FTSE 100 Close Today&Weekly Roundup

FTSE 100 Latest Weekly Roundup & Close Today

Welcome to the Investing.com UK weekly FTSE 100 latest update, designed to keep investors informed on the newest UK stock market movements and key developments. In this weekly report, you'll find a summary of the last week's significant news, and trends affecting the FTSE 100 index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday morning as soon as the London Stock Exchange (LSE) market opens at 8:00am UK local time (GMT+1).

FTSE 100 Share Price Opening 2nd September 2024

The closing share price for the start of this week, Monday 2nd September, was 8,376.63, which sat -0.15% lower than at close on Friday 30th August, indicating that the FTSE needed to rally later in the week to make up for the dip.

Investor Sentiment This Week For FTSE 100 Predictions

The FTSE 100 started the week with a -0.15 dip on Monday, and has unfortunately seen falls every day since. The swing to a more bearish sentiment that we saw at the end of last week seems to have largely played out despite some green moments for the index this week.

UK Manufacturing Sector Shows Positive Trends

In positive news for the UK manufacturing sector, the S&P Global Manufacturing Purchasing Managers' Index (PMI) rose to 52.5 in August, up from 52.1 in July. This marks a 26-month high, indicating growth (anything above 50 points to growth). August saw increases in manufacturing output, new orders, and employment, with domestic orders driving new business wins for the fourth consecutive month. However, new export orders declined for the thirty-first month straight. Inflation pressures eased as input costs and selling prices slowed. Employment growth has hit its fastest rate since July 2022. However, challenges remain, particularly in securing new overseas contracts amid geopolitical tensions and economic uncertainties. The European market, a crucial destination for UK goods, has shown reduced demand due to economic slowdowns and political uncertainties. The sector’s future growth hinges on both domestic economic stability and better global trade dynamics.

Mergers and Acquisitions Decline

Mergers and acquisitions (M&A) in the UK took a downturn in the second quarter. According to the Office for National Statistics (ONS), there were 385 domestic and cross-border M&As, down by 78 from the first quarter of 2024. The value of foreign companies acquiring UK firms stood at £5.0 billion, down from £5.6 billion in the previous quarter. Similarly, outward M&A fell to £4.2 billion from £4.6 billion, while domestic M&A dropped to £2.6 billion, down £1 billion from the first quarter.

This decline in M&A activity can be seen as a signal that businesses and investors are proceeding with caution, reflecting broader economic concerns and a preference for more conservative financial management strategies in uncertain times. This trend often corresponds with periods where companies prioritise financial resilience over aggressive expansion.

Fractional Trading in ISA Accounts

In a move that will likely boost demand for shares, HMRC will now allow ISA accounts to be used for fractional trading, where investors can hold smaller portions of high-priced shares. This decision reverses HMRC's previous stance that fractional shares did not qualify for tax-free accounts. Although often used for expensive US stocks, UK investors can now benefit from tax-free fractional shares. HMRC stated: “The government has committed to changing the ISA rules to allow certain fractional shares. Taking a pragmatic approach, we will not raise an assessment on managers or investors for fractional shares acquired before these changes are made.”

September is historically a volatile month for stocks but, as always, long-term investors are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to an additional 10% off your 1-year plan!

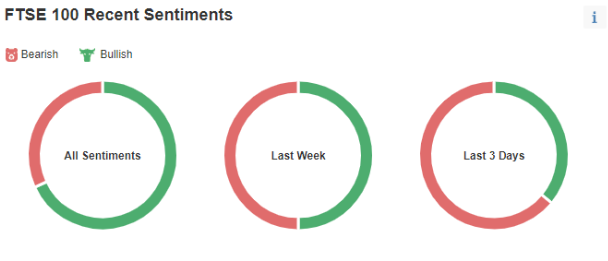

We can see that the Investing.com UK community’s sentiment towards the FTSE 100 index has kept its momentum towards a more bearish outlook, with a 64-36 Bearish-to-Bullish split, compared to last week’s 38-62 split.

Notable FTSE 100 Movements & Stock Market News

Here are some of the top stories from the footsie 100 constituents over the past 5 days.

Barratt Hits Dividend Downwards

Barratt Developments PLC (LON:BDEV) announced a significant cut to its dividend, more than halving it, amid a challenging housebuilding landscape. Basic earnings per share plummeted by 78% to 11.8p, with the company completing 14,004 homes in the year, slightly above guidance but nearly 20% lower than the previous year. Despite this, Barratt plans to complete 13,000 to 13,500 homes in the upcoming year and aims to deliver 1.5 million new homes over the next five years.

Chief Executive David Thomas highlighted that Barratt is "well-positioned to meet the strong underlying demand" and welcomed proposed government reforms to the planning system as critical to increasing housebuilding.

SEGRO agrees takeover of European rival

FTSE 100-listed warehouse property developer Segro Plc (LON:SGRO) has agreed to take over Tritax EuroBox PLC (LON:EBOX) in an all-share offer. Tritax EuroBox shareholders will receive 0.0765 new SEGRO shares per share they own, plus a dividend of 1.25 euro cents per share (approximately 1.05p).

Based on SEGRO's previous closing price of 880p, this offer values each Tritax EuroBox share at around 68.37p, a 27% premium to its closing price on May 31, which was the last day before the offer was made.

Why Are Rightmove Prices Going Up?

Rightmove PLC (LON:RMV) shares soared 20% after Australian digital property giant Rea Group Ltd (ASX:REA) announced a potential cash and share offer for the UK online real estate platform. Analyst Sean Kealy at Panmure Liberum mentioned that while Rightmove hasn't been approached, the leak has forced the news into the open prematurely, potentially leading to a "messy situation" due to short-selling and the need for a large equity placing for the cash component.

Jessica Pok at Peel Hunt (LON:PEEL) emphasised the similarities between the UK and Australian property markets, noting that REA Group is Australia's largest property listing company.

REA has until the end of September to make a formal offer.

IAG Ready For A Breakout?

International Consolidated Airlines Group S.A. (LON:ICAG) has been one of the best-performing FTSE 100 companies recently, with its share price rising over 16% from its August low.

Strong financial results and the resumption of dividends have boosted the stock, with total revenue increasing from €13.58 billion to €14.72 billion in the first half of the year. Profit after tax surged to €905 million, and cash reserves grew to €9.6 billion, while net debt dropped to €6.4 billion.

The stock recently crossed an important resistance level at 180p and remains above the 50-day and 100-day Exponential Moving Averages (EMA). Analysts expect the stock to continue its upward trajectory, potentially targeting the psychological level of 200p.

Today's FTSE 100 Close

The above investor sentiment and factors driving this week's ‘Footsie’ volatility meant that today the FTSE 100 is likely to close at a price which sits lower than the weekly FTSE 100 opening price of 8,376.63.

Best FTSE 100 Shares To Buy

Unsure where to invest next? Our proven portfolios can help you to discover high-potential opportunities.

Investors can also use our free stock screener to filter top FTSE 100 companies according to their investment strategy, and add them to a watchlist today.