A good Forex app is the first step to get close to trading success!

In the fast-paced world of forex trading, having the right app can make all the difference. With numerous options available, choosing a trading app that meets your needs is crucial for success. In this guide, we will explore the leading forex trading apps in Australia, providing reviews and download links for each.

1. 06 Leading Forex Trading Apps in Australia

Let’s go directly to the list of six leading forex trading apps that are widely used in Australia:

Mitrade - User-friendly with low fees.

Pepperstone - Competitive spreads and fast execution.

IG - Extensive market access and research tools.

Plus500 - Simple interface with risk management features.

AvaTrade - Diverse trading options and educational resources.

IC Markets - Advanced charting tools and comprehensive market analysis.

1.1 Mitrade - User-friendly with low fees

Launch Year | 2011 |

Worldwide clients | 3M+ |

Minimum Deposit | A$50 |

Maximum Leverage | 1:30 |

Spreads | Low, EURUSD 1.0300 |

Headquarters | Melbourne |

Australia Office | Melbourne |

Trading Platforms | Mitrade, Tradingview |

Trading devices | Android, iOS, Windows, and Mac OS devices |

Regulation | ASIC, CySEC, CIMA, and FSC |

Mitrade is an ASIC-licensed, Australia-based Forex broker recognized as one of the best trading platforms for individuals, with numerous domestic and international awards, such as Best Forex Trading App Australia, Best Forex Broker Asia, and Fastest Growing Forex Fintech Broker Global, among others.

It operates as a market maker and offers a user-friendly app designed for easy navigation, allowing users to trade without a steep learning curve. With a single account, traders can access Forex and various assets like indices, commodities, and cryptocurrencies. Mitrade features low spreads, no commissions, and no deposit or withdrawal fees, enabling multiple trades without worrying about costs.

The platform selectively offers over 700 carefully chosen markets, minimizing the risk of investing in low-quality products. It also limits leverage on highly volatile products to protect users from rapid losses. The Mitrade app is safe and accessible, requiring only a 50 AUD minimum deposit, and available risk-free with 50,000 AUD virtual money for new demo account users. Additionally, it provides robust risk management tools and diverse payment options, making it an excellent choice for both new and experienced traders.

Pros:

ASIC Regulation: Licensed and regulated by ASIC, ensuring a safe trading environment.

User-Friendly App: Simple interface, making it easy for beginners to navigate and trade.

Low Fees: Offers low spreads with no commissions or withdrawal fees.

Flexible Leverage: Allows leverage from 1:1 to 1:30, enabling traders to manage positions effectively.

Risk Management Tools: Provides features like stop-loss and take-profit orders to protect investments.

Multiple Payment Options: Easy deposit methods, including local bank transfers and internet banking.

Cons:

Limited Advanced Features: May lack some advanced trading tools and features compared to other platforms.

Customer Support Limitations: While available, the quality of customer support may vary based on user experience.

App Store | Google Play Store |

1.2 Pepperstone - Competitive spreads and fast execution

Founded in 2010, Pepperstone Group is an Australia brokerage firm that has rapidly established itself as a leading player in the online trading arena. With regulatory licenses from top-tier authorities, including the FCA and ASIC, Pepperstone ensures a secure trading environment for its over 400 thousand active users.

The platform is particularly favored for its exceptional forex trading experience and compatibility with popular trading software such as MetaTrader and cTrader. Traders benefit from competitive fee structures, with Standard account holders enjoying spreads as low as one pip and Razor account users facing zero spreads with minimal commissions.

With access to over 90 currency pairs, share CFDs, index CFDs, and commodity CFDs, Pepperstone offers a diverse trading landscape, although cryptocurrency trading is not available. The account opening process is user-friendly, requiring minimal time for verification, making Pepperstone an excellent choice for both novice and experienced traders.

Launch Year | 2010 |

Worldwide clients | 400K+ |

Minimum Deposit | A$0, Pepperstone recommends A$200 |

Maximum Leverage | 1:30 |

Spreads | Low, EURUSD 0.09 pips |

Headquarters | Melbourne |

Australia Office | Melbourne |

Regulation | ASIC, FCA, CySEC, DFSA, and CMA |

Pros:

Regulatory Compliance: Licensed by top-tier regulators like FCA and ASIC, ensuring a secure trading environment.

