Malaysia has become a thriving center for financial activities in recent years, with a growing interest in forex trading among its people. As investors look to diversify their portfolios and tap into global currency markets, forex trading emerges as an accessible and profitable avenue.

In this article, we delve into the intricate world of forex trading in Malaysia, providing a complete guide including tips, and essential information for both beginners and experienced traders. Additionally, we offer a list of the top 10 Forex Brokers/Platforms, carefully evaluated for reliability, security, features, and support for your reference.

1. How to start Forex trading in Malaysia for beginners

Starting your forex trading venture in Malaysia might feel overwhelming initially, but with proper guidance and strategy, it transforms into an achievable and fulfilling pursuit. Below is a comprehensive step-by-step guideline to assist newcomers in initiating their forex trading journey:

1.1 Learning the Basic Concept

Before diving into the world of forex trading, it's crucial to grasp the basic concepts. Familiarize yourself with terms such as currency pairs, pips, leverage, and risk management. The details of these concepts will be introduced more specifically in section 6 of the article. Additionally, there are abundant online resources, tutorials, and courses available to help you understand these concepts better.

Before diving into the world of forex trading, it's crucial to grasp the basic concepts. Familiarize yourself with terms such as currency pairs, pips, leverage, and risk management. The details of these concepts will be introduced more specifically in section 6 of the article. Additionally, there are abundant online resources, tutorials, and courses available to help you understand these concepts better.

1.2 Choose a Licensed Forex Broker

Selecting a reputable and licensed forex broker is paramount to your trading success. Ensure that the broker is regulated by Malaysia's regulatory body, the Securities Commission Malaysia (SCM), or other recognized international regulatory authorities such as ASIC, CySEC, FCA, etc.

Conduct thorough research, read reviews, and compare brokers to find one that aligns with your trading goals and preferences. Section 4 of the article will present detailed explanations of forex broker license checks, accompanied by a specific example.

1.3 Create a Demo Account

Practice makes perfect, and a demo account provides the ideal step for practicing your trading skills without risking real capital. Most reputable brokers offer demo accounts with virtual funds, allowing you to simulate real market conditions and test different trading strategies. Use this opportunity to familiarize yourself with the trading platform and gain confidence before transitioning to live trading.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

1.4 Create a Live Account

Once you feel comfortable and confident with your trading abilities, it's time to open a live trading account. Start with a modest amount of capital that you can afford to lose, as forex trading involves inherent risks. Choose an account type that suits your risk tolerance and trading objectives, whether it's a standard account, VIP account, or micro account.

1.5 Start Trading Forex

Once you have created your live trading account, it's time to start trading Forex. Implement the strategies and techniques you have learned through your education and practice. Monitor the markets, analyze trends, and make informed trading decisions based on your analysis.

Remember to manage your risks effectively by setting stop-loss orders and adhering to your risk management plan. Regularly evaluate your trading performance and make necessary adjustments to improve your results. Stay disciplined, patient, and focused as you navigate the exciting world of forex trading in Malaysia.

By following these steps and staying disciplined in your approach, you'll be well-equipped to start your forex trading journey in Malaysia with confidence and success. Remember to continuously educate yourself, stay informed about market developments, and practice prudent risk management to achieve your trading goals.

2. The important criteria to choose a good Forex broker

Choosing a good forex broker is crucial for a successful trading experience. Here are some important criteria to consider when selecting a forex broker:

Regulation and License: The broker has to be regulated by one or more reputable financial authorities. Regulation provides a level of protection for your funds and ensures that the broker operates with transparency and integrity.

Security: Look for brokers that offer secure trading platforms and adhere to strict security protocols to safeguard your personal and financial information.

Trading Costs: Consider the spreads, commissions, and other fees charged by the broker. Low trading costs can help maximize your profits, especially for day traders.

Trading Platforms: A user-friendly and reliable platform with advanced trading tools can enhance your trading experience and efficiency. It would be better if it supports your language.

Products: Check the range of financial instruments available for trading, including currency pairs, commodities, indices, and cryptocurrencies. A diverse selection allows you to explore different markets and trading strategies.

Execution Speed and Reliability: Look for brokers that offer fast order execution and minimal slippage, especially during volatile market conditions. Reliable order execution ensures that your trades are executed promptly and at the desired price.

Customer Support: Assess the standard and accessibility of the broker's customer support services. A responsive support team can swiftly tackle any trading issues or questions that arise during your trading time.

