The US Dollar is strengthening amid growing optimism over improved US-China trade relations.

President Trump emphasized progress in talks and confirmed recent communication with Chinese President Xi Jinping.

The New Zealand Dollar remains under pressure due to mixed signals from China, despite Trump’s assurances of continued negotiations.

NZD/USD is retracing its recent gains from the previous session, trading around 0.5960 during the Asian hours on Tuesday. The US Dollar (USD) is finding support as optimism grows over easing US-China trade tensions. US President Donald Trump signaled openness to rolling back tariffs on China, while Beijing granted exemptions on certain US imports—moves that have sparked hopes of a potential resolution to the prolonged trade conflict between the world’s two largest economies.

President Trump highlighted progress in discussions and confirmed communication with Chinese President Xi Jinping. The Wall Street Journal reported that Trump aims to mitigate the impact of automotive tariffs by preventing overlapping duties on foreign vehicles and lowering levies on imported car parts.

However, the New Zealand Dollar (NZD) is under pressure following contradictory signals from China. Despite Trump’s claims of ongoing trade negotiations, a spokesperson from the Chinese embassy firmly denied such talks, stating, “China and the US are not having any consultation or negotiation on tariffs,” and called on Washington to avoid creating further confusion. US Treasury Secretary Bessent reinforced this stance, asserting that it is up to China to take steps toward de-escalation, contradicting Trump’s earlier indication that the US would ease tariffs first.

Domestically, the NZD is weighed down by weak labor market data, which has strengthened expectations that the Reserve Bank of New Zealand (RBNZ) will cut interest rates by 25 basis points next month, with markets pricing in a 90% probability. Additionally, Finance Minister Nicola Willis announced that baseline spending in the 2025 budget will be reduced due to deteriorating economic conditions.

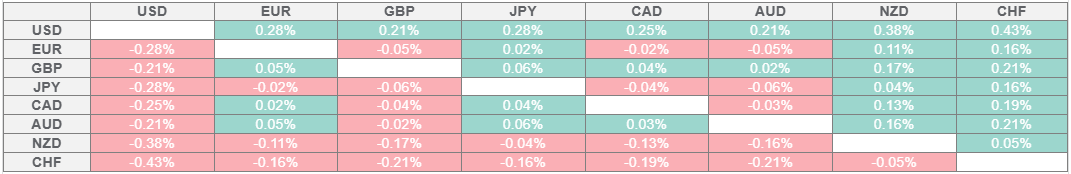

New Zealand Dollar PRICE Today

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the weakest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.