Orbit Chain hackers ring in New Year with $81.4 million exploit

- Orbit Chain cross-chain bridge suffered an exploit resulting in a loss of Tether, DAI, USDC, wBTC and ETH worth nearly $81.4 million.

- The exploiter drained the bridge and sent assets to a new wallet.

- Blockchain security firm SlowMist identified a vulnerability in the bridge or a compromise in the centralized server as the leading cause.

Orbit Bridge, an interchain communication protocol used for asset conversion reportedly suffered a hack. The protocol was drained of nearly $81.4 million in cryptocurrencies.

Also read: Vitalik Buterin proposes to solve Ethereum design’s weakness through update

Orbit Bridge hit by a series of large outflows

Orbit Bridge hackers reportedly rung in the New Year with an $81.4 million exploit. The cross-chain protocol suffered a series of large outflows identified by blockchain security firm SlowMist and on-chain intelligence provider LookOnChain.

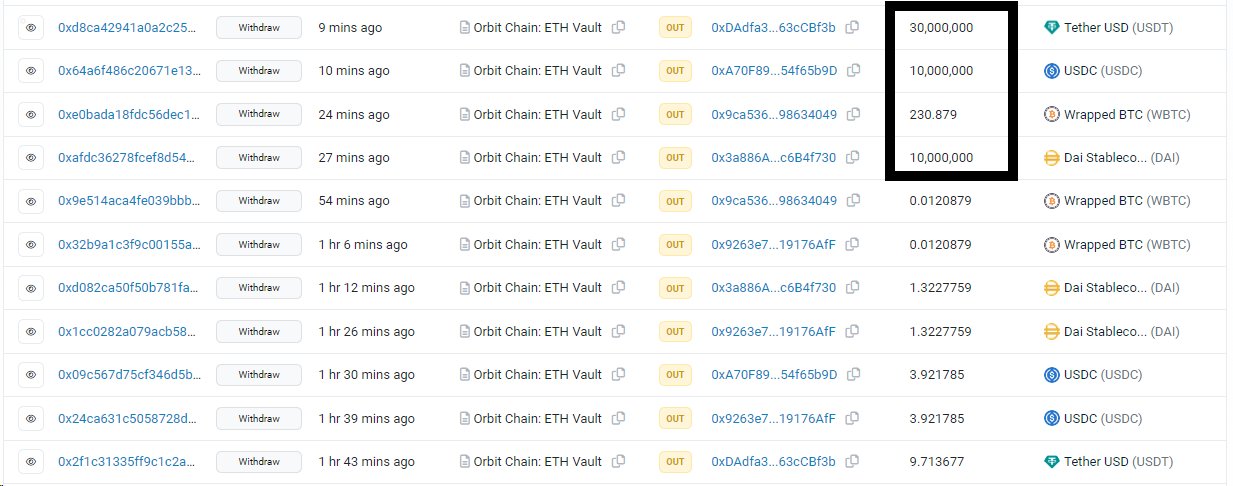

The latter reported that in five separate transactions, the Orbit Bridge sent 30 million Tether (USDT), 10 million DAI, 10 million USDCoin (USDC), 231 wBTC (worth nearly $10 million), 9,500 ETH (worth approximately $21.5 million).

Orbit Bridge drained of assets. Source: Etherscan.io

Crypto influencers and blockchain security experts like @officer_cia confirmed the hack in their recent tweets on X (formerly Twitter).

SlowMist completed a preliminary external investigation and observed that a vulnerability may exist in the Orbit Chain bridge or the centralized server has been compromised. The firm is conducting a further in-depth investigation to gather more information on the hack.

Orbit Chain confirms hack

In a recent tweet on X, Orbit Chain confirmed the hack on its protocol and labeled it an “unidentified access” to the bridge. The firm noted that it is actively engaging with law enforcement agencies to identify the exploiter and is conducting an in depth analysis of the root cause of the attack.