Educational Resources: Evaluate the educational resources provided by the broker, such as trading guides, webinars, and market analysis. Comprehensive educational materials can help improve your trading skills and knowledge.

Deposit and Withdrawal: Examine the deposit and withdrawal options provided by the broker. Having a diverse range of payment methods and swift processing speeds simplifies the management of your funds for greater effectiveness.

Reputation and Reviews: Explore the broker's standing within the industry and peruse feedback from fellow traders. Scrutinize reviews regarding reliability, customer service, and general satisfaction to assess the broker's credibility.

By considering these important criteria, you can choose a forex broker that meets your trading needs and preferences, setting you up for a successful trading journey.

3. Top 10 best Forex brokers/platforms list

Navigating the plethora of forex brokers and platforms available in Malaysia can be daunting for beginners. To alleviate this challenge and follow the criteria in section 2, we've meticulously selected a list of the top 10 forex brokers and platforms for your reference.

#1 Mitrade

Mitrade, headquartered in Melbourne, Australia, is a regulated CFD broker. Since its launch in 2019, Mitrade has quickly gained recognition for its user-friendly interface and accessible trading tools. It has garnered a user base of 3+ million globally. The platform provides various financial products, encompassing 60+ forex pairs among others.

Fees (Forex):

- Commission: Free

- Deposit and withdraw: Free

- Spread: Floating and competitive.

- Swap: Low.

- Additional fees: No.

- Minimum deposit: 50 USD ~ 236 MYR.

- Leverage: 1:1 ~ 1:200.

Features:

- Regulation: ASIC, CySEC, CIMA, FSC

- Products: 40+ cryptocurrencies, 60+ forex pairs, 200+ shares, 19 indices, 13 commodities, 36 ETFs.

- Trading app: Mitradeapp, user-friendly interface, web & mobile app.

- Payment Methods: Visa, Skrill, Mastercard, Neteller, PCI, Bank transfer, PayID, Worldpay.

- Customer services: 24/5, multiple languages.

- Education resources: blogs, courses, news, Demo account.

#2 IG

IG is a well-established brokerage firm renowned for its comprehensive trading services. With its headquarters in London, IG offers a wide range of financial products, including forex. Launched in 1974, IG has earned a strong reputation for its reliability and user-friendly platform, catering to both novice and experienced traders.

Fees (Forex):

- Commission: $1 - $10 depending on the type of account.

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: 0,8%.

- Additional fees: No.

- Minimum deposit: 50 USD ~ 236 MYR.

- Leverage: 1:1 ~ 1:200.

Features:

- Regulation: BMA, FCA.

- Products: Forex, cryptocurrencies, shares, options, indices, commodities, bonds, interest rates, knock-outs, sectors.

- Trading app: MT4, IG, L2 Dealer.

- Payment Methods: Credit card, debit card, HK FPS, or bank transfer.

- Customer services: 24/5.

- Education resources: IG Academy.

#3 AvaTrade

Founded in 2006, AvaTrade has grown to become one of the leading online brokers globally, serving clients in over 150 countries. It is regulated in multiple jurisdictions, ensuring compliance with strict financial regulations and providing traders with a sense of security and trust.

Fees (Forex):

- Commission: Free.

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: Depends on forex pairs.

- Additional fees: No.

- Minimum deposit: 100 USD ~472 MYR.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: BVIFSC, CBI, ASIC, FSCA, FRSA, FSA, CySEC, FFAJ.

- Products: Forex, cryptocurrencies, shares, options, indices, commodities, bonds.

- Trading app: MT4, MT5, AvaTradeGo.

- Payment Methods: Credit cards, debit cards, wire transfers, and other e-payment.

- Customer services: 24/7.

- Education resources: Blog, tutorials, Demo account.

#4 FBS

FBS is a regulated online broker offering financial trading services. Established in 2009, it has since gained popularity globally, serving 27+ million clients in over 150 countries. FBS provides traders with access to a variety of trading accounts, including Cent, Standard, and ECN, catering to both beginners and experienced traders.

Fees (Forex):

- Commission: Free.

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: Depends on forex pairs.

- Additional fees: No.

- Minimum deposit: 100 USD ~472 MYR.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: FSC, CySEC.

- Products: Forex, cryptocurrencies, shares, indices, commodities.

- Trading app: MT4, MT5, FBS trader.

- Payment Methods: Visa, Mastercard, Maestro, Wire transfer, Skrill, Neteller.

