Forex Today: US Dollar holds ground following Monday's choppy action

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Tuesday, April 29:

The US Dollar (USD) stays resilient against its rivals early Tuesday after struggling to find demand on Monday. The European economic calendar will feature business and consumer sentiment data for April. Later in the day, Goods Trade Balance and JOLTS Job Openings data for March, alongside the Conference Board Consumer Confidence Index data for April, from the US will be watched closely by market participants.

US Dollar PRICE This week

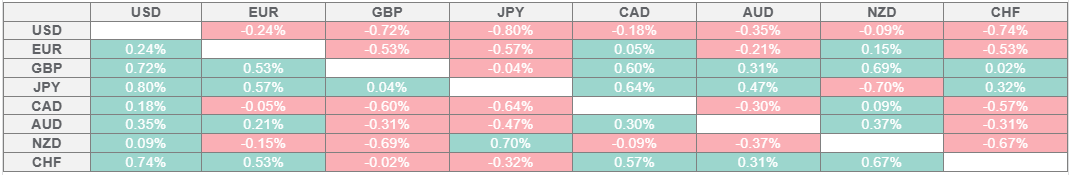

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

US Treasury Secretary Scott Bessent said late Monday that the US government is in contact with China but added that it’s up to Beijing to take the first step in de-escalation, due to the imbalance of trade between the two nations. Early Tuesday, Chinese Foreign Minister Wang Yi said that concession and retreat will only make the bully more aggressive but noted that dialogue can help resolve differences. After losing more than 0.6% on Monday, the USD Index clings to small gains above 99.00 in the European session on Tuesday. Meanwhile, US stock index futures trade marginally higher following the mixed performance seen in Wall Street's main indexes at the beginning of the week.

Canada's public broadcaster CBC News projected that Mark Carney's Liberal Party was on its way to win enough seats in the House of Commons to form a government. In his first public address, Canadian Prime Minister Carney said that he will sit down with US President Donald Trump to discuss future economic and security ties between the two sovereign nations. After closing marginally lower on Monday, USD/CAD fluctuates in a tight channel at around 1.3850 early Tuesday.

EUR/USD gained traction in the second half of the day on Monday and closed the day above 1.1400. The pair edges lower in the European morning on Tuesday and trades near 1.1380. The data from Germany showed earlier in the day that the GfK Consumer Confidence Index improved to -20.6 in May from -24.3 in April.

GBP/USD gathered bullish momentum and climbed to its highest level since March 2022 near 1.3450 on Monday. The pair corrects lower to start the European session but holds above 1.3400.

USD/JPY stages a rebound and trades in positive territory near 142.30 after losing more than 1% on Monday.

After falling below $3,270 during the European trading hours on Monday, Gold reversed its direction and ended the day in positive territory above $3,340. XAU/USD stays on the back foot early Tuesday and trades below $3,320.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.