GBP/USD drops as Trump’s tariff threat boosts US Dollar

- GBP/USD tumbles as Trump’s proposed tariffs on other industries raise fears of a trade war.

- US Dollar Index climbs 0.4% to 107.86, pressuring GBP/USD amid increased market risk aversion.

- US sees a significant drop in Durable Goods Orders and Consumer Confidence; inflation expectations rise.

The Pound Sterling extended its losses against the Greenback on Tuesday as US President Donald Trump threatened to impose tariffs on computer chips and other industries. Risk aversion extended for the second straight day, and the GBP/USD retreated from weekly highs of 1.2523, trading at 1.2432, down 0.50%

GBP/USD falls to 1.2432, down 0.50%, amid rising U.S. protectionist measures

On Monday, the Greenback recovered some ground, and most G8 FX currencies tumbled as Trump crossed the wires. He said he would impose duties on chips, pharmaceuticals, steel, aluminum, and copper if not produced in the United States (US). Therefore, the trade war is on, and traders keep the US Dollar bid.

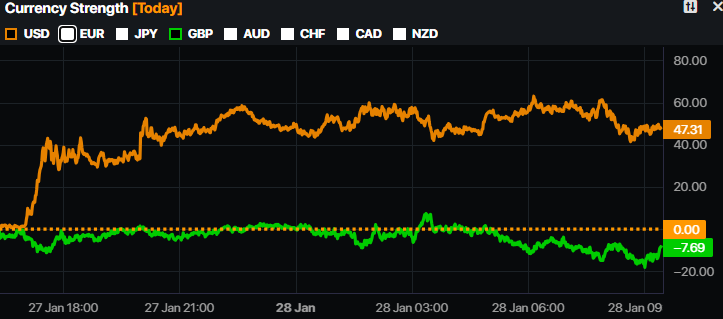

The US Dollar Index (DXY), which tracks the buck’s value against a basket of six peers, rises 0.4% up at 107.86, a headwind for the GBP/USD. A further extension above DXY’s January 24 peak of 108.19 would exert further pressure on Sterling.

Source: Prime Market Terminal

Data-wise, US Durable Goods Orders plummeted --2.2 % MoM in December, missing the 0.6% increase expected by economists and worse than November’s -2% contraction.

Lately, the US Consumer Confidence revealed by the Conference Board slumped to 104.1, below the 105.6 foreseen by analysts. The report showed that all five components of the index deteriorated. Labor market conditions dropped for the first time since September, as Americans grew pessimistic about future employment prospects.

Of note is that the survey showed that inflation expectations rose from 5.1% to 5.3%.

In the meantime, traders eye the Federal Open Market Committee (FOMC) decision on January 29. The Federal Reserve is expected to keep rates on hold as it buys time to assess the impact of Trump 2.0's presidency and as prices remain stickier than expected.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is downward biased, as buyers failed to push prices above the 50-day Simple Moving Average (SMA) of 1.2521. A daily close below the January 27 low of 1.2425 could pave the way for testing 1.2400. Once surpassed, the next stop would be the January 22 high at 1.2375.

Conversely, if GBP/USD rises above 1.2500, a test of the 50-day SMA is on the cards. Further upside is seen at 1.2575, the January 7 high.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.51% | 0.43% | 0.65% | 0.08% | 0.66% | 0.56% | 0.31% | |

| EUR | -0.51% | -0.08% | 0.13% | -0.43% | 0.15% | 0.05% | -0.18% | |

| GBP | -0.43% | 0.08% | 0.25% | -0.35% | 0.20% | 0.13% | -0.12% | |

| JPY | -0.65% | -0.13% | -0.25% | -0.59% | -0.01% | -0.13% | -0.36% | |

| CAD | -0.08% | 0.43% | 0.35% | 0.59% | 0.58% | 0.48% | 0.23% | |

| AUD | -0.66% | -0.15% | -0.20% | 0.00% | -0.58% | -0.10% | -0.34% | |

| NZD | -0.56% | -0.05% | -0.13% | 0.13% | -0.48% | 0.10% | -0.24% | |

| CHF | -0.31% | 0.18% | 0.12% | 0.36% | -0.23% | 0.34% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).