The USD/CAD pair could revisit the six-month low of 1.3781.

The successful breach above the nine-day EMA of 1.3886 would improve the short-term price momentum

The pair may test the upper boundary of the descending channel near 1.3900.

The USD/CAD pair gains ground for the second successive day, trading around 1.3890 during the European session on Monday. However, technical analysis on the daily chart indicates a prevailing bearish trend, with the pair continuing to move lower within a clearly defined descending channel.

Additionally, the 14-day Relative Strength Index (RSI) remains above the 30 level, signaling the potential for a continued short-term corrective bounce. However, with the RSI still below the 50 threshold, the broader bearish outlook remains intact. However, the USD/CAD pair tests the nine-day Exponential Moving Average (EMA), indicating a potential bullish shift in short-term momentum.

On the downside, the USD/CAD pair could revisit the six-month low of 1.3781, last touched on April 21. A clear break below this level would reinforce the bearish bias, potentially driving the pair toward the descending channel’s lower boundary near the 1.3500 area, with additional support seen around 1.3419 — its lowest point since February 2024.

The successful breach above the nine-day EMA of 1.3886 would improve the short-term price momentum and lead the USD/CAD pair to test the upper boundary of the descending channel near 1.3900. A breakout above this channel would signal a potential shift toward a bullish bias, paving the way for a move toward the 50-day EMA at 1.4123. Further gains could target the next major resistance at 1.4793 — the lowest level observed since April 2003.

USD/CAD: Daily Chart

Canadian Dollar PRICE Today

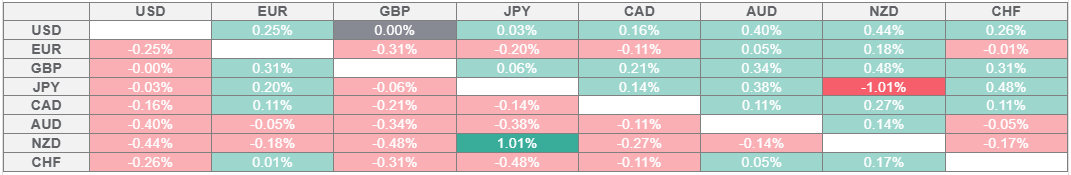

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.