EUR/CHF edges lower after release of deceptively-high Eurozone inflation, Swiss GDP

- EUR/CHF mildly falls on Friday as markets digest Eurozone HICP inflation data for November.

- The Euro weakens as it does little to change the outlook for interest rates , a key driver of FX valuations.

- CHF gains marginally on stronger GDP growth data but hamstrung by comments for the SNB’s President Schlegel.

EUR/CHF edges lower to trade on the 0.9300 handle on Friday after the release of Eurozone inflation data continues to suggest European Central Bank (ECB) members will cut interest rates at their December meeting despite the figures meeting economists’ expectations. Lower interest rates are negative for the Euro (EUR) since they decrease net capital inflows, and this puts pressure on the pair.

The Swiss Franc (CHF) meanwhile, gains a mild tailwind after the release of Swiss Gross Domestic Product (GDP) data shows Swiss economic growth outstripped expectations, and accelerated in Q3 on a year-over-year basis. The effect is likely to be blunted, however, with comments from the President of the Swiss National Bank Martin Schlegel, last week, still fresh in traders' minds. Schlegel said that interest rates in Switzerland might fall below zero. Still, EUR/CHF has fallen into negative territory after both sets of data on the back of Swiss Franc outperformance.

Eurozone inflation data decpetively high

The preliminary Eurozone Harmonized Index of Consumer Prices (HICP) rose 2.3% YoY in November in line with expectations and above the 2.0% of the previous month, according to data released Friday from Eurostat. Core HICP rose by 2.8%, which was also in line with expectations.

Despite appearing like inflation was rising, several analysts said the elevated November figures were almost entirely due to “base effects”. A base effect relates to the corresponding month of the previous year, if inflation was too low in that month it only requires a small rise for the data to show a large percentage increase in the current year.

“The increase in headline inflation from 2.0% in October to 2.3% in November was in line with expectations and was almost entirely caused by a base-effects driven by an increase in energy inflation,” said Jack Allen-Reynolds, deputy chief Eurozone economist at Capital Economics.

