Litecoin price could kickstart a 32% ascent if LTC bulls overcome this crucial level

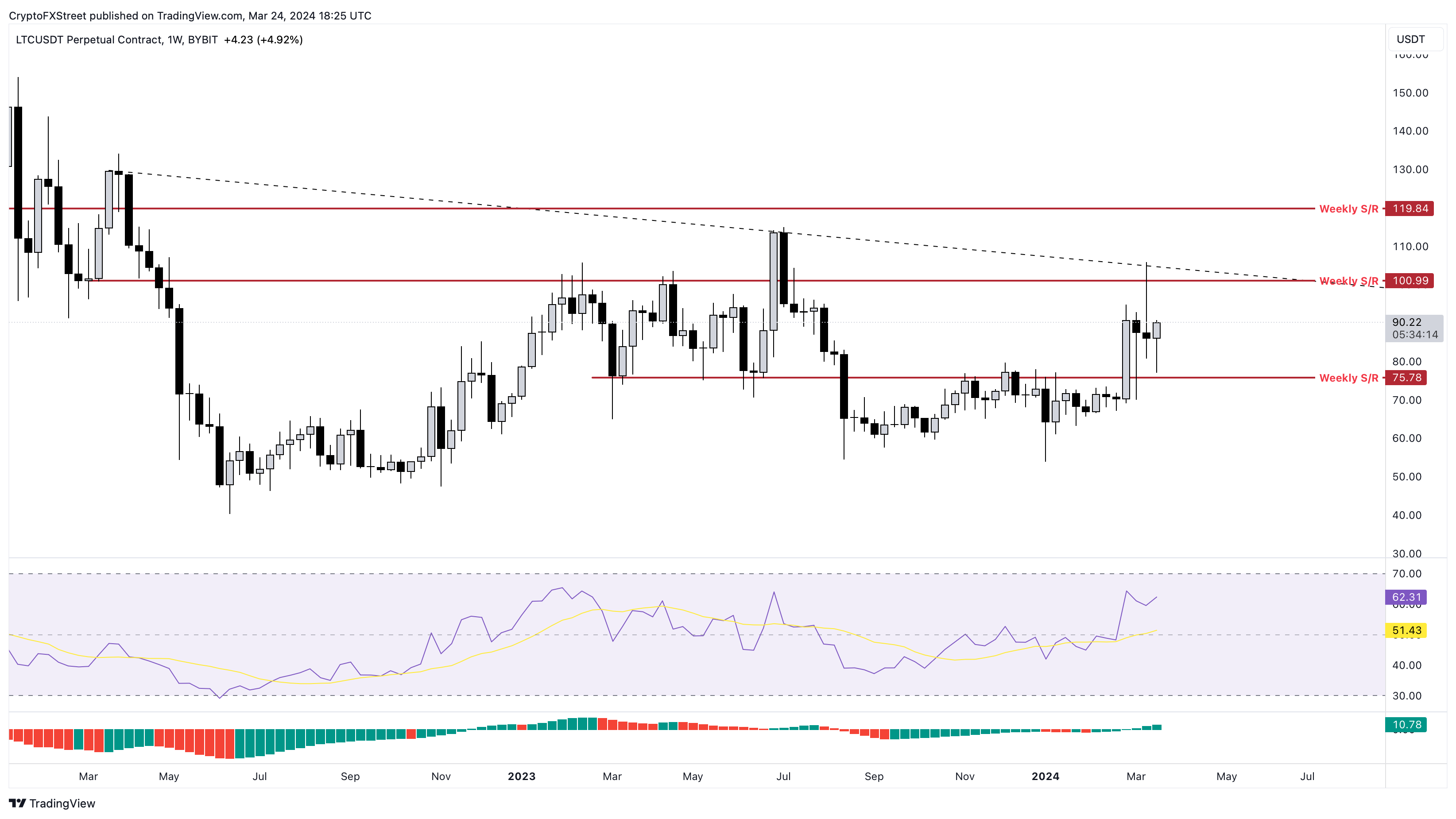

- Litecoin price hovers below the $100 psychological level and a declining resistance level.

- Due to the bullish market structure, LTC could kickstart an ascent to $119.84.

- A breakdown of the $76.78 support level will invalidate the bullish thesis.

Litecoin (LTC) price shows strength as it attempts to recover last week’s losses. LTC faces two critical hurdles, overcoming which could result in massive gains for the altcoin.

Also read: Why Litecoin active addresses spike is not a bullish sign

Litecoin price ready to shatter key levels

Litecoin price has produced three lower highs since March 2022 and currently, hovers below the trend line connecting these swing points. LTC also trades below the $100 psychological, making these two barriers very significant.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) momentum indicators are both above their respective mean levels of 50 and 0, respectively, suggesting a buyer-dominated market.

Therefore, if Litecoin price sustains its bullish momentum and overcomes the confluence resistance level at $100, it could signal sidelined buyers to step in and potentially kickstart a breakout rally. The weekly ceiling at $119.84 will be the target for some of these buyers to potentially book profits.

This move in Litecoin price would constitute a 32% ascent from the current position.

LTC/USDT 1-week chart

On the contrary, Litecoin’s bullish outlook could face invalidation if the pioneer crypto – Bitcoin triggers a steep correction. In such a case. Litecoin price could revisit the $75.78 support floor.

A breakdown of this level will create a lower low and invalidate the bullish thesis. Such a development could see LTC potentially tag $53.83, which is nearly 30% lower form $75.78.