EUR/USD Forecast In 2024/2025/2026: Which EUR Pairs Should I Buy?

The EUR is the second most traded currency in the forex market, and the EUR/USD pair is a cornerstone of the forex market, representing a critical benchmark for global trade and investment strategies. Due to the significant impact of the EUR, other EUR pairs also attract attention from traders.

In this article, we provide an overview of the strength of the Euro and the performance of the EUR/USD pair in recent years. We then forecast the movements of the EUR/USD for 2024, 2025, and 2026 to identify the best trading strategies and decisions. Additionally, we will discuss the most other promising Euro pairs to consider for an investment, helping traders navigate the complexities of the forex market with greater confidence and foresight.

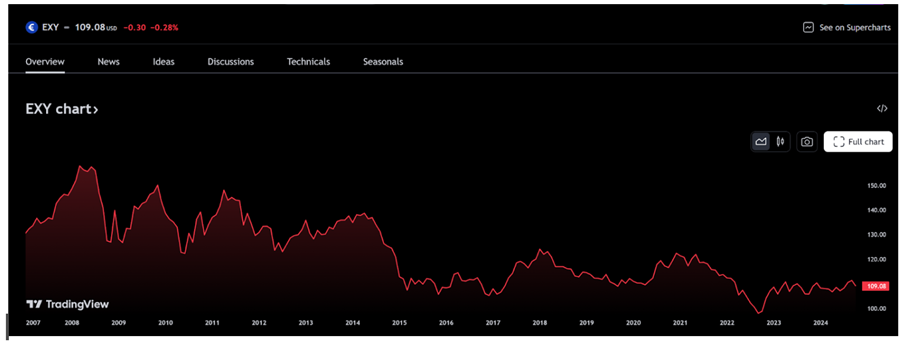

1. The strength of the EUR & related index in recent years

In the past 10 years, the performance of the EUR has experienced significant fluctuations due to the influence of economic factors and monetary policies of the Eurozone, as well as changes in global economies and conditions.

The Euro Currency Index (Source: Tradingview)

2014: At the beginning of 2014, the EUR was strong, its index held steady at 135 points and slightly raised to 138.6 points by April. However, as the year progressed, the EUR experienced a sharp decline, dropping to 112 points by the start of 2015. This downturn marks the euro's most substantial annual fall since 2005. The Eurozone's ongoing struggles paint a familiar picture of sluggish growth, persistently low inflation (0.22% on average), and high unemployment rates (11,4% on average in December).

2015: the EUR continued its decline, reaching a low of 106 points by year-end, the lowest in 12 years. While there were brief and minor recoveries throughout the year, they remained limited and short-lived. This weakening was primarily due to the ECB's ongoing asset purchases, which kept downward pressure on the Euro, coupled with the strong growth of the US economy. The Federal Reserve's hints at interest rate hikes further contrasted with the Eurozone's sluggish performance, exacerbating the Euro's decline.

2016: In the first three months of 2016, the EUR index slightly increased from 108 to 114 points. However, it then decreased throughout the year, ending at 107 points. The Brexit referendum, where the UK voted to leave the EU, created significant uncertainty in Europe, negatively affecting the Euro and increasing market volatility. Mixed economic data from the Eurozone showed improvement in some countries, but overall growth remained uneven, contributing to fluctuations in the Euro's strength. Additionally, global uncertainties regarding economic growth and political stability further influenced currency markets, adding to the instability of the Euro.

2017: The EUR index exhibited an increasing trend during 2017, rising from 107 to 124 points. The Eurozone showed signs of economic recovery, with stronger GDP growth (2,8%) and declining unemployment, which bolstered the Euro. Political stability also improved as the defeat of populist candidates in key elections, such as Macron's victory over Le Pen in France, reduced political risk. Additionally, the ECB hinted at tapering its quantitative easing (QE) program providing further support to the Euro. These positive developments contributed to a stronger and more stable Euro throughout the year.

