Best Currency Pairs To Trade & Most Volatile Forex Pairs [15 Major Forex Pairs List]

The foreign exchange (Forex) market stands as the world's largest and most liquid financial market, with an average daily trading volume of about $6 trillion. It offers significant potential for investors to profit through arbitrage opportunities. Though there are over 100 currency pairs traded daily worldwide, not all are actively involved in the forex market.

To profit in the forex market, it's crucial to understand how to select the best currency pair to trade and identify the most volatile forex pairs. This constitutes the primary focus of the article, serving as the cornerstone for analyzing effective forex trading strategies.

What are Forex pairs?

1.1 What are Forex pairs?

In the forex market, a currency is regarded as a commodity used for exchange, thus, it will not stand alone and always be paired with another currency, forming a currency pair. Each currency within the pair has its exchange rate, forming the foundation for trading positions. All transactions in the forex market, including selling, buying, or trading, occur through currency pairs, for example, EUR/USD; GBP/CAD; and USD/JPY.

In other words, a currency pair denotes the quotation between two separate currencies, where the value of one currency is expressed in terms of the other. The primary currency listed in the pair is known as the base currency, while the secondary currency is identified as the quote currency.

If the forex pair USD/JPY is quoted at 150, it means that 1 USD (the base currency) is equivalent to 150 Japanese yen (JPY - the quote currency).

1.2 Categories of currency pairs

Forex pairs can be classified into several categories based on various criteria such as liquidity, trading volume, economic importance, and geographic regions. The most common classification of forex pairs is based on their characteristics of economic importance, which is often seen in forex exchanges:

Major pairs involve currencies from the world's largest economies (e.g., EUR/USD, USD/JPY)

Minor pairs consist of currencies from smaller economies, which do not include the US dollar (e.g., EUR/AUD, GBP/CAD).

Exotic pairs involve one major currency and one from a developing or emerging economy (e.g., USD/TRY, EUR/SGD).

How to choose the right currency pairs?

In order to choose the right currency pairs to trade, traders should consider several factors such as investment knowledge and experience, capital amount, risk tolerance, or market conditions. You may consider making use of this 7-step approach to assist in your trading decisions and analysis.

Step 1: Create a watchlist

Creating a watchlist involves compiling a list of currency pairs that you are interested in trading or have potential for based on your analysis. This allows you to focus your attention on specific pairs and monitor their movements more effectively.

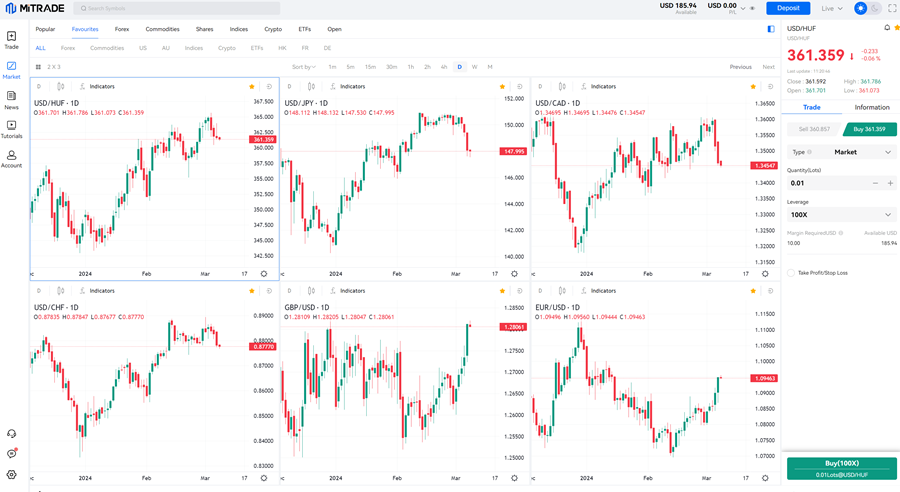

You can also create a watchlist by taking suggestions from your trading app. Some trading apps generate popular forex trading pairs according to market activity.

For example:

Some popular forex pairs (Source: Mitrade.com)

Register and trade Forex CFDs with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

Step 2: Analyze economic factors and market conditions

- Analyze the fundamental factors driving currency movements, such as interest rates, economic indicators (e.g., GDP, inflation, employment), central bank policies, or geopolitical events. These indicators provide insights into the health and direction of an economy, influencing currency values in the forex market. In particular, central bank policies, such as monetary policy decisions and intervention measures, play a pivotal role in shaping currency movements.

