USD/JPY Price Analysis: Creeps higher as buyers target 157.00

Source Fxstreet

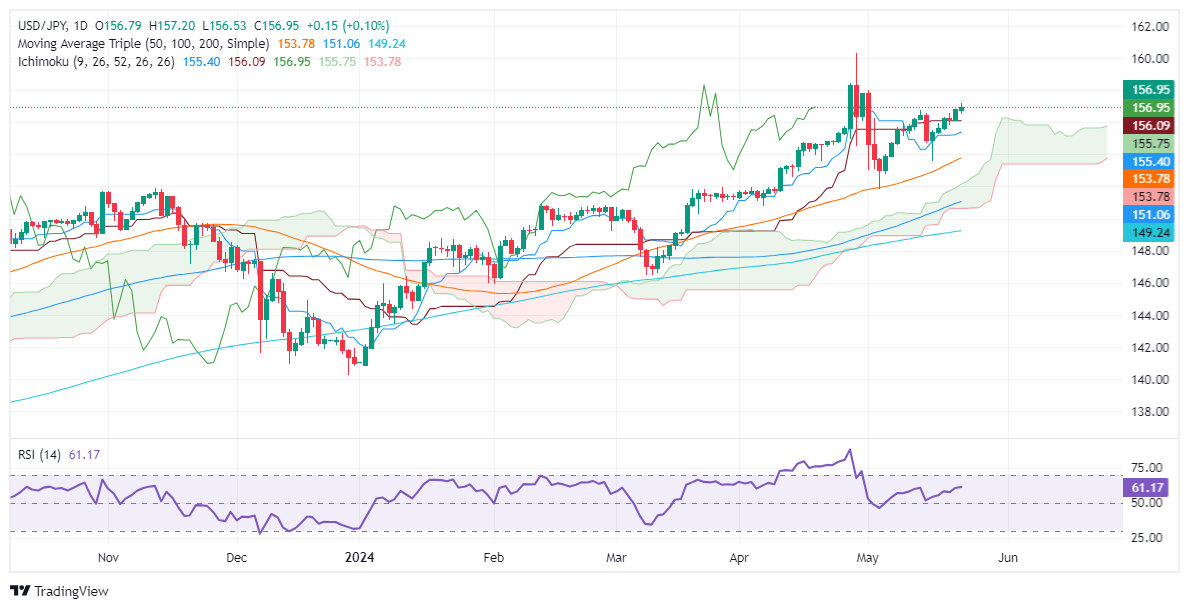

- USD/JPY rises, trading at 156.86, nearing the key psychological resistance at 157.00.

- U.S. economic data showing rapid business growth since 2022 bolsters the pair.

- Technical analysis: Resistance at 157.00, 158.44 (April 26 high), and YTD high of 160.32.

- Supports identified at Tenkan-Sen (156.05), Senkou Span A (155.61), and Kijun-Sen (155.18).

The USD/JPY registered gains for the second consecutive trading day but were marginal. The pair trades at 156.86, up by 0.03%, as economic indicators in the United States showed that business activity remains resilient, growing at the fastest pace since 2022.

USD/JPY Price Analysis: Technical outlook

The USD/JPY uptrend is persisting, but it is encountering strong resistance at the psychological 157.00 after clearing the May 14 high of 156.76. If buyers manage to surpass 157.00. that could lead to further gains. The next resistance emerges at 158.44, the April 26 high, and eventually challenges the year-to-date (YTD) high of 160.32.

On the downside, if the pair falls below the Tenkan-Sen at 156.05, it will expose the Senkou Span A at 155.61, followed by the Kijun-Sen at 155.18.

USD/JPY Price Action – Daily Chart

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

The 365-day MVRV ratio suggests that this crash may be just the beginning. If the ETF is rejected before the second quarter of 2024, it could trigger a sharp correction.

Natural Gas sinks to pivotal level as China’s demand slumpsNatural Gas price (XNG/USD) edges lower and sinks to $2.56 on Monday, extending its losing streak for the fifth day in a row. The move comes on the back of China cutting its Liquified Natural Gas (LNG) imports after prices rose above $3.0 in June. It

Natural Gas price (XNG/USD) edges lower and sinks to $2.56 on Monday, extending its losing streak for the fifth day in a row. The move comes on the back of China cutting its Liquified Natural Gas (LNG) imports after prices rose above $3.0 in June. It

The Gold price (XAU/USD) loses ground amid the stronger US Dollar (USD) and higher US Treasury bond yields on Tuesday.

Wietse Wind, founder of XRP Labs—one of the leading independent XRP Ledger development companies—has published an open letter to the community and Ripple.

Bitcoin (BTC) Price Struggles Put Short-Term Holders at a DisadvantageIn recent months, a cohort of Bitcoin (BTC) holders has been notably affected by the coin’s struggle to stabilize above $70,000. This group comprises short-term holders (STHs) — investors who have held the asset for less than 155 days.

In recent months, a cohort of Bitcoin (BTC) holders has been notably affected by the coin’s struggle to stabilize above $70,000. This group comprises short-term holders (STHs) — investors who have held the asset for less than 155 days.

Related Instrument