EUR/JPY Price Analysis: Gains momentum after Fed minutes release, traders eye 163.00

Source Fxstreet

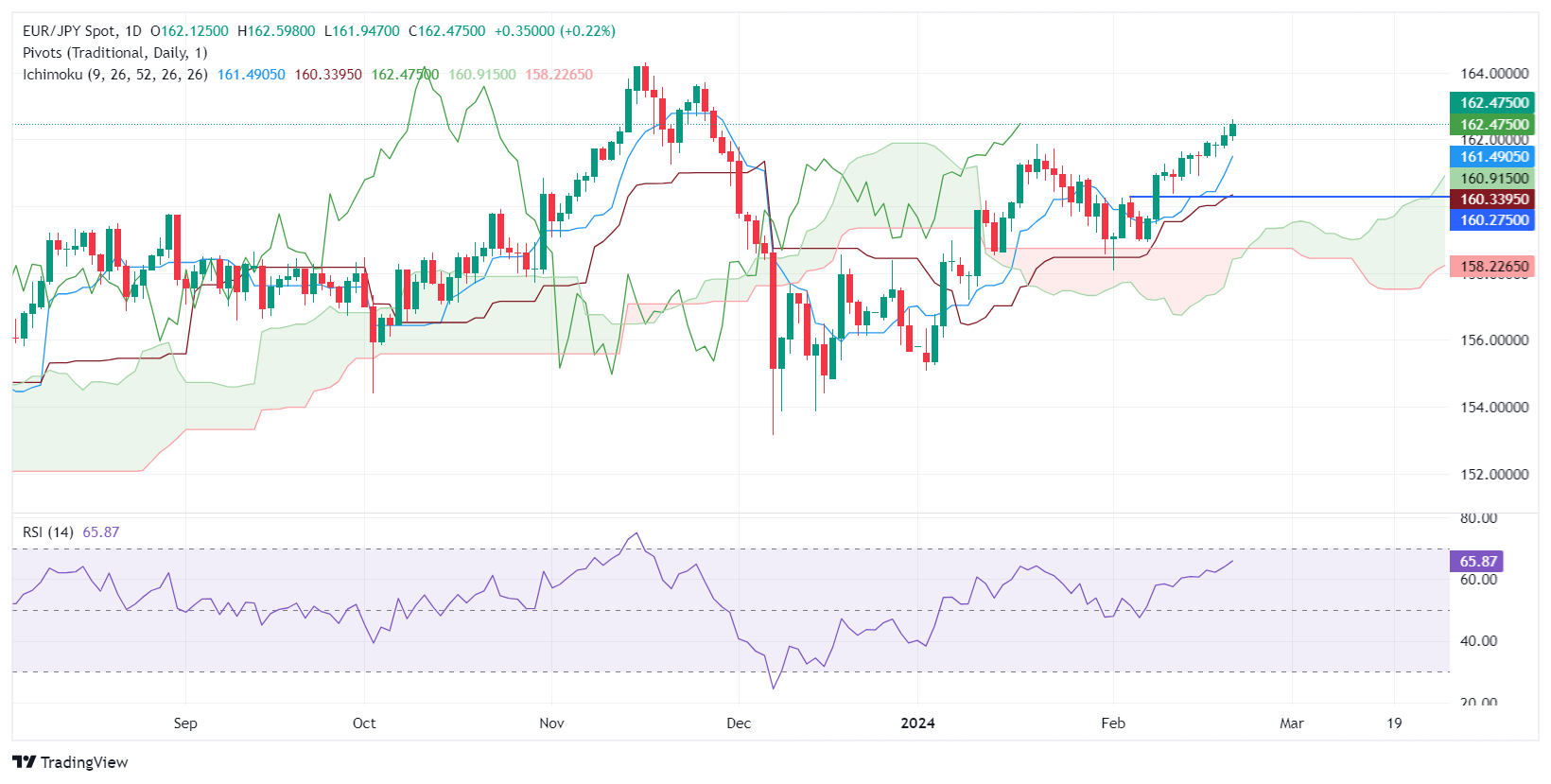

- EUR/JPY ascends to 162.47, marking a continuous rise influenced by recent Fed monetary policy insights.

- Technical analysis points to key resistance levels, with 163.00 and 163.72 as immediate targets.

- Potential pullback could see support tests at 161.48 and 160.91, depending on market dynamics.

The Euro extended its gains for the second straight day against the Japanese Yen and is up by 0.22% as the EUR/JPY trades at 162.47 late during the North American session.

The release of the latest Federal Reserve (Fed) minutes sponsored a leg-up in the EUR/JPY as the EUR/USD edged slightly up. From a technical standpoint, the pair is trading at year-to-date (YTD) highs, aiming to extend its gains. The first resistance would be the 163.00 figure, followed by the November 27 high at 163.72. A further upside is seen at 164.00, followed by last year’s high at 164.31.

On the flip side, if the pair drops below 162.00, that would pave the way to test the Tenkan-Sen at 161.48 before slumping toward the Senkou Span A at 160.91.

EUR/JPY Price Action – Daily Chart

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Be careful chasing stocks while the S&P 500 is above 5,500: BCAInvesting.com – As the S&P 500 ebbs and flows around the 5,500 level, BCA warns against chasing stocks above this level as the winds of recession are picking up pace and the cooling 'AI mania' suggest the end for U.S. stock market exceptionalism is on the horizon.

Investing.com – As the S&P 500 ebbs and flows around the 5,500 level, BCA warns against chasing stocks above this level as the winds of recession are picking up pace and the cooling 'AI mania' suggest the end for U.S. stock market exceptionalism is on the horizon.

Robinhood’s cryptocurrency arm has agreed to a $3.9 million settlement following an investigation into its past practices, the California Department of Justice announced Wednesday.

Broadcom lifts annual AI revenue outlook after Q3 results beat estimatesInvesting.com - Broadcom on Thursday lifted its guidance on annual artificial intelligence revenue after reporting third-quarter results that beat analysts' forecasts supported by strength in an AI-product revenue and strong performance from VMWare.

Investing.com - Broadcom on Thursday lifted its guidance on annual artificial intelligence revenue after reporting third-quarter results that beat analysts' forecasts supported by strength in an AI-product revenue and strong performance from VMWare.

The US labor market data hold the key for markets to gauge the size of the expected interest-rate cut by the US Federal Reserve (Fed) in September, ramping up the volatility around the US Dollar (USD).

Bitcoin (BTC) Price Struggles Put Short-Term Holders at a DisadvantageIn recent months, a cohort of Bitcoin (BTC) holders has been notably affected by the coin’s struggle to stabilize above $70,000. This group comprises short-term holders (STHs) — investors who have held the asset for less than 155 days.

In recent months, a cohort of Bitcoin (BTC) holders has been notably affected by the coin’s struggle to stabilize above $70,000. This group comprises short-term holders (STHs) — investors who have held the asset for less than 155 days.

Related Instrument