Gold stalls near $2,910 on profit-taking, steady US yields

- Gold consolidates ahead of key US Nonfarm Payrolls report.

- XAU/USD remains above $2,900 but struggles as US 10-year yield hits 4.286%.

- Trade tensions escalate as Canada and China retaliate against Trump’s tariffs.

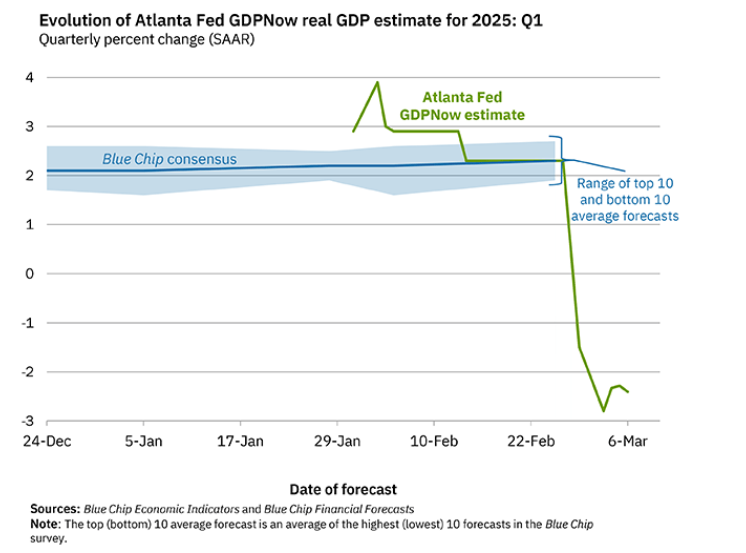

- Atlanta Fed GDPNow model revises Q1 2025 forecast to -2.4%, up from -2.8%.

Gold halted its three-day rally due to investors booking profits ahead of the crucial US Nonfarm Payrolls report. The rise of US Treasury bond yields also made holding the non-yielding metal less appealing. At the time of writing, the XAU/USD trades at $2,918, virtually unchanged.

The yellow metal consolidated above the $2,900 figure, capped by the earlier rise of the US 10-year Treasury bond yield to a one-week high, before paring those gains to stand at 4.286%.

Uncertainty surrounds the financial markets, spurred by controversial trade policies proposed by the President of the United States (US), Donald Trump. Tariffs imposed on US allies and adversaries triggered retaliation by Canada and China. Meanwhile, Mexico got a one-month delay of tariffs until April 2, after Trump and Mexico’s President Claudia Sheinbaum discussed additional improvements in fentanyl and illegal migration.

Data in the US was mixed on Thursday. The Challenger jobs report showed that layoffs rose sharply to levels not seen since the last two recessions. Meanwhile, the number of Americans filing for unemployment benefits dipped beneath projections, tempering recession fears sparked by Challenger, Gray, and Christmas data.

Following the data, the Atlanta Fed GDPNow Model projects the Gross Domestic Product (GDP) for Q1 2025 at -2.4%, up from the -2.8% contraction estimated on Wednesday.

Bullion traders will be eyeing Friday's release of February’s Nonfarm Payrolls figures, with analysts projecting 160K jobs added to the workforce.

Daily digest market movers: Gold price consolidates amid mixed US data

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, which correlates inversely to Gold prices, are flat at 1.946%, a headwind for XAU/USD prices.

- US Initial Jobless Claims for the week ending March 1 rose to 221K but remained below the 235K forecast and the previous week's 242K.

- Challenger Job Cuts in February surged from 49.8K to 172K, largely due to DOGE-related actions. Data from Challenger, Gray & Christmas revealed that the federal government was responsible for 62,242 of these layoffs.

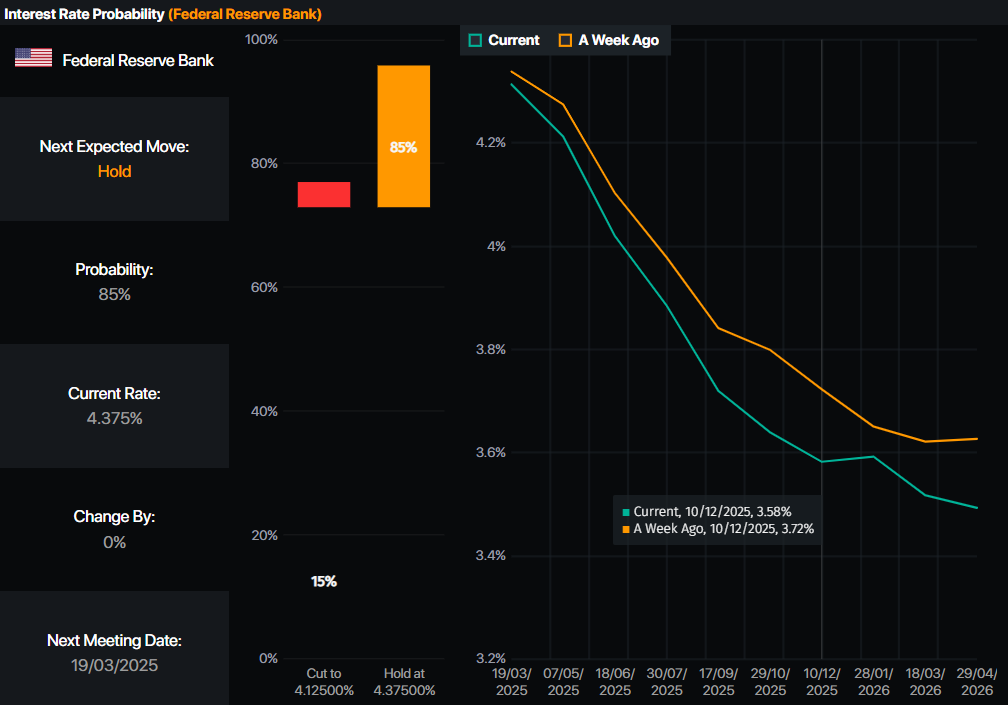

- Money market traders had priced in 74 basis points of easing in 2025, up from 72 bps on Wednesday, via data from the Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price holds firm above $2,900

Gold price consolidates for the second straight day, printing two Doji candles, indicating that neither buyers nor sellers are in charge. Momentum, as depicted by the Relative Strength Index (RSI), shows buyers losing some steam, yet the RSI is in bullish territory.

That said, the path of least resistance is skewed to the upside. XAU/USD's next resistance would be $2,950, followed by the record high at $2,954. A breach of the latter can expose the $3,000 mark.

On the other hand, a daily close below $2,900 could risk the uptrend and open the door for a “healthy” pullback. Gold’s first support would be the February 28 low of $2,832, followed by the $2,800 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.