- Customer services: 24/7.

- Education resources: News & Analytics, courses, Demo account.

#5 XM

XM is a regulated online broker founded in 2009, with its headquarters located in Limassol, Cyprus. It has attracted over 10 million clients in over 190 countries, standing out as the preferred broker for traders worldwide. XM comprises a team of over 900 seasoned professionals in the financial sector.

Fees (Forex):

- Commission: 3,5 USD/ 100.000 USD value traded. (Zero Account)

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: Depends on forex pairs.

- Additional fees: No.

- Minimum deposit: 5 USD ~23,6 MYR.

- Leverage: 1:2 ~ 1:30.

Features:

- Regulation: ASIC, CySEC, FSC, DFSA.

- Products: Forex, shares, thermal indices, equity indices, commodities.

- Trading app: MT4, MT5, XM WebTrader.

- Payment Methods: Credit and debit cards, bank transfers, e-wallets, and others.

- Customer services: 24/5.

- Education resources: Market research, learning center, Demo account.

#6 CMCMarkets

CMC Markets is a globally recognized online brokerage firm that provides access to a wide range of financial instruments, founded in 1989, with headquarters located in London, the UK. CMC Markets operates in multiple jurisdictions and is regulated by top-tier financial authorities, ensuring a secure and transparent trading environment for its clients.

Fees (Forex):

- Commission: 0,0025%

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: Depends on forex pairs.

- Additional fees: No.

- Inactivity account fees: $10/month, up to 3 months.

- Minimum deposit: $0.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: FCA, FSCS.

- Products: Forex, indices, cryptocurrencies, commodities, shares, ETFs, treasures.

- Trading app: MT4, CMC app.

- Payment Methods: Credit and debit cards, bank transfers.

- Customer services: 24/5.

- Education resources: News and analytics, CMC learn, Demo account.

#7 ICMarkets

IC Markets, an esteemed online brokerage founded in 2007, has earned widespread recognition in the financial sector for its commitment to offering competitive spreads, rapid execution, and dependable trading infrastructure. Based in Sydney, Australia, IC Markets operates on a global scale, catering to clients across more than 160 countries.

Fees (Forex):

- Commission: 3,5 USD/lot (Raw Spread account)

- Deposit and withdraw: Free

- Spread: Floating.

- Swap: Depends on forex pairs.

- Additional fees: No.

- Minimum deposit: $200 ~950 MYR.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: CySEC, FSA, ASIC, SCB.

- Products: Forex, indices, cryptocurrencies, commodities, shares, bonds.

- Trading app: MT4, MT5 cTrader.

- Payment Methods: Bank transfer, Wire transfer, Paypal, Credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli.

- Customer services: 24/7.

- Education resources: Icmarkets education, Demo account.

#8 XTB

XTB is a regulated online brokerage established in 2002, offering access to various financial markets. Headquartered in Warsaw, Poland, it serves 01+ million clients globally, providing competitive spreads and reliable trading platforms xStation. Regulated by top financial authorities, XTB prioritizes transparency and innovation, making it a trusted choice for traders worldwide.

Fees (Forex):

- Commission: Free.

- Deposit: Free

- Withdraw: up to 1,5%.

- Spread: Floating.

- Swap: Depends on forex pairs.

- Inactivity account fees: $10/month.

- Additional fees: No.

- Minimum deposit: $0.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: FCA, FSC, KNF, CNMV, CySEC.

- Products: Forex, indices, cryptocurrencies, commodities, shares, ETFs, Investment plans.

- Trading app: xStation 5.

- Payment Methods: Bank transfer, credit and debit cards, Paypal, and Paysafe.

- Customer services: 24/5.

- Education resources: Xtb education, Market Analytics, Demo account.

#9 Forex.com

Forex.com is a regulated online forex and CFD trading platform, providing access to a wide range of financial markets. Established in 2001, Forex.com has earned a strong reputation for its reliability, transparency, and user-friendly interface. Headquartered in the United States, Forex.com serves clients globally, offering competitive spreads, advanced trading tools, and comprehensive educational resources.

Fees (Forex):

- Commission: 0,08%.

- Deposit & withdraw: Free.

- Spread: Floating.

- Swap: Depends on forex pairs.

- Inactivity account fees: $15/month.

- Additional fees: No.

- Minimum deposit: $100 ~ 472 MYR.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: CySEC, CIF, ICF.

- Products: Forex, indices, cryptocurrencies, commodities, shares, bullions.