- Assess the current market environment, including volatility, liquidity, trends, and sentiments. For example, major pairs typically offer higher liquidity due to the larger market size arising from its demand and hence have a deeper order book. Unlike major pairs, exotic pairs have smaller market size which results in a more volatile trading environment making them even riskier.

Step 3: Technical Analysis

Some Forex traders utilize technical analysis tools such as price charts, indicators and drawing tools to identify trends or understand the price behavior through trading platform software that provide such features. Traders usually look for patterns such as flag and pennant, double top, head and shoulders etc. in addition to the commonly understood support and resistance level.

Step 4: Consider the trading strategy

There are many different trading strategies used by different traders. Similar to clothing, there will never be a “one size fit all” strategy as different individuals have different trading mentalities and risk appetites. Here are some considerations when trying to determine which trading strategy suits yourself better:

Trend-following strategies may be better suited to pairs with clear and consistent trends.

Range-bound strategies may work well in pairs with low volatility and well-defined support and resistance levels.

Scalping strategies may require pairs with high liquidity and tight spreads for quick execution of trades.

Step 5: Testing

Testing currency pairs using a demo account or small trades is crucial for traders, especially newbies. It offers the chance to familiarize oneself with trading platforms and evaluate the performance of chosen pairs under various market conditions. This process also validates the effectiveness of trading strategies, helping traders refine their approach before risking real capital.

Step 6: Keep Tracking and Adapt

Continuously monitor your selected forex pairs and adapt to changing market conditions. Stay informed about economic developments, news events, and technical signals that may affect currency movements. Be prepared to adjust your trading approach as needed based on new information and market dynamics.

Step 7: Manage Risk

Utilize efficient risk management techniques to safeguard your capital and reduce potential losses. Set stop-loss orders, manage position sizes, diversify your portfolio, and avoid over-leverage. Consider the risk-reward ratio for each trade and ensure that your risk exposure is within your tolerance level.

While there are no guarantee of success in trading, by having a systemic approach in your research and analysis can help you stay focused and remain within your own predetermined risk tolerance and trading style.

Important information about the most traded Forex pairs

The most traded forex pairs, typically involve currencies from the world's largest economies and financial centers. Understanding key details about the most traded forex pairs is fundamental for traders to effectively navigate the dynamic currency markets.

By gaining insights into factors such as volatility levels, market liquidity, and macroeconomic influences, traders can customize risk management, exploit market sentiment, use interest rate differentials, diversify with correlations, and apply technical analysis. This comprehensive understanding empowers traders to make informed decisions, optimize trade setups, and ultimately enhance their overall trading performance in the forex market.

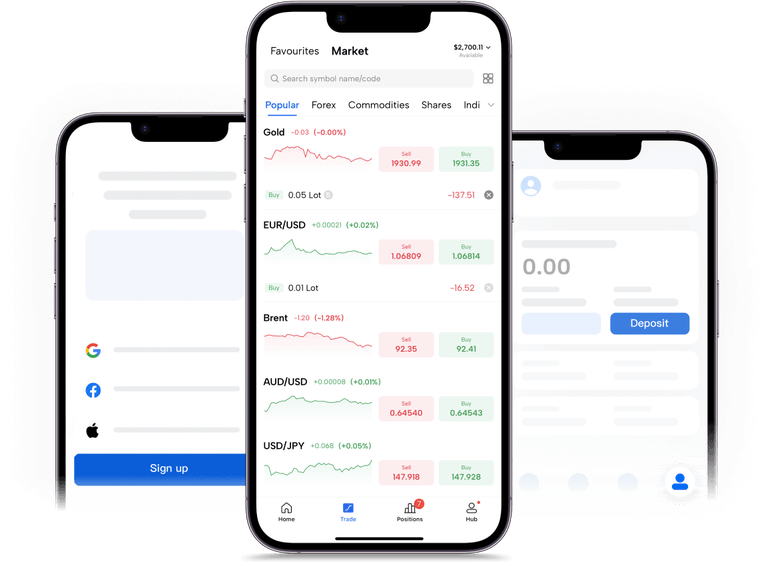

The most traded currency pairs in 2023 (Source: FXSSI)

Here's some important information about the most traded forex pairs:

EUR/USD (Euro/US Dollar)

It is widely regarded as the most traded currency pair globally, accounting for approximately 28% of daily trading volume in the forex market as of 2023.

