What to expect from Bitcoin post halving, less than 70 blocks to go

- Bitcoin price climbed to a high of $65,000 on Friday, hours ahead of the BTC halving event.

- Bitcoin halving countdown timer shows that the mining difficulty adjustment is 64 blocks away.

- Large holders and ETFs slow down their BTC acquisition and anticipate volatility around the halving.

Bitcoin (BTC) halving is a mining difficulty adjustment that halves the reward for mining a BTC block once every 210,000 blocks, which is roughly every four years. With the event less than 70 blocks away, BTC price has recovered from its Wednesday low below $60,000.

BTC price reached a high of $65,000 on Friday, covering lost ground as Bitcoin prepares for the halving event.

How Bitcoin price will react to the halving

Bitcoin price suffered nearly 20% decline from its new all-time high of $73,777 on March 14 to its April 19 low of $59,600. As the halving draws close, Bitcoin price recovered and made a comeback above $65,000.

Fortune reports that experts believe there may be an immediate “buy the rumor, sell the news” effect on price. Vetle Lunde, senior analyst at K33 Research, told Fortune that the compounding effect of the reduced BTC issuance takes months to materialize. Lunde, therefore, does not expect the halving to result in any meaningful rally, neither prior nor directly after the event.

Lunde’s opinion is backed by analysts at Deutsche Bank, who state that “Bitcoin halving is already partially priced in by the market and we do not expect prices to increase significantly following the halving event. The Bitcoin halving has been widely anticipated in advance due to the nature of the Bitcoin algorithm. Looking ahead, we continue to expect prices to stay high due to (i) expectations of future spot Ethereum ETF approvals; (ii) future central bank rate cuts; and (iii) regulatory changes,” per a recent report.

Large holders and ETFs slow down activity

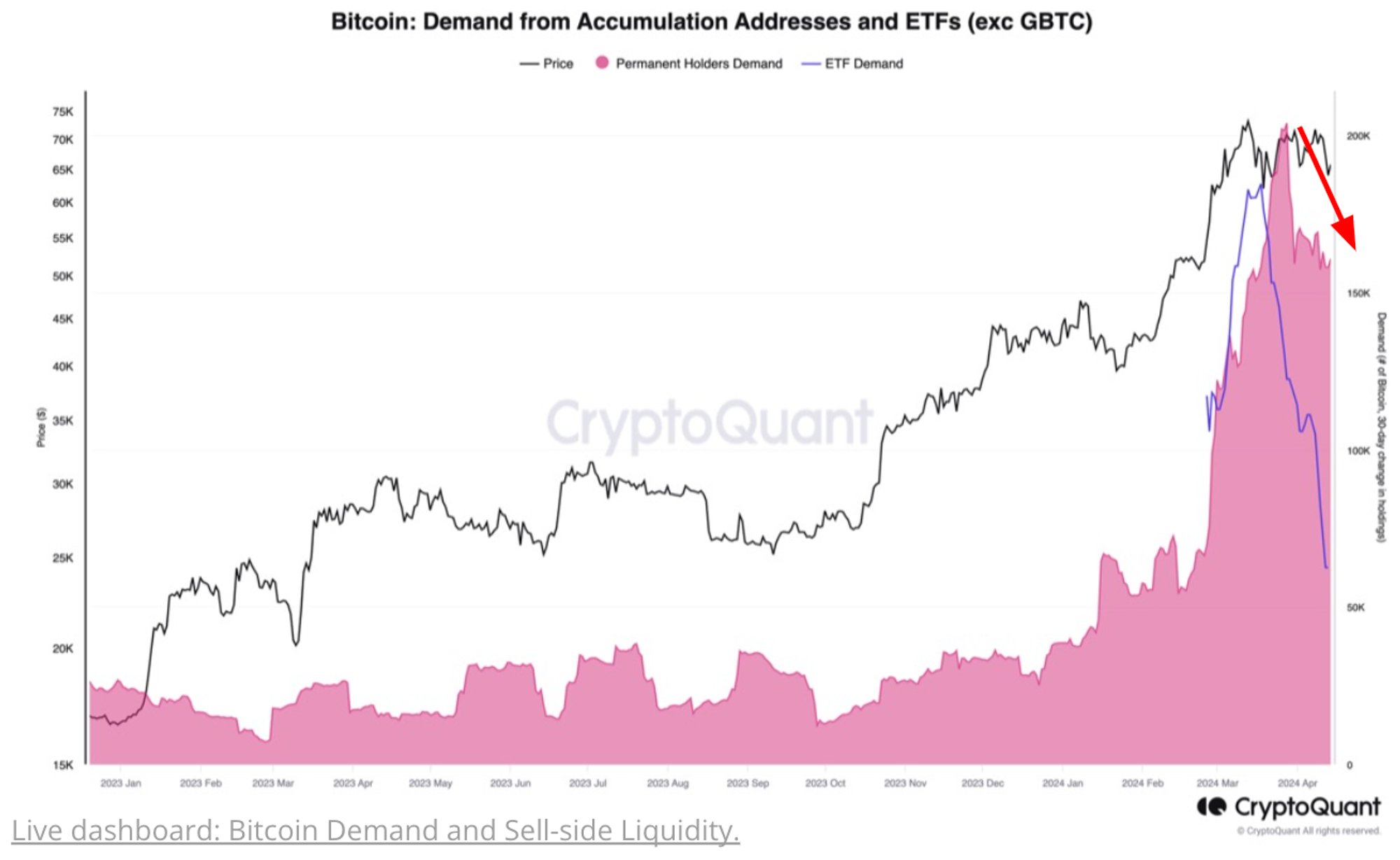

Data from crypto intelligence tracker CryptoQuant shows a noticeable slowdown in the acquisition of Bitcoin by large holders and Exchange Traded Funds (ETFs). Market uncertainties and the upcoming structural changes from the halving have likely influenced institutions.

Bitcoin demand from accumulation addresses and ETFs

Bitcoin price is $64,374 at the time of writing.