US Dollar Index breaks below 104.00 as Treasury yields fall ahead of Nonfarm Payrolls

The US Dollar Index depreciates as market expectations grow for more aggressive Fed rate cuts amid US growth concerns.

President Trump exempted Mexican and Canadian goods under the USMCA from his proposed 25% tariffs.

The US Nonfarm Payrolls is projected to show job growth, with employment rising to 160K in February.

The US Dollar Index (DXY), which tracks the US Dollar (USD) against six major currencies, continues its losing streak for the fifth consecutive day, pressured by declining US Treasury yields. Market expectations of more aggressive Federal Reserve (Fed) rate cuts amid concerns over US economic growth are contributing to the weakness. The DXY is trading around 103.90 with 2- and 10-year yields on US Treasury bonds standing at 3.94% and 4.24%, respectively, during the early European hours on Friday.

Traders are closely watching global trade developments, particularly Canada’s decision to delay its second round of retaliatory tariffs on US products until April 2. This move follows US President Donald Trump’s exemption of Mexican and Canadian goods under the USMCA from his proposed 25% tariffs.

On the labor market front, US Initial Jobless Claims for the week ending March 1 fell to 221K, down from 242K the previous week, according to the US Department of Labor (DOL). The figure came in below market expectations of 235K. Meanwhile, the upcoming US Non-Farm Payrolls (NFP) report is projected to show a modest rebound, with job additions expected to rise to 160K in February, up from 143K in January.

Atlanta Fed President Raphael Bostic commented on Thursday that the US economy remains in a state of flux, making it difficult to predict future developments. Bostic reiterated the Fed’s commitment to bringing inflation down to 2% while minimizing labor market disruptions. He also stressed the importance of business sentiment in shaping monetary policy decisions.

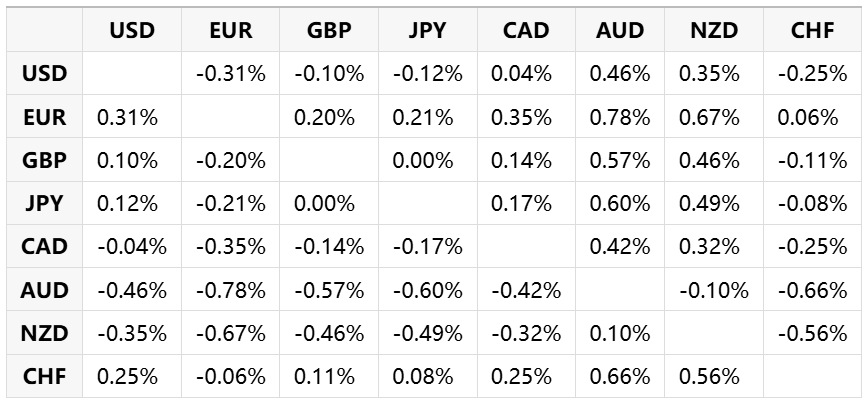

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.