- Trading app: Forex.com app, MT5.

- Payment Methods: Bank transfer, credit and debit cards, Neteller, Skrill.

- Customer services: 24/5.

- Education resources: Academy, Demo account.

#10 FxPro

FxPro is a regulated online brokerage established in 2006, offering trading services in financial markets. With a global presence across over 160 countries, FxPro is regulated by top-tier financial authorities, offering competitive spreads, advanced trading platforms, and excellent customer support, FxPro is a trusted choice.

Fees (Forex):

- Commission: $35/ $1 million traded.

- Deposit & withdraw: Free.

- Spread: Floating.

- Swap: Depends on forex pairs.

- Inactivity account fees: $5/month and $15 maintenance after 6 months of inactivity.

- Additional fees: No.

- Minimum deposit: $100 ~ 472 MYR.

- Leverage: 1:1 ~ 1:30.

Features:

- Regulation: CySEC, FCA, FSCA, SCB.

- Products: Forex, indices, cryptocurrencies, commodities, shares.

- Trading app: FxPro, MT4, MT5 & cTrader.

- Payment Methods: Bank transfer, Wire transfer, Credit/Debit cards, PayPal, Neteller, Skrill.

- Customer services: 24/5.

- Education resources: FxPro education, Demo account.

Here are the top 10 popular forex brokers currently operating in Malaysia. Each platform has its advantages and disadvantages, as well as different trading interfaces. Traders can use Demo accounts on these platforms to practice and familiarize themselves with the trading environment to select the most suitable one.

4. How to check Forex broker license?

Checking a forex broker's license is crucial to ensure that it operates legally and adheres to regulatory standards. Here are steps you can take to verify a forex broker's license:

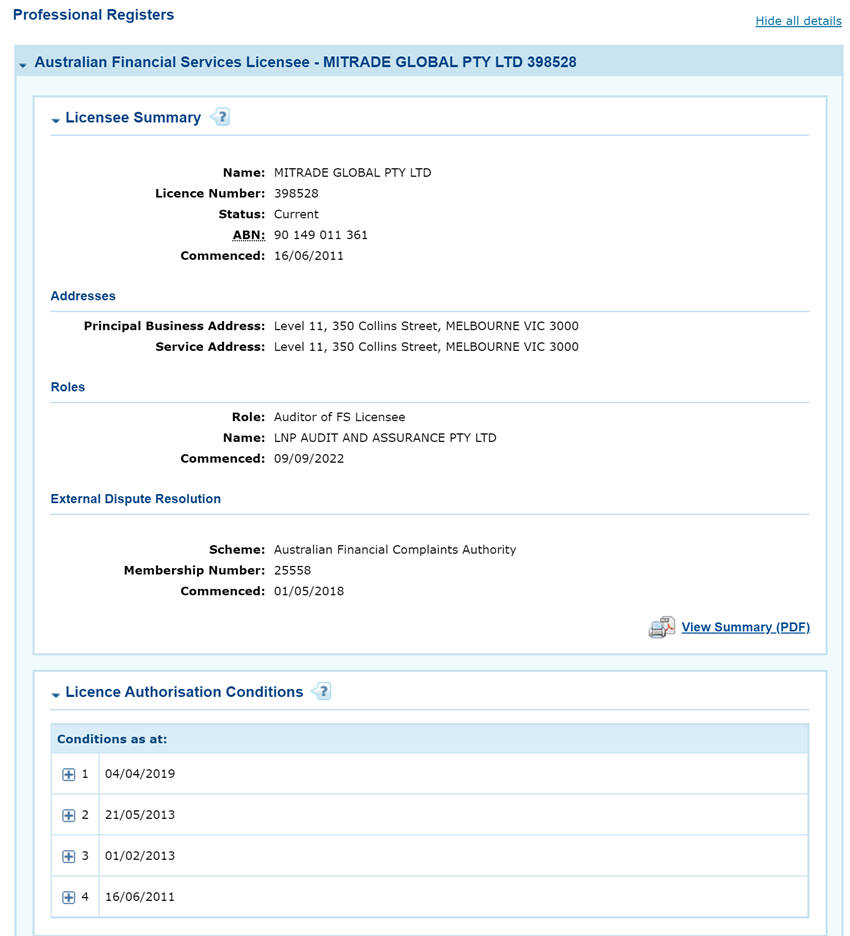

#Step 1. Visit and check the broker's website: Go to the broker's website and look for information about their regulatory oversight. Find details about the regulatory authorities that supervise the broker's operations. Depending on the broker's location, this could be the Australian Securities and Investments Commission (ASIC) in Australia, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, or others.

