AUDUSD Long-term Forecast: Bulls to Get Energy from RBA

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Australian Dollar began 2022 on an upward trend versus the US Dollar but peaked in April, just after the US Federal Reserve raised interest rates for the first time this year. That single move put in motion a gloomy year for the Australian dollar, causing the currency to fall 15%.

Although the Federal Reserve's hawkishness added the most to the AUD/USD fall, China's lengthy COVID lockdowns, which dragged on the domestic economy, are also a major factor.

However, things have changed, as the Aussie has been picking up pace since October 2022 and started 2023 on a high note.

With the RBA’S and Fed's interest rate hikes and China’s reopening, what will 2023 bring for the Aussie?

Summary

● AUD/USD’s future depends on the monetary policies of the Reserve Bank of Australia and the Federal Reserve.

● The Fed's hawkishness may change in the second half of 2023.

● Factors like China’s reopening, commodity prices, global recession, and war in Ukraine will be the major drivers of the AUD/USD.

Trading the AUDUSD online

AUD/USD Live Chart - Mitrade

The major range of the AUD/USD monthly chart is 0.7661 to 0.6170. Its 50% - 61.8% retracement zone is 0.6916 - 0.7091.

Because the market is declining, this region represents a big resistance zone. The first strength indicator in 2023 will be the breach of the 50% area at 0.6916.

If buyers can form a support base above 0.6916, the rally might extend beyond the 61.8% or Fibonacci level at 0.7091. Breaking this level will put the AUD/USD in a solid position and may activate a sprint to the upside.

Failure to continue a rebound above 0.6916 indicates that the AUD/USD is still under a bearish influence. The initial downward target will be 0.6531. Maintaining this price will signal the resumption of counter-trend buyers.

If it fails, expect the selling to continue to 0.6170. If this price is wiped out with substantial selling pressure, the Aussie might fall toward the upper to mid-50s range.

Will RBA raise rates in 2023?

Although the RBA's monetary policies were dominated by the ultra-aggressive US Fed and fear about a worldwide recession in 2022, the length of the current Australian rate rise cycle will be key for the AUD prediction in 2023 and beyond.

After raising interest rates eight times between May 2022 and December 2022, raising average lending rates to their highest level over a decade, the RBA stated at its December 2022 meeting that it expects future rate hikes.

The RBA is most likely keeping an eye on the somewhat overpriced property market, and the inflation situation is less alarming than in the US or Europe.

Most Australian households have short-term fixed mortgage rates, and discretionary income may suffer as a result.

In February, the Reserve Bank governor Philip Lowe indicated that although the bank has discontinued acquiring bonds, this does not suggest a near-term increase in interest rates. He also indicated that underlying inflation would rise further in future quarters to about 3.25% before dropping to around 2.75% during 2023".

Experts believe the RBA will be cautious to avoid an overly severe housing downturn and anticipate rates to peak at 3.60% and then begin to fall in the third quarter of 2023.

This would indicate a less appealing carry and less positive risk in a likely scenario for overall sentiment and less economic damage, which may benefit the AUD.

Treasury yields

Although US treasuries significantly impact longer-dated Australian government bonds, Australian 10-year rates have lately traded lower than their US peers after trading above them for a long time.

This appears to be the case, and the unfavorable spread may extend further. That bond yield viewpoint is also expected to impact the AUD's forecast significantly.

Inflation

High energy costs and supply-chain issues, along with government stimulus and robust consumer spending, have brought inflation in Australia to a decades-high level.

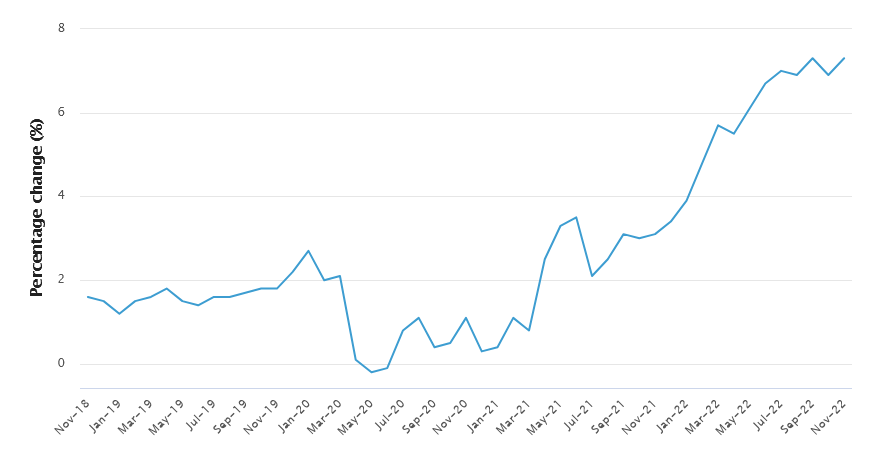

Although pricing pressures in Australia have subsided, annual inflation is way too high at 7.3% as of November 2022.

