USD/JPY weakens on BoJ hike speculation ahead of Trump’s inauguration

- USD/JPY could face pressure as Trump's inauguration nears, with potential impacts from protectionist policies.

- Speculation rises on BoJ rate hike from 0.25% to 0.50%, first since July 2024, lifting yen.

- Hawkish comments from BoJ Governor Ueda and Deputy Governor Himino suggest monetary tightening.

The Japanese Yen gained some ground compared to the US Dollar in early trading on Monday, ahead of US President Donald Trump’s inauguration. Speculations that the Bank of Japan (BoJ) will hike rates kept the USD/JPY lower, trading near 155.60, down over 0.44%.

USD/JPY dips to 155.60; markets anticipate a rate hikefrom BoJ

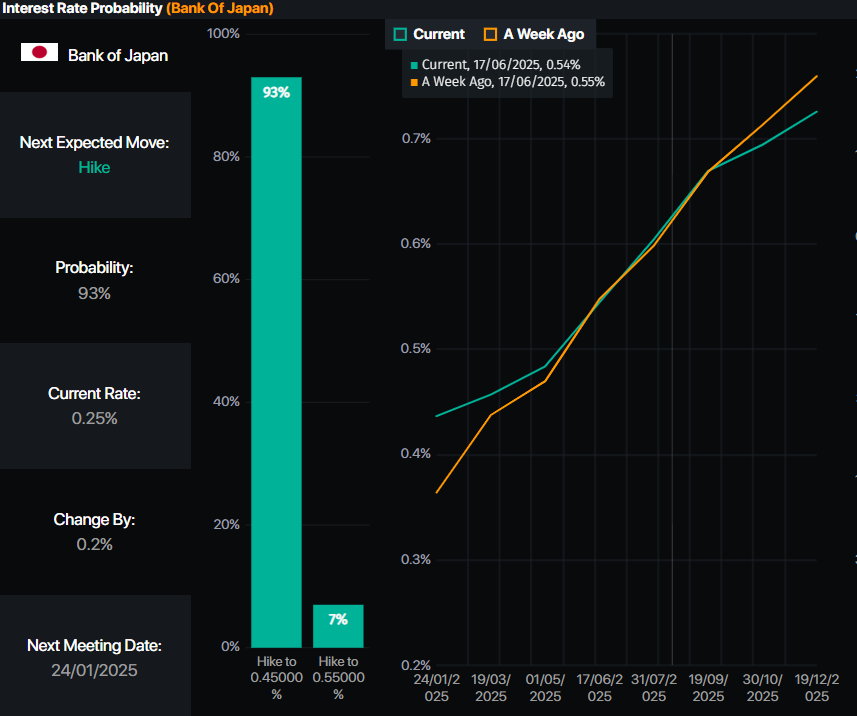

Interest rates in Japan remain among the lowest in the G8. According to money markets futures, the BoJ would likely increase borrowing costs from 0.25% to 0.50% on Friday, the first since July 2024.

Last week, BoJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino delivered hawkish remarks, laying the ground for the January 23-24 meeting. The December meeting minutes showed that board members favored a rate increase.

Source: Prime Market Terminal

Therefore, further USD/JPY downside is seen as the interest rate differential between the US and Japan will diminish. However, US President Donald Trump’s taking office could keep traders on their toes due to his protectionist policies, which could be inflation-prone and prevent additional easing to the Federal Reserve.

US financial markets will remain closed on Monday due to Inauguration Day, alongside Martin Luther King Day. Therefore, liquidity conditions will likely remain thin as markets resume their activities on Tuesday.

USD/JPY Price Forecast: Technical outlook

The pair remains bullishly biased, though it has fallen below the Tenkan-sen and the 20-day Simple Moving Average (SMA), opening the door for a retracement to the Kijun-sen at 155.65. A breach of the latter will expose the 50-day SMA at 154.88, followed by a support trendline drawn from the September 2024 lows.

On the other hand, if USD/JPY climbs past 156.00, further upside is seen, with buyers eyeing the Tenkan-Sen at 156.92, followed by the 20-day SMA at 157.24.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.36% | -1.11% | -0.37% | -1.21% | -1.29% | -1.36% | -0.58% | |

| EUR | 1.36% | 0.19% | 0.92% | 0.05% | 0.13% | -0.11% | 0.66% | |

| GBP | 1.11% | -0.19% | 0.65% | -0.15% | -0.05% | -0.31% | 0.46% | |

| JPY | 0.37% | -0.92% | -0.65% | -0.83% | -0.87% | -1.09% | -0.39% | |

| CAD | 1.21% | -0.05% | 0.15% | 0.83% | -0.02% | -0.16% | 0.61% | |

| AUD | 1.29% | -0.13% | 0.05% | 0.87% | 0.02% | -0.34% | 0.46% | |

| NZD | 1.36% | 0.11% | 0.31% | 1.09% | 0.16% | 0.34% | 0.59% | |

| CHF | 0.58% | -0.66% | -0.46% | 0.39% | -0.61% | -0.46% | -0.59% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).