2018 – 2020: The EUR showed a weakening trend from 2018 to early 2020 due to trade tensions between the US and China, which created global economic uncertainties. Alongside this, events that caused economic and political instability in Europe, such as the budget crisis in Italy, the ECB maintaining low interest rates and restarting QE to combat low inflation and weak growth, ongoing uncertainty regarding the UK's exit from the EU, and the outbreak of the COVID-19 pandemic in 2020, further weighed on the Euro. At the end of March 2020, the EUR index was at 109 points, similar to the level in March 2015. However, with efforts to support the economy, such as extensive fiscal and monetary measures across the Eurozone, some stability was achieved. This helped the Euro recover slightly, and by the end of the year, it maintained a level of 120 points.

2021 – 2024: Throughout 2021 and the first nine months of 2022, the EUR continuously weakened due to economic stagnation from the COVID-19 pandemic and rising inflation. Additionally, the political tensions between Russia and Ukraine caused a severe energy crisis in Europe. The Fed's significant interest rate hikes in 2022 further negatively impacted the EUR, and although the ECB also raised rates, their increases were slower and lower compared to the Fed's. In September 2022, the EUR index reached a historic low of 98 points but later recovered due to the ECB's tightening monetary policy, decreasing inflation trends (2.9% in December 2023), and improved energy situation. The EUR index has since remained around the 109 points mark up to the present (Oct 2024).

2. The performance of EUR/USD over the years

Over the years, the trend of EUR/USD has fluctuated, reflecting changes in the strength of the Euro against the US Dollar.

The price chart of EUR/USD over the years (Source: Tradingview)

2000-2001: The euro was introduced in 1999, and during the early 2000s, the EUR/USD exchange rate fluctuated as markets adjusted to the new currency. In May 2001, the EUR/USD hit a historic low of 0.8 and maintained this level until the end of the year.

2002-2008: The euro strengthened against the US dollar, reaching highs above 1.60 in June 2008. Factors such as strong economic growth in the eurozone and concerns about the US economy contributed to this trend.

2008-2014: The global financial crisis led to a significant appreciation of the US dollar relative to the euro. The EUR/USD exchange rate fell sharply during this period, reaching lows around 1.05 in 2015.

2015-2017: The euro recovered some ground against the US dollar amid improved economic conditions in the eurozone and monetary stimulus measures by the European Central Bank. The exchange rate fluctuated between 1.05 and 1.15 during this period.

2018-2021: Trade tensions between the US and other countries, along with geopolitical uncertainties, influenced the EUR/USD exchange rate. The euro remained relatively weak against the US dollar, decreasing from 1.2 in January 2018 to 1.09 in March 2020. The exchange rate slight recovered from 1.09 in March 2020 to 1.22 in May 2021 and then it reversed the downward trend towards the end of 2021, ending the year at 1.12.

The next section of the article will analyze in more detail the EUR/USD exchange rate from 2022 to the present to provide better guidance for investment decisions for traders in the future.

Register and trade live with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

3. Historical EUR/USD analysis in 2022/2023/2024

Since early 2022 up to the present moment, the EUR/USD trend has experienced fluctuations, mirroring the Euro's performance against the US Dollar.

The price chart of EUR/USD from 2022 to Oct 2024 (Source: Tradingview)

At the beginning of 2022, the EUR/USD was trading at 1.12. In February 2022, political tensions between Ukraine and Russia escalated into armed conflict, destabilizing the situation in Europe. This was particularly concerning as Russia is a major supplier of natural gas to the region, exacerbating the energy crisis, along with a food shortage crisis. Inflation in Europe also surged to 8.47%.

Economic stagnation and high inflation were also present in the United States, but the Federal Reserve implemented monetary tightening measures as early as March 2022, whereas the ECB started later in July 2022. This led to a significant weakening of the Euro against the US Dollar in the first 9 months of 2022. 9/2022, the EUR/USD was trading at 0.98, the lowest level since 2002. From September to December, the EUR partially regained strength, thanks to the ECB's monetary tightening policies and a GDP growth of 3.4%, higher than the 1.9% in the US, which also supported the Euro. The EUR/USD exchange rate increased by approximately 10% in the final three months of the year, reaching 1.08.

From 2023 to now (Oct 2024), the EUR/USD exchange rate has remained relatively stable, trading within a narrow range of 1.05 to 1.1. This can be attributed to the Federal Reserve halting interest rate hikes in July 2023 and maintaining them at 5.25% to 5.5%, with plans to reduce rates in the second half of 2024. Meanwhile, the ECB has also kept interest rates high at 4.5%, ceasing rate hikes in September 2023. Despite the Eurozone's GDP in 2023 being only 0.7% compared to the US's 2.5%, it had little impact on the exchange rate as the USD cooled off, and the Eurozone expects economic recovery in the near future.