For example, Access legal documents on the Mitrade website:

#Step 2. Visit the regulatory authority's website: Proceed to the official website of the regulatory authority that oversees the broker. Look for a section specifically related to registered or licensed entities.

#Step 3 Search for the Broker: Utilize the search function provided on the regulatory authority's website to locate the broker. You may be required to enter the broker's name or license number.

The licensed forex brokers often teach you how to check their licenses to avoid confusing them with unlicensed brokers.

For example, on the official site of Mitrade, you can find the ways to check all the licenses at https://www.mitrade.com/about-us/mitrade

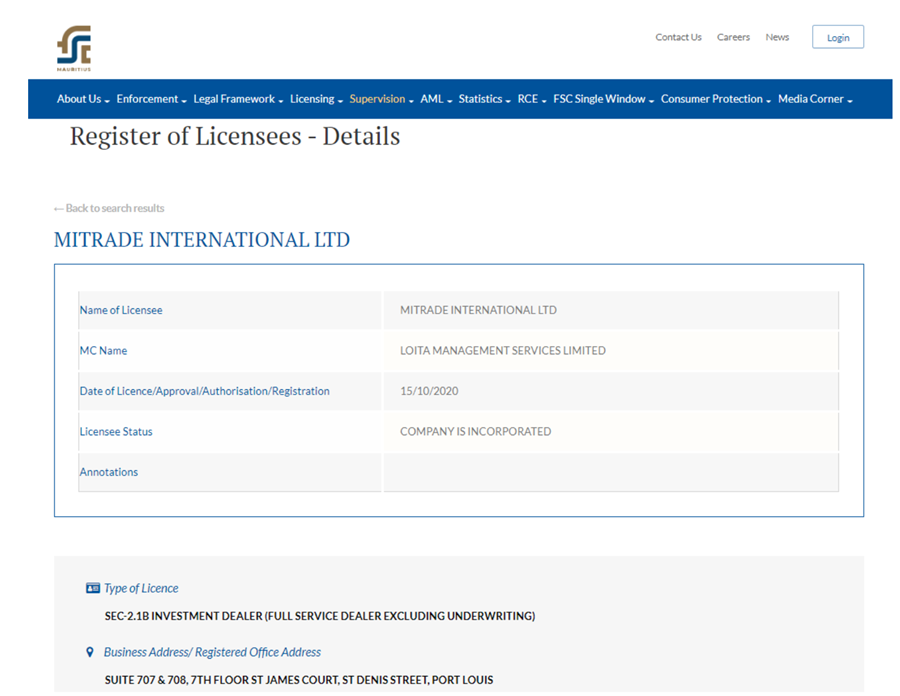

I will show you how to search for Mitrade’s license on ASIC and FSC’s websites:

https://www.fscmauritius.org/en

#Step 4. Verify the License: Once you locate the broker, carefully review the license details provided. Ensure that the broker's name matches the information available on their website and promotional materials.

#Step 5. Review Additional Information: Take note of any additional details provided by the regulatory authority, such as the license status, regulatory history, and any disciplinary actions taken against the broker.

By following these steps, you can verify a forex broker's license and make informed decisions when choosing a broker to trade with. Remember that trading with a licensed broker offers greater protection for your funds and ensures a fair trading environment.

