Gold has wild ride with US Dollar pressured by German election outcome

- Gold price pops near 0.50% in the early European session on Monday.

- Although the Far-Right AfD has gained 20% of votes, the CDU has booked a comfortable lead.

- US Dollar Index drops, opening room for Gold to tick higher.

Gold’s price (XAU/USD) edges higher and trades near $2,945 at the time of writing on Monday due to a weaker US Dollar (USD) as a reaction to the recent German federal election outcome. Although the far-right party Alternative for Germany (AfD) has gained 20% of votes, the Christian Democratic Union of Germany (CDU) is comfortable in the lead with 208 seats against AfD’s 152. The Euro (EUR) jumped higher on the outcome, resulting in a weaker US Dollar, which coincided with XAU/USD higher.

Meanwhile, traders will watch the US Gross Domestic Product (GBP) release for the fourth quarter of 2024 later this week. Given the recent slowdown in US activity and economic data (for example, the softer Services Purchase Managers Index (PMI) reading on Friday), another drop in US yields could be triggered, with markets anticipating the Federal Reserve lowering its monetary policy rate to boost the economy and demand.

Daily digest market movers: On the table

- Canada’s Equinox Gold Corporation sought to acquire Calibre Mining in a deal that would value the combined companies at $5.4 billion. This is the latest example of dealmaking as miners capitalize on record gold prices, Bloomberg reports.

- The US dollar weakened after several reports and economic data points last week revealed that US business activity slowed and consumer confidence waned, with expectations for inflation surging and markets pricing in more rate cuts by the Federal Reserve this year, Bloomberg reports.

- Conservative CDU leader Friedrich Merz emerged as the winner in Sunday’s German federal election. However, the results gave his Christian Democrat-led bloc just one clear path to power, facing intense pressure to quickly form a government. While the far-right AfD doubled support to become the second-strongest party with 20.8% of the votes, it fell short of a blocking minority on its own, the Financial Times reports.

Technical Analysis: Back up again

Traders must be getting headaches from these constant whipsaw moves. With more and more banks calling for the $3,000 mark, the risk is building that the Gold price might not actually reach it. A similar story was seen in the Euro against the US Dollar (EUR/USD), where at one point this year all banks called for parity, though the pair never got there and instead moved higher.

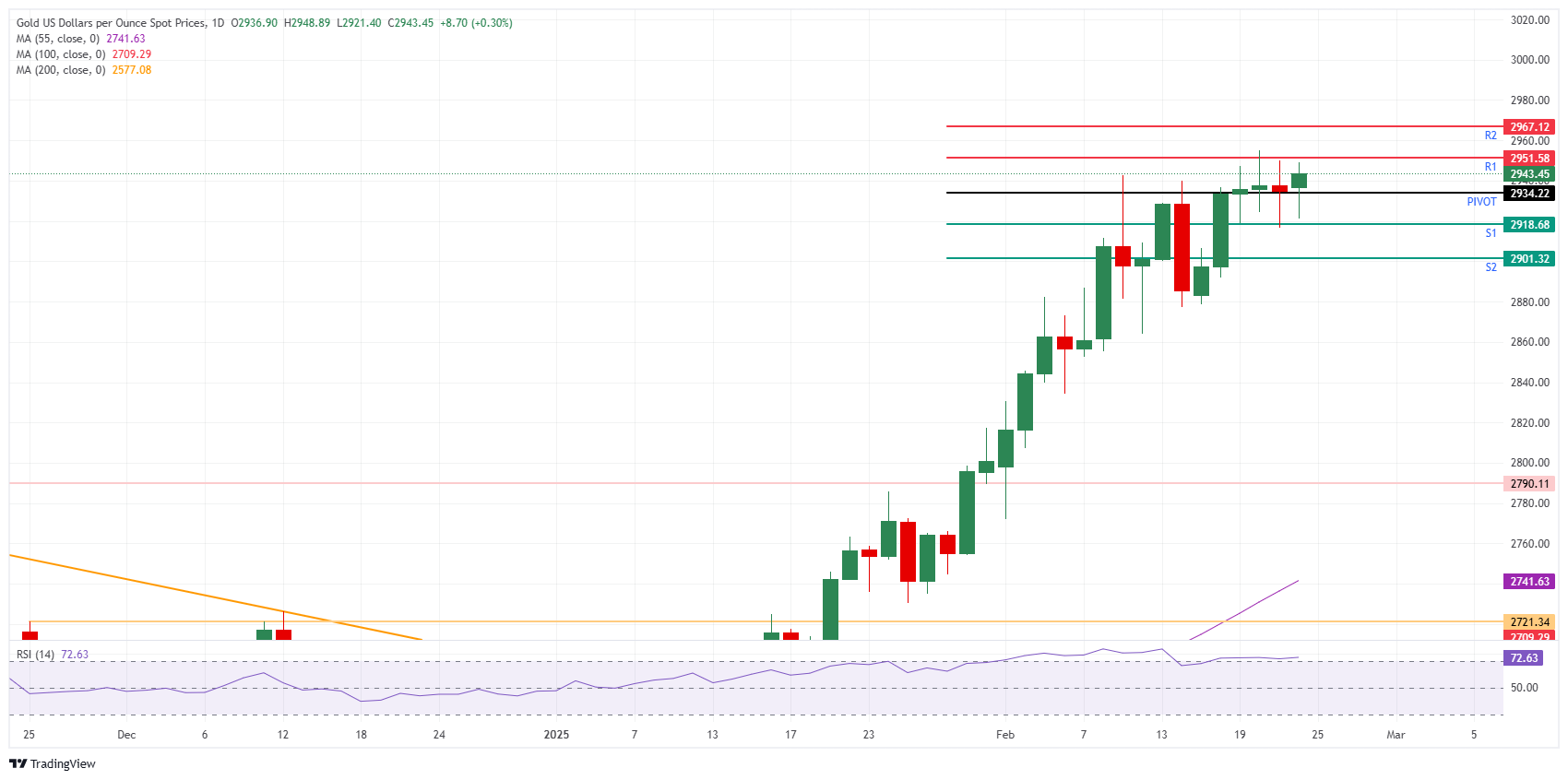

For this Monday, the all-time high at $2,955 remains the main level to watch. On the way up, the daily R1 resistance at $2,951 precedes. Further up, meaning that there will be a new all-time high, the R2 resistance stands at $2,967.

On the downside, support levels are plentiful, with the daily Pivot Point at $2,934. Further down, the S1 support comes in at $2,918, which roughly coincides with Friday’s low. In case that level does not hold, the $2,900 big figure comes into play with the S2 support at $2,901.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.