4. Should I buy EUR/USD? How to trade online?

Trading the EUR/USD currency pair has its advantages and disadvantages. Here are some key points to consider before deciding to trade this forex pair:

Pros | Cons |

+ High Liquidity: The EUR/USD is the most traded currency pair in the world. High liquidity means tight spreads and less slippage, making it easier to enter and exit trades. + Availability of Information: There is a wealth of information available for both the Eurozone and the U.S. economies. Economic reports, news, and analysis are readily accessible, aiding in making informed trading decisions. + Lower Transaction Costs: Due to its high liquidity, the transaction costs (spreads) for EUR/USD are generally lower compared to less liquid currency pairs. + 24-Hour Market: The forex market is open 24 hours a day, five days a week, allowing for flexibility in trading times and the ability to respond to global events. | + High Volatility: The high liquidity of EUR/USD attracts high-frequency traders and large institutional investors. Their activities can lead to rapid price changes and increased market noise. + Economic Interdependence: The U.S. and Eurozone economies are interlinked. Events affecting one can quickly impact the other, sometimes in unpredictable ways. + Complex Analysis: Trading EUR/USD requires understanding and analyzing two major economies, which can be complex. Keeping track of numerous economic indicators, central bank policies, and geopolitical events is essential. + Leverage Risks: Forex trading often involves high leverage, which can amplify both gains and losses. Traders need to be cautious with their use of leverage, especially in a volatile pair like EUR/USD.

|

Understanding both the advantages and disadvantages can help traders develop effective strategies and manage risks appropriately. Always consider your own risk tolerance, trading experience, and market understanding before engaging in forex trading.

It's easy to trade EUR/USD online nowadays thanks to the development of fintech. Traders can follow the steps below to get started:

+ Choose a reliable online broker by researching their reputation, fees, and trading platforms such as Mitrade, Etoro, Interactive Broker . Ensure they're regulated by authorities like the ASIC, CySEC, or FCA. Compare features such as trading tools and customer support to make an informed decision.

+ Open an account: Traders can easily open an account online by following step-by-step instructions provided on a broker’s platform or trading apps.

+ Deposit: Depending on the broker, a minimum deposit may be required, and payment methods may vary.

+ Analyze price trends: Traders can use a combination of fundamental and technical analysis to anticipate the price movement of EUR/USD.

+ Trade: After analyzing the price trends, open a buy position if you expect the price to rise, and open a sell position if you anticipate the price to fall. Simultaneously, setting up a stop-loss order or taking profit to manage risks.

Note:

+ Traders can use a demo account, often provided by forex brokers, to familiarize themselves with the market and the trading platform.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Trade Demo with $50,000 risk-free virtual money

Trade Demo with $50,000 risk-free virtual money

5. EUR/USD Forecast in 2024/2025/2026

Key events, such as the U.S. Federal Reserve's interest rate decisions and the upcoming presidential election in November, will significantly impact market sentiment and trading behavior. While some forecasts suggest a bearish trend could push the rate closer to 1.0700, others anticipate a recovery towards 1.1200 by mid-year, depending on the economic performance of both the Eurozone and the U.S.

Forecasting the EUR/USD exchange rate for specific future years like 2024, 2025, and 2026 involves numerous factors such as economic data, geopolitical events, central bank policies, and market sentiment, making it challenging to provide precise forecasts. Traders and analysts typically use a combination of fundamental analysis, technical analysis, and market research to formulate their forecasts. Below are the EUR/USD price forecasts from reputable financial institutions, economic research firms, and market analysts for your reference.