The pair is influenced by monetary policies, particularly interest rates set by the European Central Bank (ECB) and the US Federal Reserve (Fed), this pair is also affected by economic data releases from the Eurozone and the United States, as well as geopolitical events impacting both regions.

USD/JPY (US Dollar/Japanese Yen)

USD/JPY comprised roughly 13% of the daily forex trading volume in 2023.

It is known for its liquidity and volatility, making it the second most popular forex pair among traders seeking to capitalize on short-term price movements.

This pair is influenced by the monetary policies of the Federal Reserve (Fed) and the Bank of Japan (BoJ), as well as the economic conditions of both countries and global risk sentiment.

GBP/USD (British Pound/US Dollar)

It can experience significant volatility during major news releases and events impacting either economy. Additionally, in 2023, it boasted a high daily trading volume, accounting for approximately 11% of the forex market, nearly equal to that of the USD/JPY pair.

Similarly, the pair is affected by the monetary policies of the Federal Reserve (Fed) and the Bank of England (BoE) and the economic data from both countries, as well as Brexit-related developments and geopolitical factors.

AUD/USD (Australian Dollar/US Dollar)

AUD/USD comprised roughly 6% of the daily forex trading volume in 2023.

The pair is influenced by the monetary policies of the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed) as well as the economic data from both countries.

The AUD value is closely linked to Australia's commodity exports, particularly steel and generated energy such as iron ore, natural gas, and coal, which constitute a significant portion of the country's GDP.

USD/CAD (US Dollar/Canadian Dollar)

USD/CAD accounted for about 5% of the daily forex trading volume in 2023.

The pair is affected by factors such as crude oil prices (due to Canada's significant energy exports), economic data from both countries, and monetary policy decisions by the Bank of Canada (BoC) and the Federal Reserve (Fed).

USD/CHF (US Dollar/Swiss Franc)

USD/CHF comprised roughly 5% of the daily forex trading volume in 2023.

Many investors and traders often refer to the pair as a safe haven, as Switzerland is known for its stability and neutrality in finance.

The pair is influenced by the monetary policies set by the Swiss National Bank (SNB) and the Federal Reserve (Fed) and the economic conditions of both countries.

NZD/USD (NZ Dollar/ US Dollar)

NZD/USD accounted for about 4% of the daily forex trading volume in 2023.

The pair is influenced by the monetary policies set by the Reserve Bank of New Zealand (RBNZ) and the Federal Reserve (Fed) and the economic conditions of both countries.

EUR/JPY (Euro/ Japanese Yen)

EUR/JPY comprised roughly 4% of the daily forex trading volume in 2023.

The pair is influenced by monetary policies, particularly interest rates set by the European Central Bank (ECB) and the Bank of Japan (BoJ) as well as the economic conditions of both countries.

GBP/JPY (British Pound/ Japanese Yen)

GBP/JPY accounted for about 4% of the daily forex trading volume in 2023.

The pair is influenced by monetary policies, particularly interest rates set by the Bank of England (BoE) and the Bank of Japan (BoJ) as well as the economic conditions of both countries.

EUR/GBP (Euro/British Pound)

EUR/GBP comprised roughly 4% of the daily forex trading volume in 2023.

The pair is influenced by monetary policies, particularly interest rates set by the European Central Bank (ECB) and the Bank of England (BoE) as well as the economic conditions of both countries.

These major currency pairs typically offer high liquidity, tight spreads, and ample trading opportunities, making them popular choices among forex traders worldwide. However, it's essential to conduct a thorough analysis and stay informed about the factors driving each currency pair's movements to make smart decisions.

Key points about the most volatile Forex pairs

The most volatile forex pairs are those that experience significant price fluctuations over short periods, offering traders potential opportunities for profit but also increased risk.

