[IN-DEPTH ANALYSIS] South Korea: The KRW is a One-Way Bet. Downward!

Executive Summary

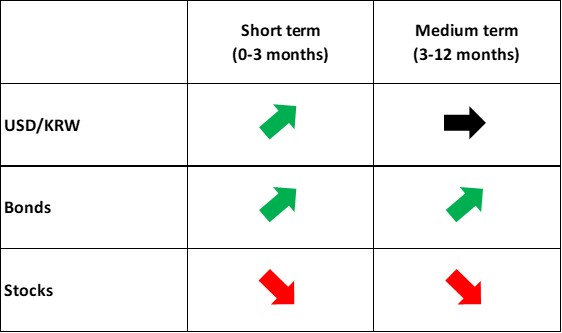

Under the combined pressures of a weakening South Korean economy, the Bank of Korea (BoK) resuming its rate-cutting cycle and Trump’s high tariffs, the Korean Won (KRW) is expected to decline in the short term (0-3 months). In the medium term (3-12 months), as the USD Index peaks and retreats, coupled with the stabilizing effect of the National Pension Service’s (NPS) FX hedging program, the KRW is likely to enter a range-bound fluctuation.

* Investors can directly or indirectly invest in the foreign exchange market, bond market and stock market through passive funds (such as ETFs), active funds, financial derivatives (like futures, options and swaps), CFDs and spread betting.

1. Macroeconomics

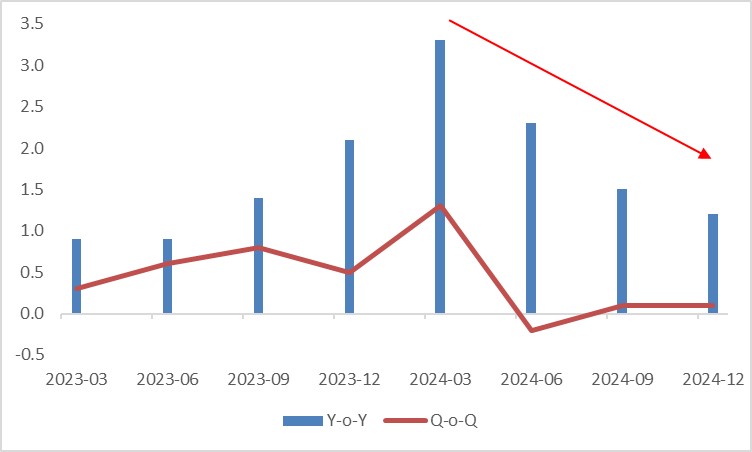

South Korea’s economic growth has noticeably slowed since Q2 2024. In Q4, real GDP growth decelerated to 1.2% year-on-year, below the consensus expectation of 1.4%, primarily due to weak domestic demand (Figure 1.1). Breaking it down, private consumption growth softened from 0.5% quarter-on-quarter in Q3 to 0.2% in Q4. Gross fixed capital formation fell 0.9% quarter-on-quarter, dragged down by declines in equipment and construction investment. Looking ahead, domestic demand shows little sign of a meaningful recovery. Consumer surveys indicate that sentiment remains clouded by domestic political turmoil, casting uncertainty over the outlook. Additionally, Trump’s high tariffs are weakening export expectations, further dampening manufacturers’ equipment investment plans.

Figure 1.1: South Korea real GDP growth (%)

Source: Refinitiv, Tradingkey.com

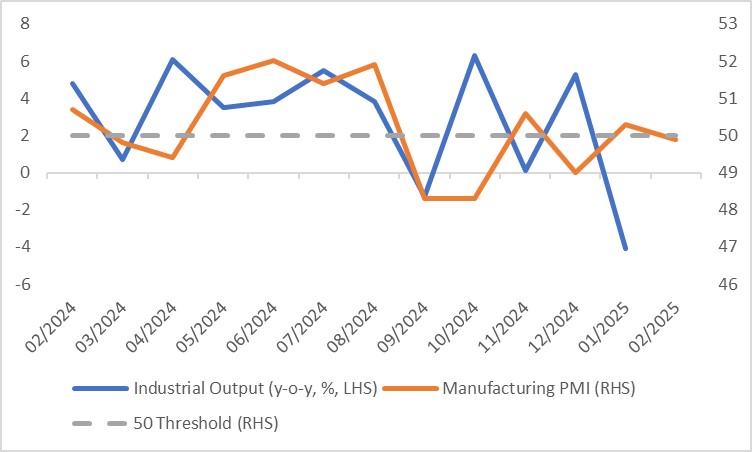

Beyond consumer confidence, high-frequency indicators such as industrial production (IP) and the Manufacturing PMI paint a grim picture of South Korea’s economy at the start of 2025. January IP fell 4.1% year-on-year—worse than the market’s expected decline of 2%—reflecting a high base effect and compounded domestic and global political and economic risks. Manufacturing, a key IP component, also shows signs of slowing. Over the past 12 months, the Manufacturing PMI has hovered around the 50 threshold, dipping to 49.9 in February (Figure 1.2).

