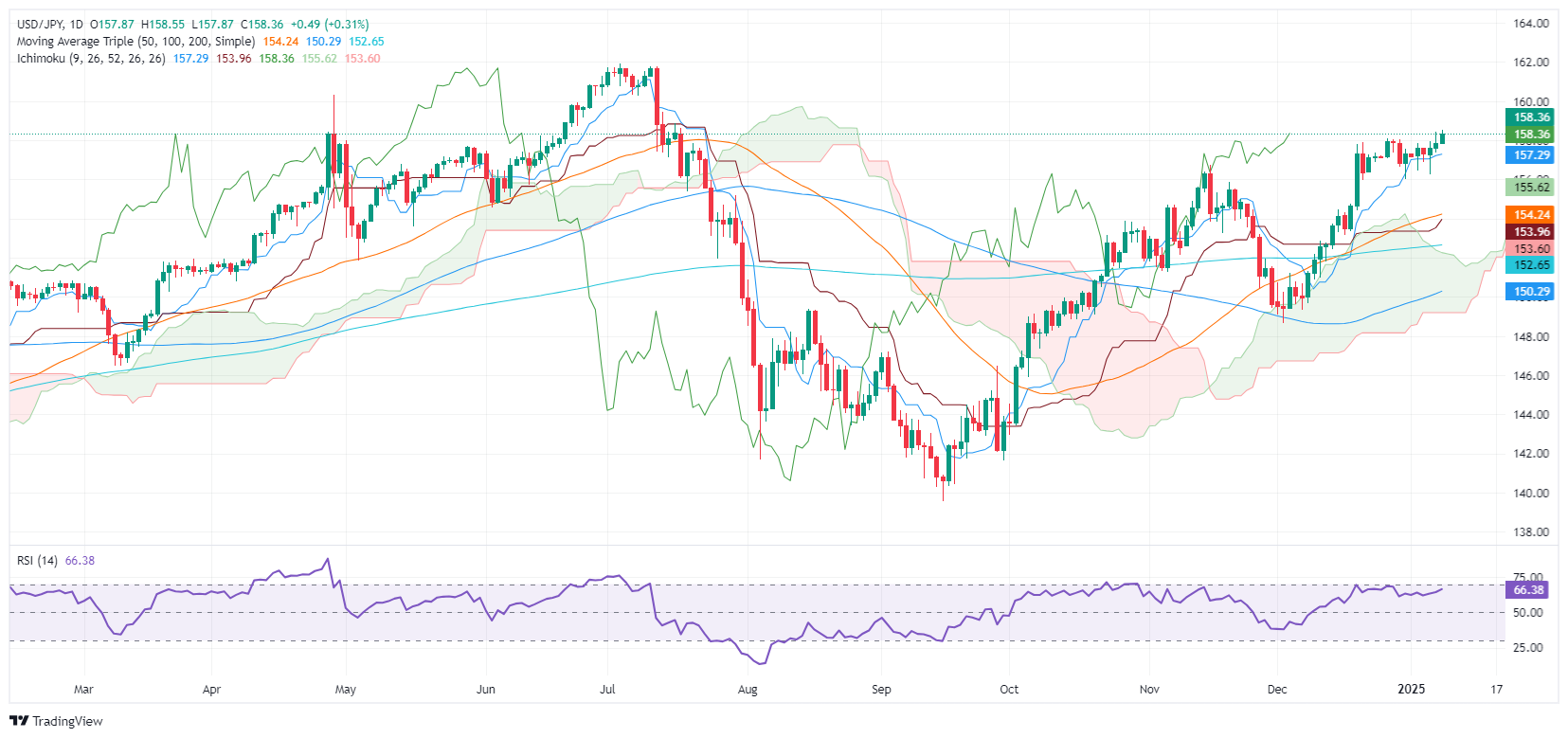

USD/JPY Price Forecast: Climbs and clears 158.00 as traders eye 160.00

- USD/JPY ascends to 158.34, supported by hawkish hints in Fed's December minutes and positive US employment figures.

- Technical indicators suggest potential resistance at 159.00, with a pivotal target of 160.00 in sight, under watch for possible Japanese intervention.

- Downside risks remain, with immediate support at the Tenkan-Sen line of 157.28, followed by December’s low at 156.02.

The USD/JPY edged higher late in the North American session after the Federal Reserve revealed its December meeting minutes. This, along with US jobs data and risk aversion, keeps the Greenback underpinned throughout the day. The pair trades at 158.34, up 0.19%.

USD/JPY Price Forecast: Technical outlook

The USD/JPY has risen above December’s high before the US Nonfarm Payrolls report, opening the door to challenge the 160.00 figure. Due to being close to the latter, Japanese authorities would likely begin their intervention jawboning to halt the Greenback’s advance.

That said, the USD/JPY first key resistance would be 159.00. Once cleared, the next stop would be 160.00 ahead of testing last year’s peak at 161.95.

Conversely, if sellers moved in and kept the USD/JPY from rising above 159.00, the first support would be the Tenkan-Sen at 157.28. A breach of the latter will expose the December 31 swing low of 156.02.

USD/JPY Price Chart – Daily

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.