Institutions/Firms | 2024 | 2025 | 2026 |

ING (5/2024) | Q3: 1.10 Q4: 1.10 | Q1: 1.10 Q2: 1.10 Q3: 1.10 Q4: 1.10 | Q1: 1.10 Q2: 1.10 Q3: 1.10 Q4: 1.10 |

RBC Capital Markets (5/2024) | Q3: 1.05 Q4: 1.07 | Q1: 1.08 Q2: 1.08 Q3: 1.09 Q4: 1.08 | – |

J.P Morgan (5/2024) | Q3: 1.05 Q4: 1.09 | Q1: 1.12 Q2: -- Q3: -- Q4: -- | – |

Westpac (5/2024) | Q3: 1.09 Q4: 1.10 | Q1: 1.11 Q2: 1.12 Q3: 1.13 Q4: 1.14 | Q1: -- Q2: -- Q3: -- Q4: -- |

NBA (5/2024) | Q3: 1.16 Q4: 1.17 | Q1: 1.18 Q2: 1.19 Q3: 1.21 Q4: 1.22 | Q1: 1.23 Q2: 1.23 Q3: -- Q4: -- |

FX Forecasts (3/2024) | Q3: 1.16 Q4: 1.17 | Q1: 1.18 Q2: 1.19 Q3: 1.21 Q4: 1.22 | Q1: 1.23 Q2: 1.23 Q3: -- Q4: -- |

The exchange rate forecasts are typically adjusted by banks and financial institutions on a monthly or quarterly basis based on economic and financial data. Traders should regularly update themselves with the latest information to stay as close to the market as possible.

The table below show the forecast from financial institutions about EUR/USD for 2024-2026 , on average :

6. Analysis of other EUR pairs

While the EUR/USD pair garners significant attention as the most traded currency pair in the forex market, there are numerous other EUR pairs that offer compelling opportunities for traders. Understanding the dynamics of these pairs and their unique drivers can provide traders with additional avenues for diversification and profit potential. In this analysis, we will explore the potential opportunities presented by trading the other EUR pairs, examining their key drivers, and future outlooks to help traders navigate the forex market with confidence and precision.

EUR/GBP (Euro/British Pound): The EUR/GBP pair reflects the economic and political relationship between the Eurozone and the United Kingdom.

Key drivers:

Economic performance: Comparative economic health of the UK and the Eurozone.

Central bank policies: Actions by the Bank of England (BoE) and the ECB.

Political stability: Government policies and political events in both regions.

EUR/JPY (Euro/Japanese Yen): The EUR/JPY pair is influenced by the economic and monetary policies of the Eurozone and Japan, as well as global risk sentiment.

Key drivers:

Monetary policy: ECB's stance compared to the Bank of Japan's (BoJ) continued ultra-loose monetary policy.

Economic data: Inflation rates, industrial production, and trade balances.

Risk sentiment: As a safe-haven currency, the Yen often strengthens during periods of global uncertainty.

EUR/CHF (Euro/Swiss Franc): The EUR/CHF pair reflects the relationship between the Eurozone and Switzerland, with the Swiss Franc being a traditional safe-haven currency.

Key drivers:

Economic stability: Comparative stability and economic performance of the Eurozone and Switzerland.

Monetary policy: ECB policies versus the Swiss National Bank's (SNB) interventions to prevent excessive Franc appreciation.

Risk sentiment: During periods of global uncertainty, the Franc tends to strengthen.

EUR/AUD (Euro/Australian Dollar): The EUR/AUD pair reflects the economic relationship between the Eurozone and Australia, influenced by commodity prices and trade.

Key drivers:

Commodity prices: Australia's economy is heavily reliant on commodities, so prices of iron ore, coal, and other exports impact the AUD.

Economic performance: GDP growth, employment data, and trade balances.

Monetary policy: Actions by the ECB compared to the Reserve Bank of Australia (RBA).

7. Conclusion

Looking ahead to 2024, 2025, and 2026, the direction of the EUR/USD pairing is influenced by many factors. These include decisions made by the FED and the ECB about money policy, changes in how economies grow, and tensions between countries. Because of these uncertainties, traders should pay close attention to what's happening in the markets and be ready to change their trading strategies. It might be a good idea for traders to spread their investments across different currency pairs to manage risk and take advantage of opportunities in the forex markets.

What are the primary factors influencing the EUR/USD exchange rate in the coming years?

How might the ECB's monetary policy affect the EUR/USD exchange rate in 2024?

How should traders approach risk management when trading EUR pairs in the upcoming years?

What are the potential effects of energy prices on the Euro?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.