Figure 1.2: South Korea industrial production and manufacturing PMI

Source: Refinitiv, Tradingkey.com

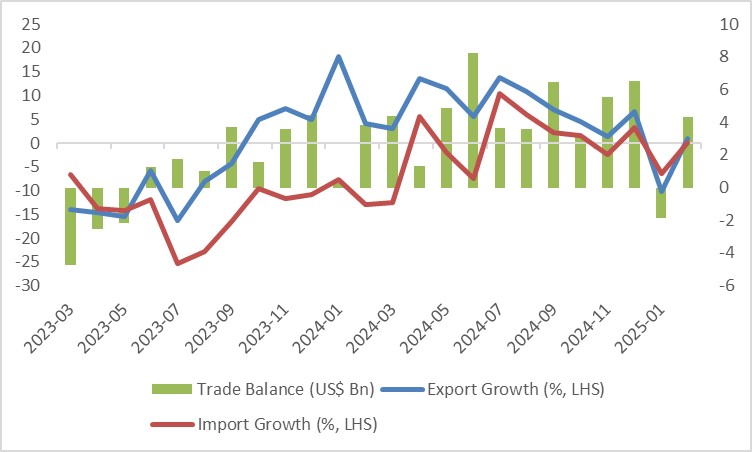

On the export front, February marked a turnaround from the sluggish trend since early 2024, with exports rising 1% year-on-year. With imports growing only 0.2%, the trade balance swung to a surplus of US$4.3 billion (Figure 1.3). But can this export improvement drive economic growth? Unfortunately, we believe it cannot. U.S. tariffs play a pivotal role here, impacting South Korea through both direct and indirect channels. Directly, tariffs on Korean goods could undermine export competitiveness, particularly in key sectors like autos, electronics and semiconductors. Indirectly, a tariff-induced global slowdown—similar to its effect on other export-oriented economies—would reduce Korea’s shipments to non-U.S. markets.

Figure 1.3: South Korea's exports and imports

Source: Refinitiv, Tradingkey.com

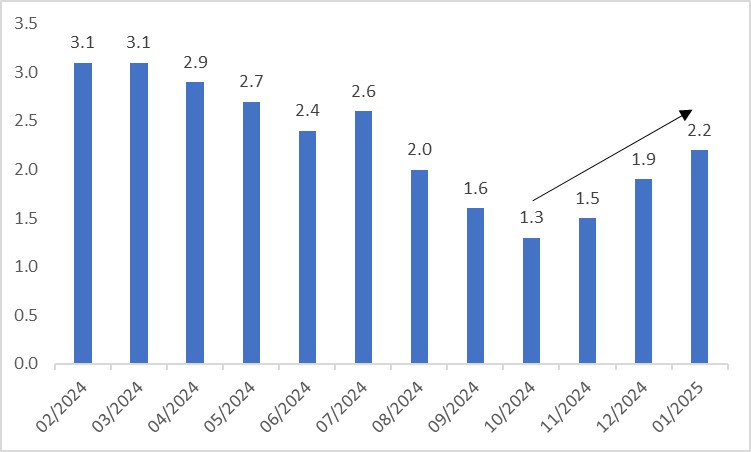

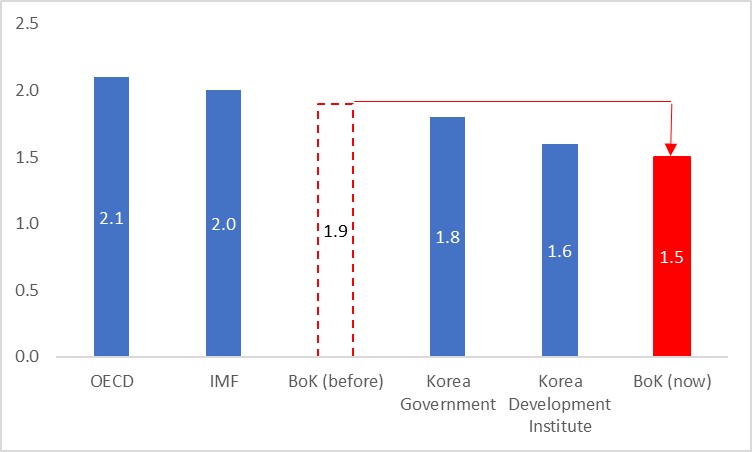

Inflation in South Korea has been rebounding since October 2024, reaching 2.2% in January 2025 (Figure 1.4). This uptick prompted the BoK to pause rate cuts in January. However, facing dual domestic and external pressures, the central bank lowered its GDP forecast (from 1.9% to 1.5% for 2025, below other institutions’ estimates) and resumed its easing cycle (Figure 1.5). Going forward, we expect the BoK to maintain a dovish stance.