Low Fees: Competitive fee structure with Standard accounts having spreads as low as one pip and Razor accounts offering zero spreads with minimal commissions.

User-Friendly Platforms: Offers popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, catering to various trader preferences.

Easy Account Opening: Streamlined account registration process with quick verification, allowing traders to start trading swiftly.

No Deposit/Withdrawal Fees: Pepperstone does not charge fees for funding or withdrawing from accounts.

Cons:

No Cryptocurrency Trading: Pepperstone does not offer the option to trade cryptocurrencies, limiting diversity for crypto traders.

Complexity of Account Types: The choice between Standard and Razor accounts may be confusing for new traders unfamiliar with the implications of spreads and commissions.

App Store | Google Play Store |

1.3 IG - Extensive market access and research tools.

As a leading choice in the forex trading arena, IG is recognized for its extensive range of services and outstanding trading tools.

The platform is highly regarded for its regulatory compliance across multiple Tier-1 jurisdictions, ensuring a secure trading environment.

IG excels in offering top-notch educational resources, advanced research tools, and innovative trading technologies, making it suitable for traders of all experience levels. While IG features competitive spreads and a diverse selection of financial instruments, it may not be the best option for those primarily interested in stock trading or for beginners who might find the platform overwhelming.

Launch Year | 2010 |

Worldwide clients | 313K+ |

Minimum Deposit | A$0 |

Maximum Leverage | 1:30 |

Spreads | Low |

Headquarters | London, UK |

Australia Office | Melbourne |

Regulation | ASIC, FCA, JFSA, CySEC, BaFin, FINMA, DFSA, FSCA, MAS, etc. |

Pros:

Regulation and Safety: IG is regulated by Tier-1 licenses, including the Financial Conduct Authority (FCA), which provides a level of security for investors.

Wide Range of Investment Options: IG offers over 17,000+ markets, providing a diverse selection for investors.

User-Friendly Platform: The trading platform is designed to be intuitive, making it accessible for both experienced and new investors.

Educational Resources: IG provides comprehensive educational materials, including webinars and courses, which are valuable for traders at all levels.

Cons:

High Costs for Infrequent Traders: The trading fees can be steep for those who trade infrequently.

Basic Charting Tools: The charting tools are considered basic unless users subscribe to a Pro account, which incurs additional fees.

Complex Fee Structure: The various fees and conditions can be confusing, particularly for new investors.

App Store | Google Play Store |

1.4 Plus500 - Simple interface with risk management features.

Plus500 is a well-established online trading platform, renowned for its competitive spreads and user-friendly interface. Founded in 2008 and headquartered in Israel, the broker offers a diverse range of Contracts for Difference (CFDs) across various asset classes, including forex, commodities, indices, and cryptocurrencies. Regulated by multiple authorities, including the UK's Financial Conduct Authority (FCA), Plus500 emphasizes client protection and transparency.

With over 26 million registered users, Plus500 has built a reputation for reliability and innovation in the fintech space. The platform provides robust risk management tools, including guaranteed stop loss orders and negative balance protection, catering primarily to traders looking for a straightforward trading experience. Despite some limitations in customer support and integration with third-party tools, Plus500 remains a popular choice for both novice and experienced traders seeking efficient execution and low trading costs.

Launch Year | 2008 |

Worldwide clients | 26M |

Minimum Deposit | A$100 |

Maximum Leverage | 1:30 |

Spreads | EURUSD: 1.2 |

Headquarters | London, UK |

Australia Office | Sydney |

Regulation | ASIC, FCA, JFSA, CySEC, FMA, DFSA, ISA, FSCA, MAS, etc. |

Pros:

Strong Regulation: The platform is highly regulated by multiple financial authorities, including the FCA, ASIC, and MiFID, ensuring a secure trading environment.

User-Friendly Platform: Plus500 provides a robust proprietary trading platform that is intuitive and designed for efficient trading.

Wide Range of Instruments: Traders have access to over 2,800 tradable instruments, including 65 forex pairs, CFDs on commodities, stocks, and cryptocurrencies.

Educational Resources: Plus500 offers educational materials, including videos and webinars, making it suitable for beginners.

