chartered said in emailed comments on Wednesday.…

Amid an ongoing flush crush, the global cryptocurrency market capitalization has dropped by 4.3% to $2.14 trillion in the past 24 hours.

Technical analysis: How far down will Bitcoin price go?

Bitcoin price’s 6% crash on Wednesday has seen the pioneer crypto test the Bull Market Support Band, which helps traders gauge potential levels of support during bullish market conditions and make informed trading decisions based on price action around these levels.

If this support band holds, Bitcoin price could bounce. However, a slip through it could see BTC extend the dump to the $50,168 support level.

Notice the lower highs on the Relative Strength Index (RSI), which is a show of falling momentum. This bearish outlook is reinforced by the red shade on the Awesome Oscillator (AO), signifying growing bearish sentiment.

Furthermore, the DXY Compare indicator is also rising, a trajectory that has historically been countercurrent with Bitcoin price. This adds credence to the bearish thesis.

BTC/USDT 1-week chart

On the other hand, it is worth noting that the Bitcoin Bull Market Support Band always serves strong support during every bull cycle of BTC. If history rhymes, BTC could wick through the support and bounce back.

— Seth (@seth_fin) May 1, 2024

The Best Time to buy #Bitcoin is when it hits Bull Market Support Band. Holding Bitcoin with no leverage is chill.

Look how many times $BTC price revisit this Band.

FOMC today at 20:00. Will be Important! I will report on the FOMC later today!

ZOOM OUT!!!! Chill!!… https://t.co/8jOaxchJe3 pic.twitter.com/MujMCuDOO7

As reported in a previous article, only a candlestick close above $72,000 would suggest Bitcoin price is out of the woods. This would set the tone for a reclaiming of the $73,777 peak of March 14, with the potential to establish a new all-time high above it.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.