Figure 1.4: South Korea CPI (%)

Source: Refinitiv, Tradingkey.com

Figure 1.5: South Korea real GDP growth forecasts (%)

Source: Refinitiv, Tradingkey.com

2. Exchange Rate (USD/KRW)

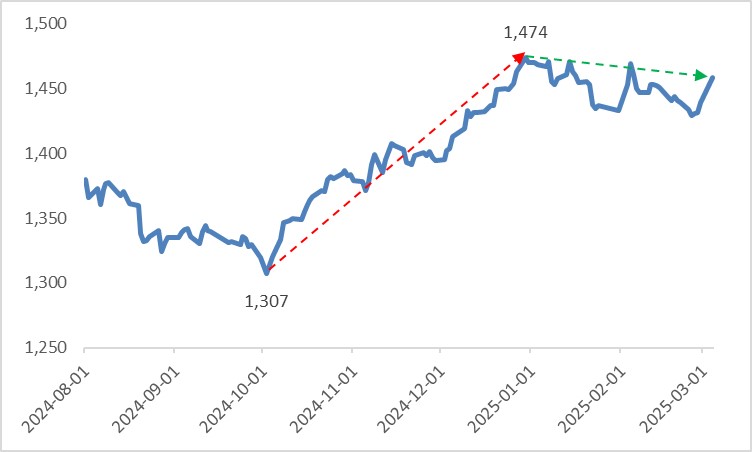

The KRW has slid from a high of 1,307 in September 2024 to a low of 1,474 in December, hitting its weakest level since the 2009 financial crisis. This was driven by internal factors—such as President Yoon Suk Yeol’s martial law declaration—and external pressures from a strengthening USD Index. Since the start of 2025, as markets reassess the implications of Trump’s tariff policies, the dollar index has softened, allowing the KRW to fluctuate upward (Figure 2).

Looking ahead, the KRW will be shaped by a mix of domestic and external, bullish and bearish factors over the short and medium term. Bearish domestic factors: The BoK resumed its rate-cutting cycle on 25 February due to economic weakness, adding pressure on the KRW. This is compounded by capital outflows, including foreign investors exiting and domestic investors seeking overseas opportunities. Bullish domestic factors: The NPS’s FX hedging program provides a stabilizing effect, reducing volatility and mitigating depreciation pressure. The BoK also notes that after the KRW’s sharp Q4 2024 decline, the USD/KRW rate exceeds its fair value, suggesting the currency is undervalued. If accurate, this undervaluation, alongside the NPS program, could limit the KRW's further significant drops. External factors: Uncertainty over U.S. tariffs weighs negatively on the KRW. As outlined, tariffs will hit exports and the trade surplus, exacerbating an already fragile economy and pressuring the currency.

We expect the USD Index to rise in the short term (0-3 months) before weakening in the medium term (3-12 months); For more details, please refer to “[IN-DEPTH ANALYSIS] US: Will the USD Index Decline Irreversibly from Today Onward?, published on 3 March 2025”. Consequently, we foresee the KRW weakening against the USD in the near term, then stabilizing in a trading range as the dollar retreats.

Figure 2: USD/KRW

Source: Refinitiv, Tradingkey.com

3. Bonds

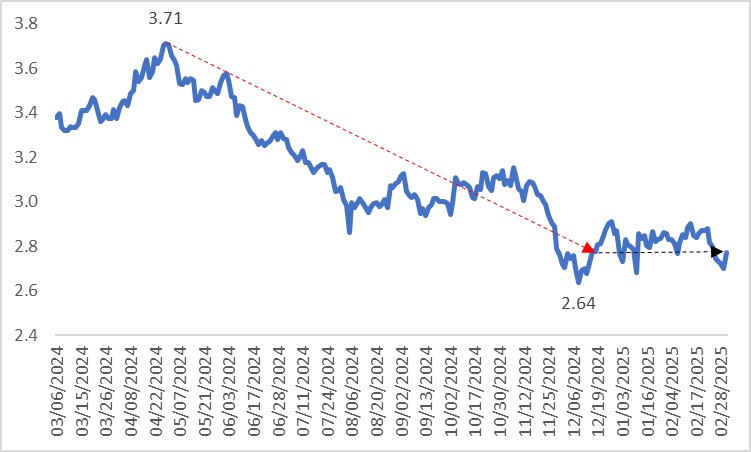

As the BoK began cutting rates, Korean Treasury Bond (KTB) yields have trended downward since May 2024. However, rising inflation and the January pause in rate cuts have kept yields range-bound since the start of 2025 (Figure 3.1). Going forward, KTB yields will be driven by three key factors:

- Rate Cuts: The resumption of the easing cycle will suppress KTB yields through the standard transmission mechanism—lower policy rates reduce interbank overnight rates, which in turn drag down bond yields.