Cons:

No Copy Trading Features: The platform lacks social trading and copy trading options, limiting strategy diversification for some users.

No Active Trader Discounts: Plus500 does not offer discounts for high-volume traders, which could be a drawback for frequent traders.

Customer Support Limitations: While support is available via chat and email, the absence of telephone support may be an inconvenience for some users.

App Store | Google Play Store |

1.5 AvaTrade- Diverse trading options and educational resources

AvaTrade is a globally recognized forex and CFD broker, established in 2006 and headquartered in Dublin, Ireland. With a commitment to providing a secure and user-friendly trading environment, AvaTrade is regulated by multiple esteemed financial authorities, including the Central Bank of Ireland and the FSCA in South Africa. The broker offers a diverse range of trading instruments, including forex, commodities, stocks, and cryptocurrencies, making it suitable for both novice and experienced traders.

AvaTrade is celebrated for its competitive trading fees, advanced trading platforms such as MetaTrader 4 and 5, and innovative features like automated trading and social trading through its AvaSocial platform. With a strong emphasis on education, AvaTrade provides a wealth of resources, including webinars, tutorials, and market analysis, empowering traders to make informed decisions.

Launch Year | 2006 |

Worldwide clients | 400K+ |

Minimum Deposit | A$100 |

Maximum Leverage | 1:30 |

Spreads | EURUSD: 0.9 |

Headquarters | Dublin, Ireland |

Australia Office | Sydney |

Regulation | ASIC, JFSA, MiFID, ISA, FSCA, etc. |

Pros:

Platform Variety: Offers a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, and proprietary platforms like AvaTrade WebTrader and AvaOptions.

Copy Trading Options: Strong offerings for social and copy trading through platforms like ZuluTrade and AvaSocial.

User-Friendly Mobile Apps: Proprietary mobile apps offer a good level of functionality and ease of use for traders on the go.

Cons:

Research Limitations: Research offerings are somewhat limited, relying mostly on external sources like Trading Central, with less in-house analysis.

Pricing Competitiveness: Retail pricing is average compared to industry leaders, which may not attract price-sensitive traders.

Platform Performance Issues: Some proprietary platforms, like AvaOptions, have been noted for slow loading times and outdated designs.

App Store | Google Play Store |

1.6 IC Markets - Advanced charting tools and comprehensive market analysis.

IC Markets is a forex and CFD broker established in 2007, headquartered in Australia. Renowned for its low spreads and competitive fees, IC Markets caters to a diverse range of traders, from casual investors to seasoned professionals. The broker offers over 2,100 tradable instruments, including forex pairs, commodities, indices, and cryptocurrencies, across multiple advanced trading platforms like MetaTrader 4, MetaTrader 5, and cTrader.

With robust regulatory oversight from authorities such as ASIC and CySEC, IC Markets is recognized for its commitment to client security and transparency. Whether you're interested in day trading, swing trading, or algorithmic trading, IC Markets provides the tools and support necessary to enhance your trading experience.

Launch Year | 2007 |

Worldwide clients | 200K+ |

Minimum Deposit | A$200 |

Maximum Leverage | 1:30 |

Spreads | Low |

Headquarters | Sydney, Australia |

Australia Office | Sydney |

Regulation | ASIC, MiFID, SCB, etc. |

Pros:

Low Spreads: IC Markets offers some of the lowest spreads in the industry, making it cost-effective for traders.

Advanced Trading Platforms: Supports popular platforms like MetaTrader 4, MetaTrader 5, and cTrader, providing a feature-rich trading environment.

24/7 Customer Support: Multilingual support available via live chat, email, and phone, ensuring assistance when needed.

No Inactivity Fees: There are no fees for dormant accounts, allowing traders to maintain their accounts without additional costs.

Cons:

No Proprietary Trading Platform: Lacks a unique platform, relying instead on third-party solutions.

Average Research Tools: While it offers some research resources, the tools may not be as comprehensive as those provided by other brokers.

Withdrawal Processing Times: Some withdrawal methods may take longer, particularly bank transfers, which can take 2-5 business days.

Complex Fee Structure: Although generally competitive, the fee structure can be complex, especially for beginners trying to understand commissions and spreads.

