Here is what you need to know on Thursday, April 24:

The US Dollar (USD) stays resilient against its peers early Thursday after posting gains for two consecutive days. The weekly Initial Jobless Claims figures, Durable Goods Orders and Existing Home Sales data for March will be featured in the US economic calendar. Investors will continue to assess the latest developments surrounding the US-China trade conflict and pay close attention to comments from central bankers.

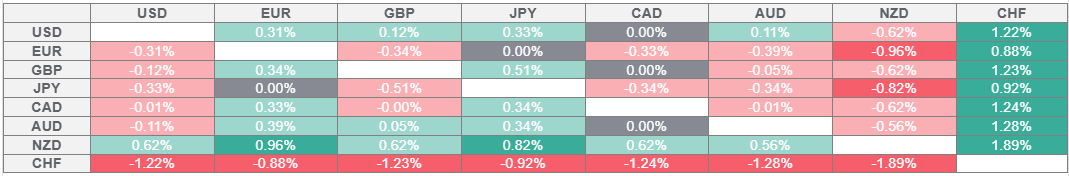

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Wall Street Journal reported on Wednesday that the White House was considering slashing tariffs on Chinese goods to de-escalate the trade conflict. Later in the day, United States (US) Treasury Secretary Scott Bessent noted that President Donald Trump has not offered to lower tariffs on China unilaterally but said that current tariff levels are not sustainable for either, adding that he would not be surprised if they were to come down in a mutual way.

Wall Street's main indexes ended the day decisively higher on Wednesday and the USD Index closed in positive territory. Meanwhile, the data from the US showed that the private sector's business activity continued to expand, albeit at a softening pace in April, with the S&P Global Composite PMI declining to 51.2 from 53.5. Early Thursday, US stock index futures trade marginally lower and the USD Index consolidates its gains at around 99.50.

Following Tuesday's sharp decline, EUR/USD held steady during the first half of the day on Wednesday before losing its footing during the American trading hours. After losing nearly 1% on the day, EUR/USD stages a technical correction and trades in positive territory at around 1.1350 in the European morning on Thursday. IFO sentiment data from Germany will be watched closely by investors later in the session. Several European Central Bank (ECB) policymakers will be delivering speeches as well.

GBP/USD extended its decline on Wednesday and registered its lowest daily close in a week below 1.3250. The pair edges higher in the early European session but remains below 1.3300. While speaking at the International Monetary Fund (IMF) event, Bank of England (BoE) Governor Andrew Bailey said that the central bank must take the risk to economic growth from global trade disruption very seriously.

Gold failed to shake off the bearish pressure on Wednesday and lost more than 2.5% on the day. After dropping all the way to $3,260, XAU/USD regained its traction and reclaimed $3,300. At the time of press, the precious metal was trading at around $3,320, rising about 1% on the day.

USD/JPY gathered bullish momentum and gained more than 1% on Wednesday. The pair corrects lower and trades below 143.00 in the European morning on Thursday. In the Asian session on Friday, market participants will pay close attention to Tokyo Consumer Price Index data for April.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.