- WGBI Inclusion: KTB is set to join the World Government Bond Index (WGBI), a major global benchmark. This will prompt passive funds tracking the index to allocate to KTB while enhancing its international credibility and attracting active investors. This demand surge will boost KTB prices and lower yields.

- Supply Pressure: Conversely, a potential supplementary budget from the government, financed through additional bond issuance, could increase KTB supply, pushing prices down and yields up.

Figure 3.1: KTB 10Y yields (%)

Source: Refinitiv, Tradingkey.com

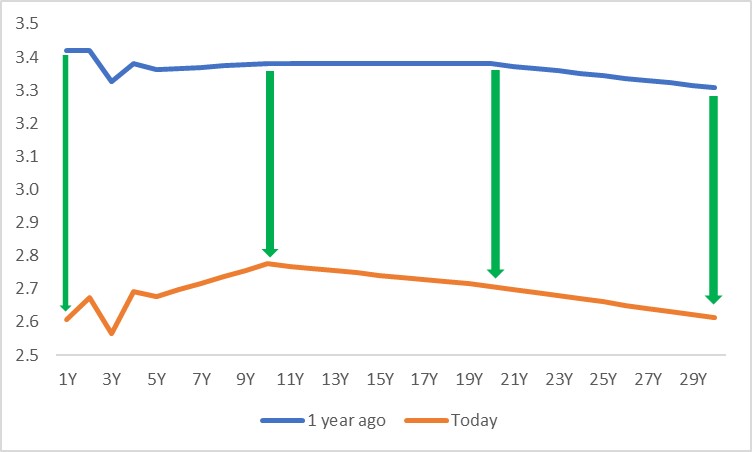

Balancing these dynamics, we expect KTB yields to decline modestly. Given their positive correlation with the KRW, falling yields will add further downward pressure on the currency. Among these drivers, policy rate cuts will likely have the most significant impact. As short-end yields are more sensitive to policy rate changes, we anticipate the KTB yield curve will steepen, departing from its flat trajectory over the past year (Figure 3.2).

Figure 3.2: KTB yield curve (%)

Source: Refinitiv, Tradingkey.com

4. Stocks

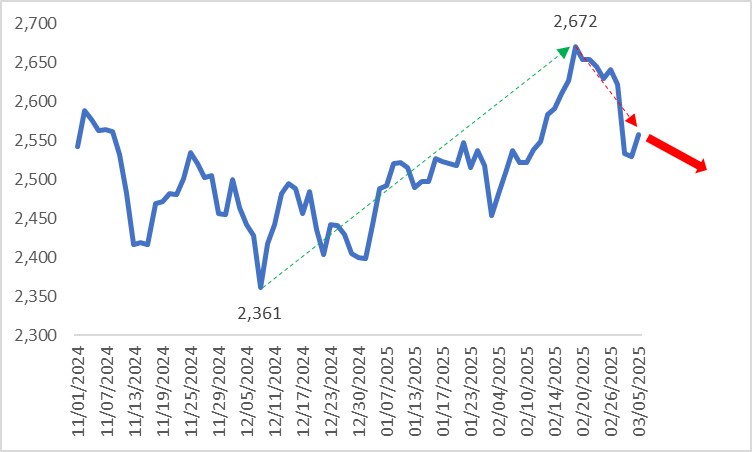

From early December 2024 to mid-February 2025, the Korean stock market rallied from its lows, buoyed by global economic optimism, robust semiconductor demand and a spillover from U.S. equity gains in January. However, domestic political instability, economic deterioration and a U.S. market pullback have since dragged it lower (Figure 4).

Looking ahead, the Korean stock market faces two opposing forces. Bearish force: As detailed in the macroeconomic section, South Korea’s worsening economy will suppress corporate revenues and earnings. A global slowdown, led by the U.S., could further dent the semiconductor sector (e.g., Samsung Electronics and SK Hynix). Bullish force: The BoK’s rate cuts will provide liquidity, easing valuation pressures via the denominator in equity pricing models. However, we believe the former will outweigh the latter, leading us to maintain a bearish outlook on Korean equities.

Figure 4: KOSPI

Source: Refinitiv, Tradingkey.com