Gold drops over 1% from Thursday’s all-time high

- Gold dives lower and slips below $2,925 on Friday.

- The Trump administration puts lifting trade bans against Russia on the table.

- Traders are mulling the upcoming US preliminary S&P PMI data for February.

Gold’s price (XAU/USD) slides over 1% lower from its Thursday all-time high of $2,954 and trades around $2,925 at the time of writing on Friday. The move comes ahead of the United States (US) preliminary Purchase Managers Index (PMI) reading for February and after the US President Trump administration commented on the possibility of lifting sanctions against Russia.

Meanwhile, S&P Global and Hamburg Commercial Bank (HCOB) data showed that business activity in the services sector declined in February in France, Germany and the overall Eurozone, with the French preliminary Services PMI data falling further into contraction to 44.5, missing the 48.9 estimate and contracting further from the previous 48.2.

Now, all eyes will be on the US preliminary S&P Global PMI data for February. The services sector will be the leading indicator, expected to tick up to 53.0 from 52.9 in January.

The focus will move to Germany this weekend for the general election, being held on Sunday and where the far-right party Alternative for Germany(AfD), which enjoys great participation from Elon Musk, could be up for a landslide victory.

Daily digest market movers: On the table

- The US Trump administration signaled that sanctions relief for Russia could be on the table in talks over the war in Ukraine as US President Donald Trump wants to have a quick resolution for the conflict, Bloomberg reports.

- Shares from Chinese Laopu Gold Co. Ltd, a company that manufactures and sells jewelry, rose as much as 21% to a record high after its net profits more than tripled this year, bucking a slowdown in luxury spending, Reuters reports.

- South African company Sibanye Stillwater Ltd.’s full-year loss narrowed after higher Gold prices offset low Palladium rates that weighed on the company’s US mining operations. The loss came in at $398 million for 2024, Bloomberg data reports.

Technical Analysis: Monday’s start

All eyes are on Germany this weekend as people head to the voting booths for a new government. Although this might not directly impact Gold’s price, it could see a more harsh or softening stance from US President Trump on Europe in the grander scheme of things. The market reaction on Monday will be interesting.

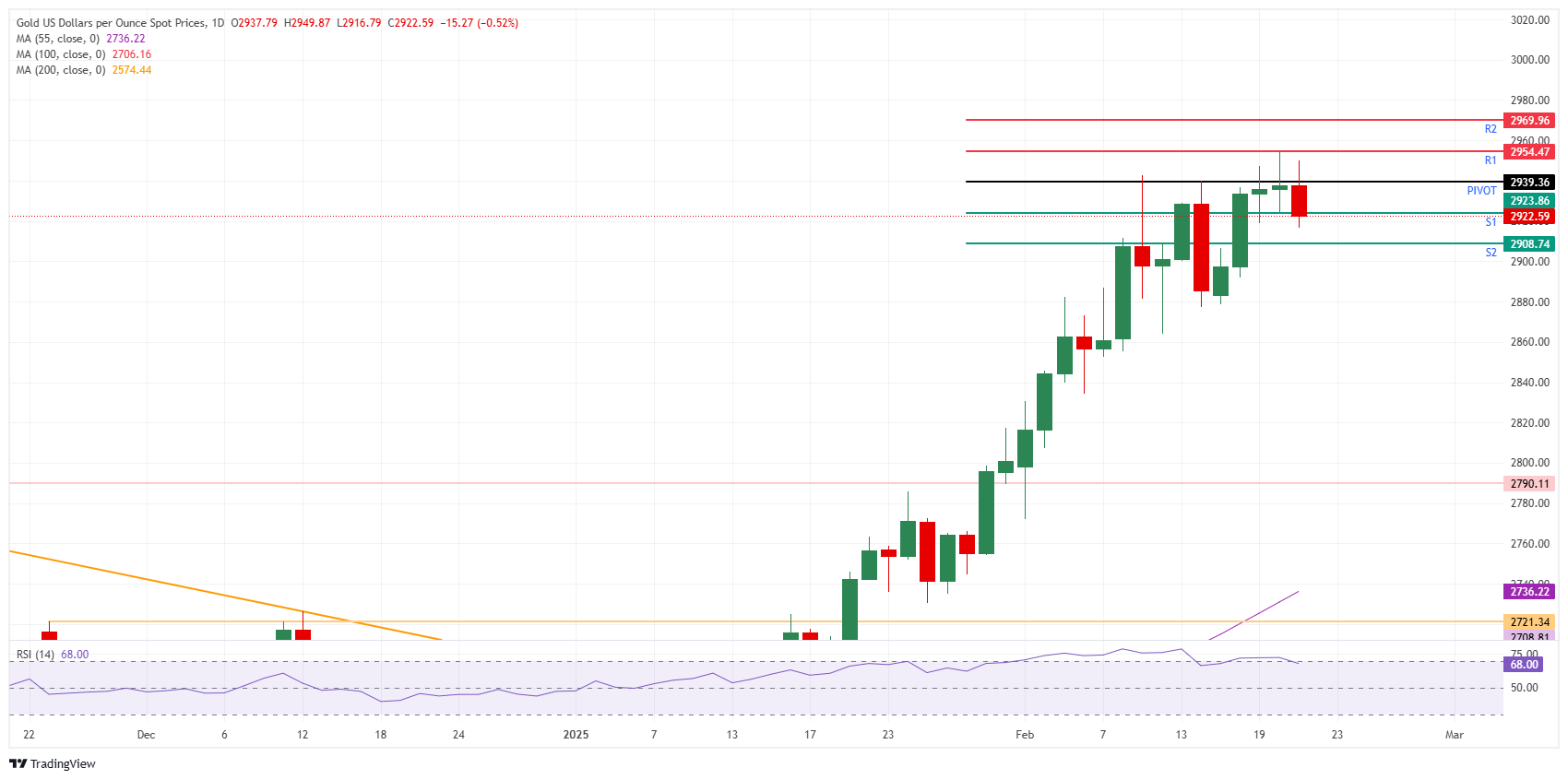

The first level to hold on Friday comes in at the S1 support at $2,923. Further down, the S2 support stands at $2,908.

On the upside, a big catalyst would be needed to see Gold completely recover its incurred daily losses. The Pivot Point at $2,939 is the first level to regain, followed by the R1 resistance and the all-time high converging at $2,954. From there, the R2 resistance at $2,969 is next to watch before looking ahead again at $3,000.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.