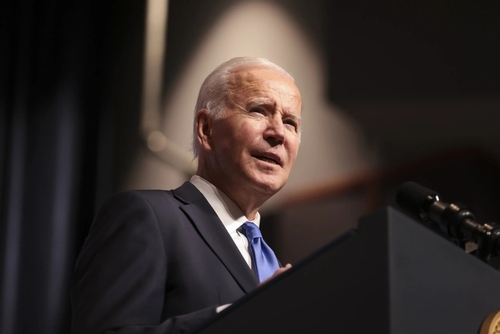

Biden administration announces new Chinese chips probe, Semiconductor stocks gain

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Investing.com -- U.S. semiconductor stocks mostly edged higher in premarket trading on Tuesday after the Biden administration launched a new trade investigation into Chinese-made legacy semiconductors.

The probe, initiated under Section 301 of the Trade Act of 1974, could lead to additional tariffs on older Chinese chips that are used in everyday products such as automobiles, washing machines, and telecom gear.

Semiconductor companies like Broadcom (NASDAQ:AVGO), AMD (NASDAQ:AMD), and Marvell (NASDAQ:MRVL) Technology saw gains of around 1.8%, 1.8%, and 0.4%, respectively. Meanwhile, ETFs tracking the sector, including the SOXX and SMH, rose by 0.3% and 0.2%. Micron (NASDAQ:MU) also posted a modest gain of 0.1%, while Nvidia (NASDAQ:NVDA) and Taiwan Semiconductor saw slight declines of 0.3% and 0.8%.

The investigation is aimed at protecting U.S. semiconductor producers from China’s state-driven expansion of its chip industry, which has enabled Chinese companies to offer chips at artificially lower prices.

U.S. Trade Representative Katherine Tai stated that the probe would help safeguard U.S. market competition and ensure that China does not dominate the global semiconductor market.

While the investigation will be completed under President-elect Donald Trump’s administration, the Biden administration's decision to move forward now could result in new tariffs on Chinese semiconductors.

These tariffs would add to the 50% tariff on Chinese chips scheduled to take effect on January 1.

Reuters reported that China's commerce ministry said the probe raises concerns about potential disruptions to global chip supply chains.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.