5. Forex trading time in Malaysia

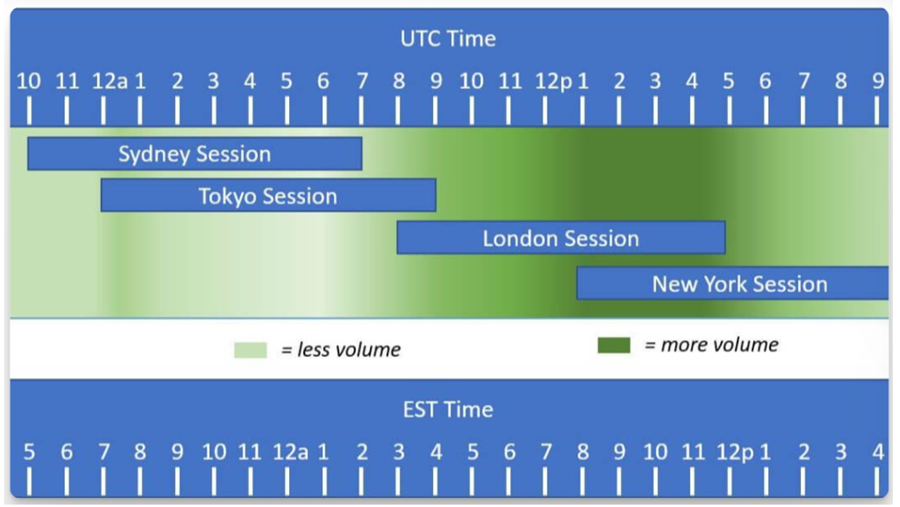

Malaysia operates within the GMT+8 time zone, aligning its regular trading hours with the key Asian financial hubs. It's important to note that forex trading is available 24 hours a day, five days a week, enabling traders in Malaysia to participate in the market at any time. However, trading volumes and volatility may vary across sessions, with the most significant opportunities often arising during the overlap of major sessions.

Therefore, it is generally considered that between 8:00 AM and 5:00 PM GMT (4:00 PM to 1:00 AM GMT+8), traders can expect ample liquidity, narrow spreads, and significant price fluctuations, making it an optimal period for active trading.

6. The basic knowledge about Forex trading

6.1 Forex Trading Fees

+ Commission fees: Refer to the charge imposed by brokers for facilitating trades in the foreign exchange market.

+ Spread: Refers to the difference between the bid price (the sell price) and the ask price (the buy price). It represents the broker's fee for executing trades.

+ Swap: Swap, also known as overnight financing or rollover fee, is the interest rate differential between the two currencies being traded. It is applied when a position is held overnight and can be either positive or negative depending on the direction of the trade and the interest rate differentials between the currencies involved.

6.2 Forex Trading Orders

+ Market Order: Refers to a request to buy or sell a forex pair at the current market price, executed immediately at the best available price.

+ Limit Order: Refers to a request to buy or sell a forex pair at a specified price or better, ensuring execution only at the desired price level or improved.

+ Stop Order: Refers to a request to close the open trading position of a forex pair once it reaches a specified price, used to limit losses or protect profits.

+ Take Profit Order: Refers to a request to close a trade at a predetermined price level to lock in profits when the market moves favorably.

+ Trailing Stop Order: Refers to a dynamic request that adjusts the stop price as the market moves in the trader's favor, helping to protect profits by maintaining a specified distance from the current market price.

6.3 Forex Trading Size

+ Lot: Refers to a standardized quantity of a forex pair, typically representing 100,000 units of the base currency in forex trading.

+ Leverage: Refers to the ratio of borrowed funds to the trader's capital (e.g., 1:100), determining the extent to which positions can be magnified relative to the initial investment.

+ Margin: Refers to the amount of money required to open and maintain a trading position.

Initial Margin = Lot Size * Current Price * Leverage ratio

Maintainance margin = Initial margin * Maintainance margin ratio

These are some of the basic concepts and considerations in forex trading. Additionally, traders should learn about fundamental and technical analysis to make informed decisions in forex trading. This knowledge can be found in educational resources provided by the broker/platform.

7. FAQs about Forex trading in Malaysia

#7.1 Is forex trading legal in Malaysia?

Yes, forex trading is legal in Malaysia. However, it is regulated by the Securities Commission of Malaysia (SC) and the Bank Negara Malaysia (BNM).

#7.2 Is forex trading taxable in Malaysia?

Yes, income from forex trading is subject to taxation in Malaysia, and traders are required to report their trading profits as part of their total income for the year, with tax rates based on their income bracket.

#7.3 How can I stay updated with forex market news and analysis relevant to Malaysia?

You can stay updated with forex market news and analysis relevant to Malaysia by following reputable financial news websites, subscribing to forex trading forums, and utilizing trading platforms that offer real-time market analysis and commentary.

#7.4 What are the risks of forex trading in Malaysia?

The risks of forex trading in Malaysia include market volatility, leverage amplification, liquidity challenges, regulatory changes, counterparty risks, operational disruptions, psychological biases, and country-specific events. Traders should employ proper risk management techniques to mitigate potential losses.

#7.5 How does the interest rate set by Bank Negara Malaysia (BNM) affect forex trading in Malaysia?

Changes in the interest rate set by Bank Negara Malaysia (BNM) can influence the value of the Malaysian Ringgit (MYR) and impact forex trading conditions, including currency exchange rates and market sentiment.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.