Forex Today: US Dollar rallies as Donald Trump remains on track to win presidency

Here is what you need to know on Wednesday, November 6:

The US Dollar (USD) gathers strength early Wednesday as markets react to US presidential election results, with the USD trading at its highest level since early July above 105.00. The US economic calendar will not feature any high-tier data releases and investors will continue to pay close attention to headlines surrounding the election outcome in key battleground states.

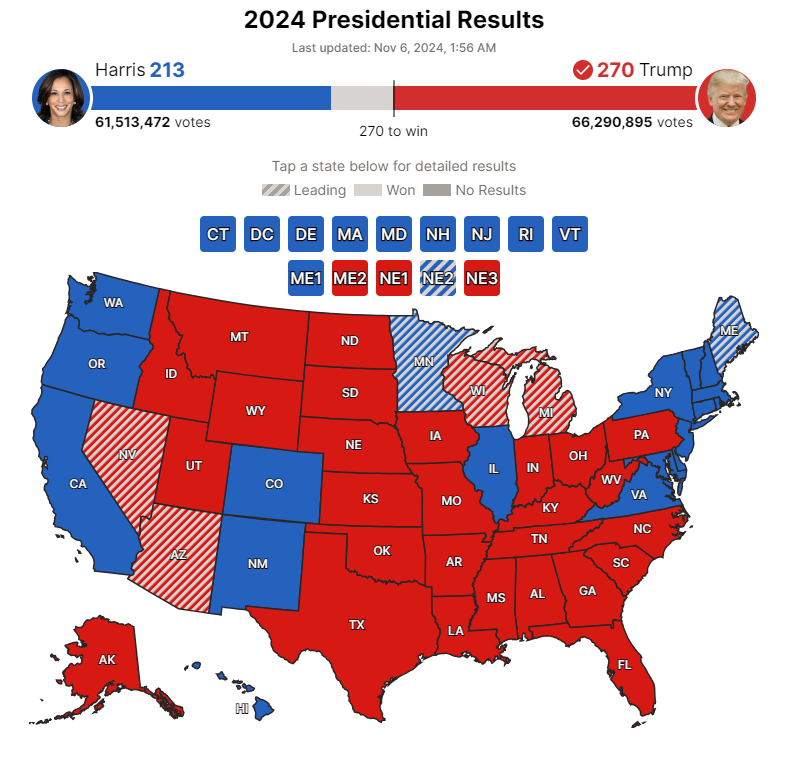

Donald Trump is projected to retake key battleground states that he narrowly lost in 2020. Almost every new major news outlet has called Georgia and North Carolina for Donald Trump. Just recently, Fox News has called Pennsylvania and Wisconsin for also Donald Trump. According to Decision Desk HQ, Trump is on track to become the 47th President of the United States. Furthermore, Republicans are projected to take the majority of the House after securing the Senate.

Source: Decision Desk HQ

In the meantime, the benchmark 10-year US Treasury bond yield is up more than 3% on the day above 4.4% and US stock index futures gain between 1.5% and 1.7%.

EUR/USD stays under heavy bearish pressure and loses nearly 2% on the day below 1.0750 in the early European session. Eurostat will publish Producer Price Index (PPI) data for September later in the session. European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech at 14:00 GMT.

GBP/USD declines sharply on Wednesday and trades below 1.2900, pressured by impressive USD strength.

USD/JPY gathers bullish momentum and trades at its highest level since late July above 154.00.

Gold turns south after posting small daily gains on Tuesday and falls toward $2,700, dragged by the rallying US Treasury bond yields.

AUD/USD stays on the back foot and loses nearly 1.5% on the day, trading slightly below 0.6550. Similarly, NZD/USD was last seen losing 1.4% at 0.5930.