USD/JPY falls as US GDP misses estimates bolstering Yen

- USD/JPY falls as US GDP growth slows to 2.3%, below expected 2.6%.

- Improved jobless claims fail to boost dollar amid prevailing economic concerns.

- Yen strengthens from policy divergence; Fed holds rates while BoJ maintains tighter stance.

The USD/JPY retreats in early trading during the North American session after economic data showed the US economy grew lower than expected a day after the Federal Reserve (Fed) decided to keep rates unchanged. The pair trades at 154.09, down 0.76%.

USD/JPY dropped below 154.00 amid weaker-than-expected US economic growth

Data from the United States (US) weighed on the Greenback, as Gross Domestic Product (GDP) for the last quarter of 2024 dipped from 3.1% to 2.3%, missing investors' estimates of 2.6%. At the same time, the US Department of Labor revealed that Jobless Claims for the week ending January 25 increased by 207K beneath forecasts of 220K and the previous week 223K.

After the data, the USD/JPY extended its losses toward 153.83, but buyers reclaimed the 154.00 figure.

The Japanese Yen extended its gains as there was a divergence between the Bank of Japan (BoJ) and the Fed, favoring the former's appreciation. Therefore, further USD/JPY downside is seen, as US GDP data could signal the economy may be decelerating at a faster pace.

This week, the Japanese economic docket will feature the Unemployment Rate, Industrial Production, and Retail Sales. In the US, the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, and Fed speakers.

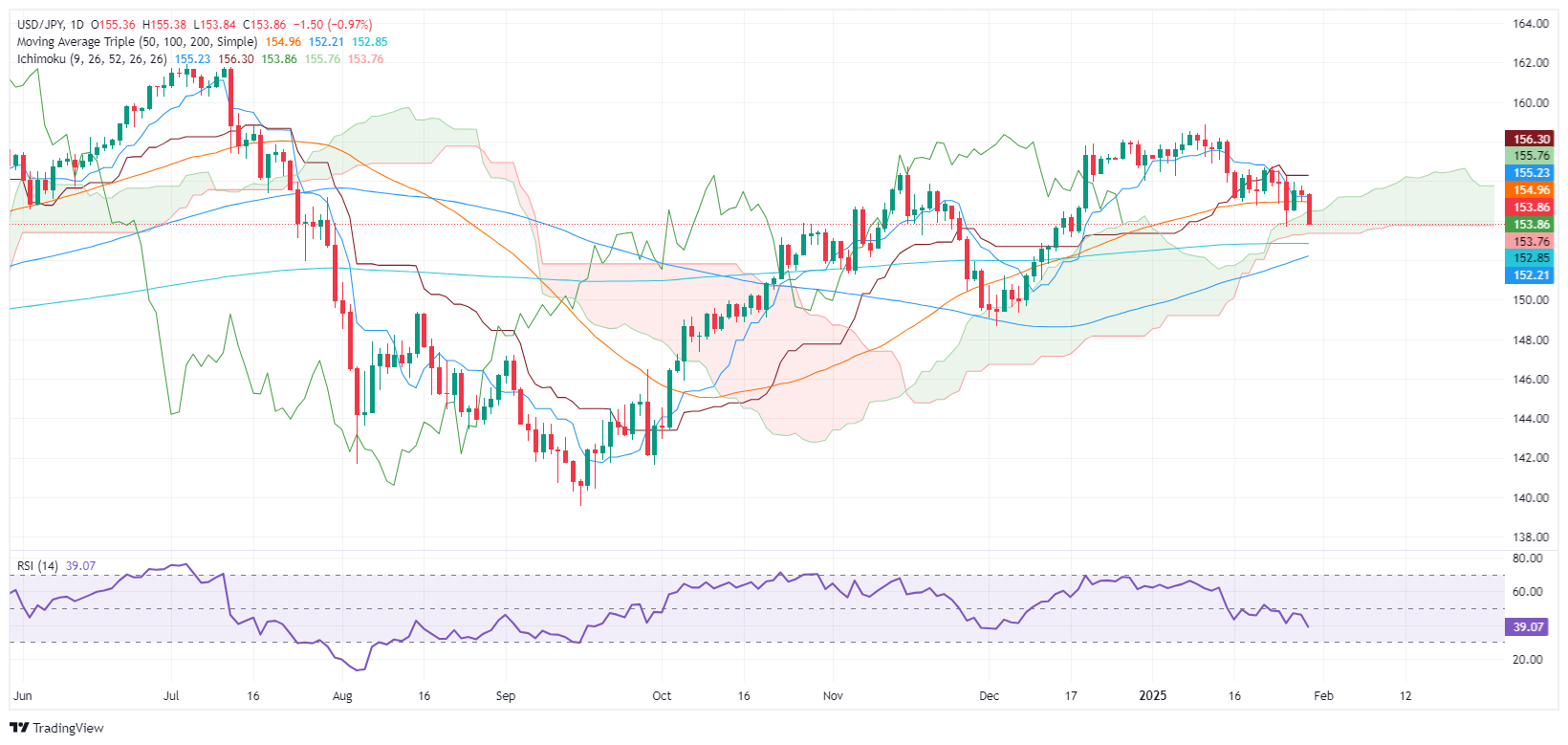

USD/JPY Price Forecast: Technical outlook

The USD/JPY has fallen inside the Ichimoku Cloud (Kumo), indicating that sellers are gathering momentum after clearing the 50-day Simple Moving Average (SMA) at 154.97. The Relative Strength Index (RSI) is bearish. Therefore, bears could be confident that they are in charge.

For a continuation they need to exit the Kumo, clearing the Senkou Span B at 153.76. Once done, sellers could drive the USD/JPY towards the 200-day SMA at 152.85 ahead of the 100-day SMA at 152.22.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.24% | -0.22% | -0.97% | -0.11% | -0.04% | -0.00% | -0.12% | |

| EUR | 0.24% | 0.02% | -0.75% | 0.13% | 0.20% | 0.24% | 0.12% | |

| GBP | 0.22% | -0.02% | -0.79% | 0.11% | 0.18% | 0.22% | 0.09% | |

| JPY | 0.97% | 0.75% | 0.79% | 0.87% | 0.94% | 0.94% | 0.85% | |

| CAD | 0.11% | -0.13% | -0.11% | -0.87% | 0.07% | 0.10% | -0.02% | |

| AUD | 0.04% | -0.20% | -0.18% | -0.94% | -0.07% | 0.03% | -0.08% | |

| NZD | 0.00% | -0.24% | -0.22% | -0.94% | -0.10% | -0.03% | -0.13% | |

| CHF | 0.12% | -0.12% | -0.09% | -0.85% | 0.02% | 0.08% | 0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).