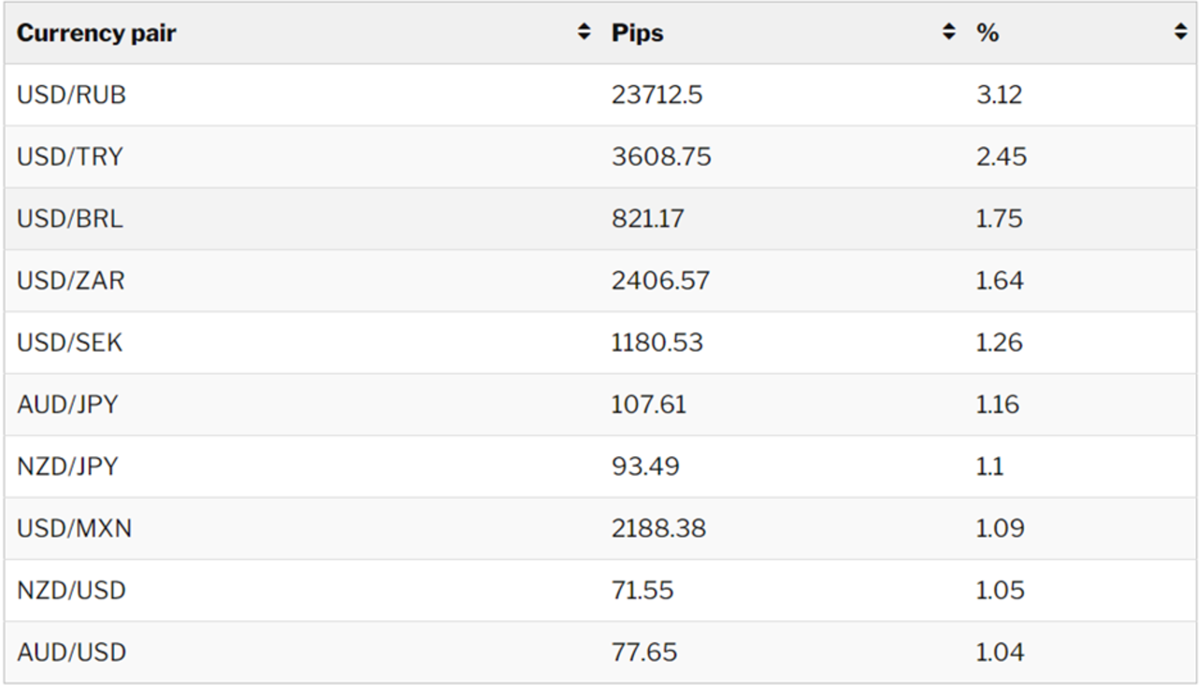

The most volatile forex pairs in 2023 (Source: Forex.in.rs)

Similar to the most traded forex pairs, the most volatile forex pairs are also influenced by the monetary policies of their central banks and economic conditions. In addition, there are following key points that traders should consider:

High volatility: These pairs exhibit rapid and unpredictable price movements over short periods.

Liquidity concerns: Some volatile forex pairs may also exhibit lower liquidity, which can result in wider bid-ask spreads and increased slippage.

Example: USD/ ZAR (US Dollar/ South African rand) is known for its volatility, but it may have lower liquidity compared to major pairs like EUR/USD or USD/JPY.

Exotic forex pairs: Exotic currency pairs, which involve currencies from emerging or smaller economies, often exhibit higher volatility compared to major pairs due to lower liquidity and greater uncertainty.

News events and announcements: Volatility tends to spike around major economic announcements such as central bank interest rate decisions, GDP releases, employment reports, and geopolitical developments. Traders should be prepared for increased volatility during these events.

Commodity-linked currencies: Currency pairs involving commodity-linked currencies such as the Russian Ruble (RUB), the Australian dollar (AUD), and the Brazilian Real (BRL) tend to be more volatile due to their sensitivity to commodity prices and global economic conditions.

Adaptability: Volatility levels can change over time based on market conditions, economic developments, and geopolitical events. Traders should continuously monitor volatility levels and adjust their trading strategies accordingly.

Traders who are comfortable with higher levels of risk and volatility are typically better suited to trade the most volatile forex pairs. These traders often have experience in managing risk effectively and are skilled in executing trades quickly in rapidly changing market conditions.

Day traders and scalpers, who aim to profit from short-term price movements, may find volatile pairs particularly appealing due to the frequent opportunities for quick gains. However, it's essential for traders to have a thorough understanding of the market and employ robust risk management strategies when trading volatile pairs to mitigate potential losses.

