USD/JPY Price Analysis: Bears overtake bulls as pair remains below 154.00

- USD/JPY bounces from 14-week low of 151.93, now at 153.73.

- Technical outlook shows potential for rally towards 156.00 if resistance is cleared.

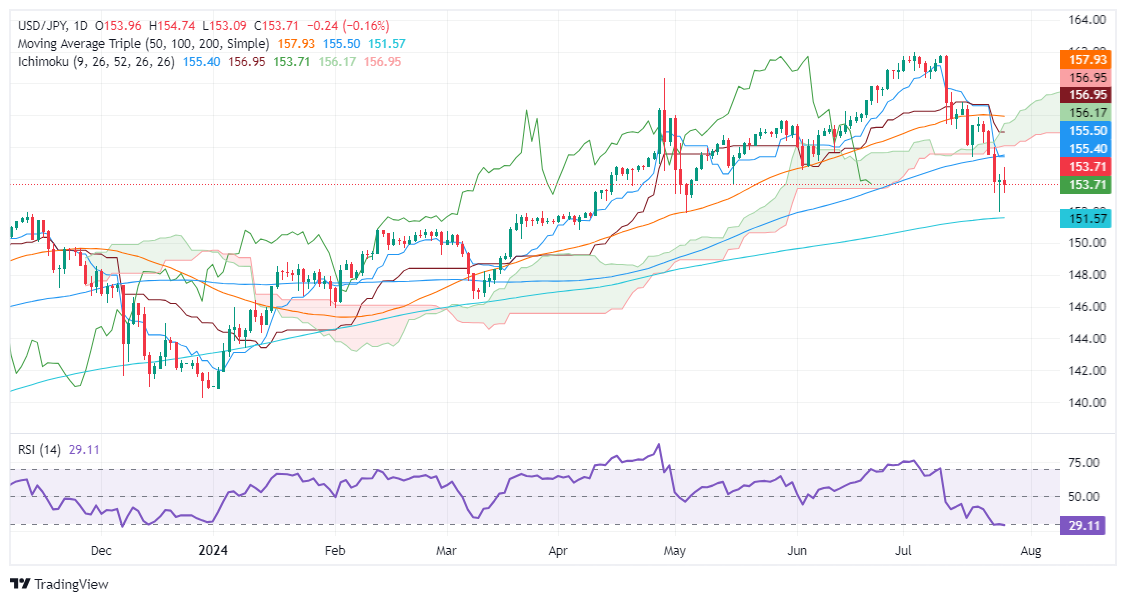

- Momentum favors sellers, with RSI near oversold; key support at 153.00 for bearish continuation.

The USD/JPY dropped 0.14% on Friday as the pair recovered some ground after hitting a 14-week low of 151.93. However, it bounced off that level and cleared key resistance levels. At the time of writing, the major trades at 153.73.

USD/JPY Price Analysis: Technical outlook

The pair printed a ‘dragonfly doji’ on Thursday, though Friday’s price action failed to make a bullish candle, which could open the door for a rally at least toward the bottom of the Ichimoku Cloud (Kumo) at 156.00.

Momentum suggests that sellers are in charge, as the Relative Strength Index (RSI) is bearish and almost flatlined around oversold conditions.

For a bearish resumption, bears need to push prices below 153.00. Once done, the next support would be the July 25 low of 151.94, followed by the 151.00 mark. Conversely, if USD/JPY buyers want to regain control, they must reclaim the 156.00 figure to lift prices above the Kumo.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.