App Store | Google Play Store |

2. How to Download and Trade on a Forex App?

To download and start trading on a forex app, follow these detailed steps:

Step 1: Choose Your Broker

Select one of the leading forex brokers that offer a reliable trading app. Research their features, customer support, and trading conditions to find the best fit for your trading style and goals.

Step 2: Visit the App Store or Download Links on Official Sites

Navigate to your device's app store—either the Apple App Store for iOS devices or the Google Play Store for Android. Ensure that you are searching for the official forex app from the broker to avoid counterfeit versions.

Once you find the app, click on the download button. The app will begin downloading and will automatically install on your device. Depending on your internet connection, this may take a few moments.

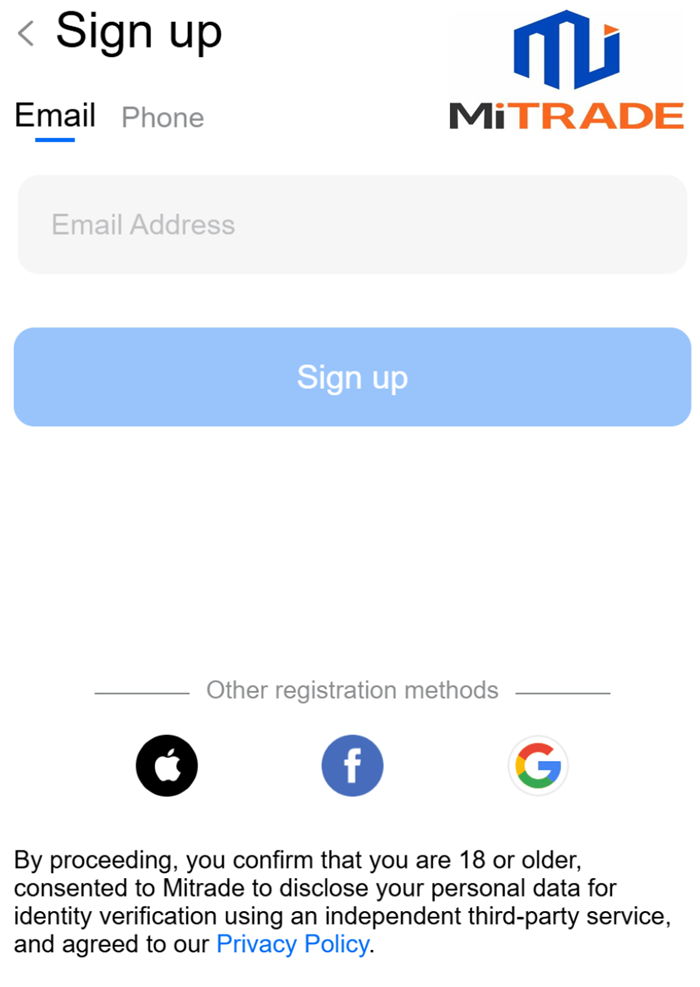

Step 3: Create an Account

Open the app after installation. Follow the on-screen prompts to create a trading account. This will typically involve providing your email address, creating a secure password, and entering some personal information for verification.

(Risk-free demo account with 50,000 AUD virtual money)

If you are a new user, many brokers offer welcome bonuses or free trading credits—be sure to take advantage of these offers.

Step 4: Deposit Funds

To start trading, you'll need to fund your account. Navigate to the deposits section of the app and choose from the available payment options, such as credit/debit cards, bank transfers, or e-wallets. Follow the instructions to complete your deposit, ensuring that you meet any minimum deposit requirements.

Step 5: Start Trading

Once your account is funded, you can explore the app’s features. Use the search function to find trading pairs, such as USD/JPY. Analyze market trends and decide whether to place a buy (long) or sell (short) order based on your predictions.

You can also utilize various trading tools available within the app, such as setting leverage, placing take profit and stop loss orders, and accessing technical indicators for in-depth market analysis.

Step 7: Complete Your Trade

After setting your parameters and confirming your order, your trade will be executed. Monitor your positions through the app and use the available charting tools and indicators to make informed decisions.

3. Summary

Selecting the right forex trading app is essential for success in the forex market. The apps listed in this guide are among the top choices in Australia, each offering unique features and benefits. By carefully considering your trading needs and preferences, you can find the app that best suits your trading style.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.