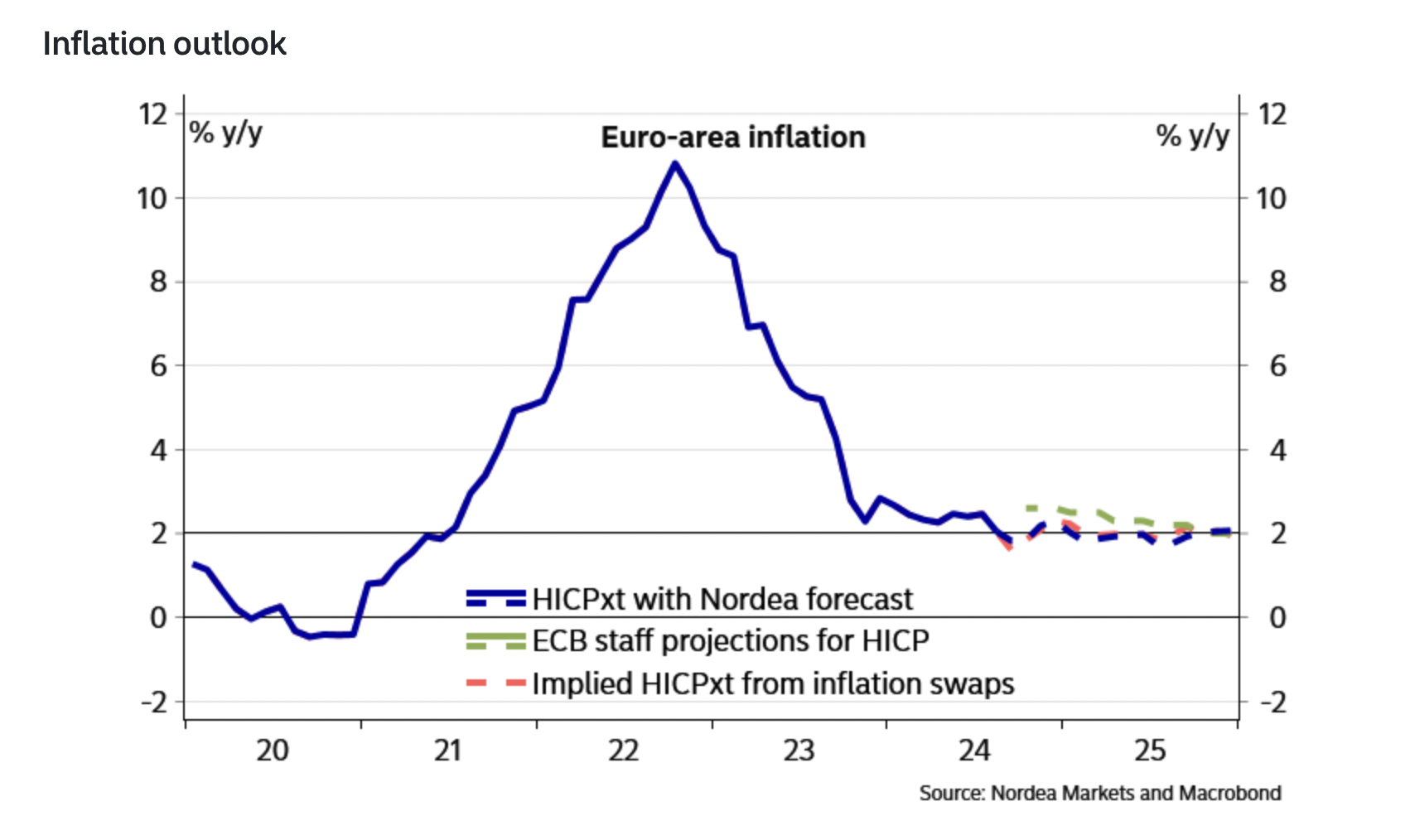

The view was shared by Anders Svendsen, chief analyst at Nordea, who said, “Inflation rises on base effects but remains on track to return to the ECB's inflation target in the first part of 2025, allowing the ECB to continue cutting policy rates towards neutral.”

Svendsen goes further to argue that inflation will likely fall to the European Central Bank’s (ECB) 2.0% target more quickly than the ECB is currently forecasting.

“Markets and the ECB agree that inflation will close in on 2% but disagrees on the timing. We believe the ECB will change its forecast to reflect an earlier return to 2% at its meeting in December. With that outlook, the ECB can continue cutting policy rates to neutral,” he writes.

Capital’s Allen-Reynolds thinks the November data marginally reduces the chance of the ECB making a double-dose 50 basis points (pbs) (0.50%) cut to rates in December, however, in spite of this, there is still a “good chance” of 50 bps reduction nevertheless, as well as lower rates further down the track.

“The continued strength of euro-zone services inflation in November reduces the chance that the ECB will cut interest rates by 50 bps in December,” yet adds, “While we think there is a good case for the ECB to cut interest rates by 50bp in December, several influential members of the Governing Council seem opposed to the idea and the strength of services inflation will arguably bolster their case. But if we’re right that services inflation will decline in December and beyond, and that the economy will remain weak, we think bigger cuts will be on the cards sooner or later.”

France's budget woes a drag

A further drag on the Euro is the political risk around the French budget with Prime Minister Michel Barnier struggling to get stringent budget cuts passed through parliament because of his wafer-slim majority.

The political battle highlights France’s weak fiscal position and has led to the spread in yields between French Government Bonds over German Bunds to widen by 82 bps, indicating outsized risks for French bond-holders.

“French Prime Minister Michel Barnier will have to make more concessions to the budget bill to prevent the government from falling. Far-right National Rally President Bardella stressed yesterday that “other red lines” remained. In the meantime, French political uncertainty is not spreading to the rest of the Eurozone which limits the drag on EUR.”

CHF vulnerable on SNB rhetoric

EUR/CHF saw limited downside pressure after Swiss GDP data, even though it would have been expected to strengthen CHF. Swiss GDP recorded a 2.0% rise in Q3 YoY, above the 1.8% forecast and the 1.8% previously. QoQ GDP rose 0.4%, in line with expectations and below the revised-down 0.6% of Q2.

The effect of the data was muted by growing expectations that the Swiss National Bank (SNB) will slash interest rates by 50 bps at its December meeting following comments from SNB President Schlegel in which he warned that negative interest rates cannot be ruled out.

“The SNB has plenty of room to slash the policy rate as Swiss inflation is tracking below the bank’s Q4 forecast of 1.0%. Market is pricing-in about 60% probability of a 50 bps rate cut to 0.50% at the December 12 meeting,” said Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman (BBH).