Top 15 major Forex pairs list

The following table lists the current data of the top major forex pairs:

Name | Symbol | Sell | Buy | 6-Month Change |

Euro/US Dollar | EUR/USD | 1.11269 | 1.11274 | 1.64% |

US Dollar/Japanese Yen | USD/JPY | 141.583 | 141.597 | - 4.38% |

British Pound/US Dollar | GBP/USD | 1.31667 | 1.31673 | 2.79% |

US Dollar/Swiss Franc | USD/CHF | 0.84536 | 0.84549 | -3.65% |

US Dollar/Canadian Dollar | USD/CAD | 1.35881 | 1.35892 | 1.01% |

Australian Dollar/US Dollar | AUD/USD | 0.67661 | 0.67666 | 2.27% |

New Zealand Dollar/US Dollar | NZD/USD | 0.62032 | 0.62051 | 0.62% |

Euro/Japanese Yen | EUR/JPY | 157.543 | 157.559 | -2.81% |

Euro/British Pound | EUR/GBP | 0.84506 | 0.84513 | -1.12% |

Euro/Swiss Franc | EUR/CHF | 0.94058 | 0.94087 | -2.06% |

Australian Dollar/US Dollar | AUD/USD | 0.67661 | 0.67666 | 2.27% |

New Zealand Dollar/US Dollar | NZD/USD | 0.62032 | 0.62051 | 0.26% |

Euro/Japanese Yen | EUR/JPY | 157.543 | 157.559 | -2.81% |

Euro/British Pound | EUR/GBP | 0.84506 | 0.84513 | -1.12% |

Euro/Swiss Franc | EUR/CHF | 0.94058 | 0.94087 | -2.06% |

Euro/Canadian Dollar | EUR/CAD | 1.5118 | 1.51219 | 2.67% |

Euro/Australian Dollar | EUR/AUD | 1.6443 | 1.64467 | -0.62% |

Euro/New Zealand Dollar | EUR/NZD | 1.7933 | 1.7937 | 1.01% |

British Pound/Japanese Yen | GBP/JPY | 186.417 | 186.445 | -1.7% |

British Pound/Swiss Franc | GBP/CHF | 1.11304 | 1.1133 | -0.95% |

Source: Mitrade (*as of 18/09/2024)

FAQs about trading currency pairs

5.1 What is the best time to trade forex pairs?

The best time to trade forex pairs depends on market hours and overlaps. Generally, the most active trading sessions occur during the overlap of major financial centers, such as the London-New York overlap (between 8:00 AM and 12:00 PM (EST) or 1:00 PM and 5:00 PM (GMT), which offers increased liquidity and trading opportunities. Traders often find the highest volatility and potential for price movements during these periods.

5.2 What are the factors that affect forex pairs?

Several factors affect forex pairs, including:

Central bank policies: Monetary policy decisions and interest rate changes by central banks influence currency values.

Economic indicators: GDP, employment data, inflation rates, and trade balances. For example, Higher interest rates tend to attract more foreign capital, which strengthens the domestic currency and vice versa. Higher inflation rates tend to weaken the domestic currency, as it erodes its purchasing power and makes exports less competitive. A positive trade balance (surplus) means that the country exports more than it imports, which increases the demand for its currency and vice versa.

Geopolitical events: Political instability, trade tensions, and geopolitical conflicts can impact currency values.

Regulatory frameworks and government intervention: Some governments establish regulatory frameworks to oversee forex trading activities or intervene in the foreign exchange market to stabilize exchange rates.

Market sentiment: The overall mood and expectations of the market participants can influence the supply and demand of currencies, as well as their volatility and risk appetite.

5.3 How much do I need to trade forex?

The amount required to trade forex varies depending on factors such as forex pairs, position sizes, leverage, risk tolerance, and broker requirements.

Some brokers accept deposits as low as $50, while others may require $1,000 or more. It's crucial to trade only with funds you can afford to lose and to consider the impact of leverage on risk.

Chart EUR/USD in 7/3/2024 (Source: Mitrade)

For example, Mitrade stipulates the minimum deposit required within its trading platform payment page for each country or channel. If you trade EUR/USD with a position size of 0.01 lot and leverage of 1:1, according to the current rate ( the chart above) you would need approximately $1088.03. However, with leverage of 1:30, you would only need $36.27 USD.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.