Australian CPI data

In its December monetary meeting, the RBA maintained its inflation-fighting approach, saying it would do everything required to bring inflation to the central bank's target zone of 2% to 3%.

Westpac predicts that Australia's headline inflation will peak at 7.4% in 2022 (the December quarterly result will be revealed on January 25). They foresee headline inflation to drop to 3.7% in 2023, significantly below the Reserve Bank's current prediction of 4.7.

According to Rabobank's Jane Foley, the latest Australian labor market report, which indicated employment unexpectedly fell in December 2022, may force policymakers to pause monetary tightening.

She added that indicated market rates had altered relative to one month ago to highlight a change in views on the high in RBA policy rates and the timing of the projected policy shift.

Underlying inflation is presently at 6.1%, with the RBA expecting it to rise to 6.5% before falling to 3.8% by 2023.

The RBA will continue to prioritize inflation. However, according to ANZ Research, activity indicators will indicate the extent to which demand and so inflationary pressures are subsiding.

Global economic crises

The Australian dollar is a strong currency, and the direction of global risk sentiment will be the major driver next year. Many analysts believe that a modest mood improvement will accompany a still adverse energy scenario, forcing investors to pick which pro-cyclical currencies to invest in.

The anticipated possibility of a worldwide recession was key to AUD weakening in 2022. The trend is anticipated to continue in 2023.

The Australian government presented its federal budget in October 2022, which reduced its long-term iron ore pricing expectations from $91 per tonne to $55 per tonne, highlighting the deteriorating demand for Australia's major export.

Growth in 2022 should have exceeded 4%, but this will be much more difficult to achieve in 2023. Higher interest rates, reset mortgages, a sinking housing market, and potentially a weaker labor market should push growth back to about 3%. Against the context of a global downturn, this would still be an impressive outcome.

China’s reopening

On the plus side, China's reversal of its zero-COVID policy and the revival of the Chinese property industry are likely to boost Australian exports, which are critical to the country's economy.

The China factor will remain highly important regarding the Aussie since Australia has the G10's most China-dependent export economy.

Given China's internal economic difficulties and the tensions associated with the Russia-Ukraine conflict, the authorities may have opted to take a more practical approach to trade with Australia.

According to many experts, the real estate crisis will be a major drag on the Chinese economy. While retail might improve under lighter Covid restrictions, decreasing global demand will hurt exports.

One encouraging factor is that the new Australian government is pursuing a more friendly relationship with China, clearing the path for export restrictions to be lifted next year.

Recessions in the United States and Europe will impact on the global economy in 2023, affecting Australia's external accounts. However, a rebound in China will be beneficial.

So far, the iron ore price has benefited. Still, ANZ Research predicts that removing COVID limitations in China will improve Australia's tourist and education exports, which need a boost.

Is the US dollar more predictable in 2023?

The Fed has been driven to tighten strongly over the last year, outperforming any tightening cycle in the prior three decades.

Unsurprisingly, inflation and Fed rate policies remain primary concerns for investors in 2023. According to J.P. Morgan Research 2023 Outlook Survey participants, two variables are the most significant for US fixed-income markets in 2023; the Fed’s stance followed by US recession concerns.

The Fed's more aggressive monetary stance put downward pressure on the Australian dollar. Since March, the Fed has foreshadowed aggressive rate rises to curb inflation, partly driven by growing domestic costs.

However, with inflation already showing signs of weakening, the Fed is projected to issue a 50bp rise in December before slowing the tightening pace and providing 25bp hikes at the February and March meetings. Following that, rate rises are projected to be paused.

In the report, Jay Barry, Co-Head of US Rates Strategy at J.P. Morgan, said,

“The almost 500bp of expected cumulative hikes is already delivering a commensurate tightening of financial conditions, which we believe will tip the economy into a mild recession later next year. With a slowing aggregate demand, we project the unemployment rate will rise to 4.3% by the end of next year.”

Inflation

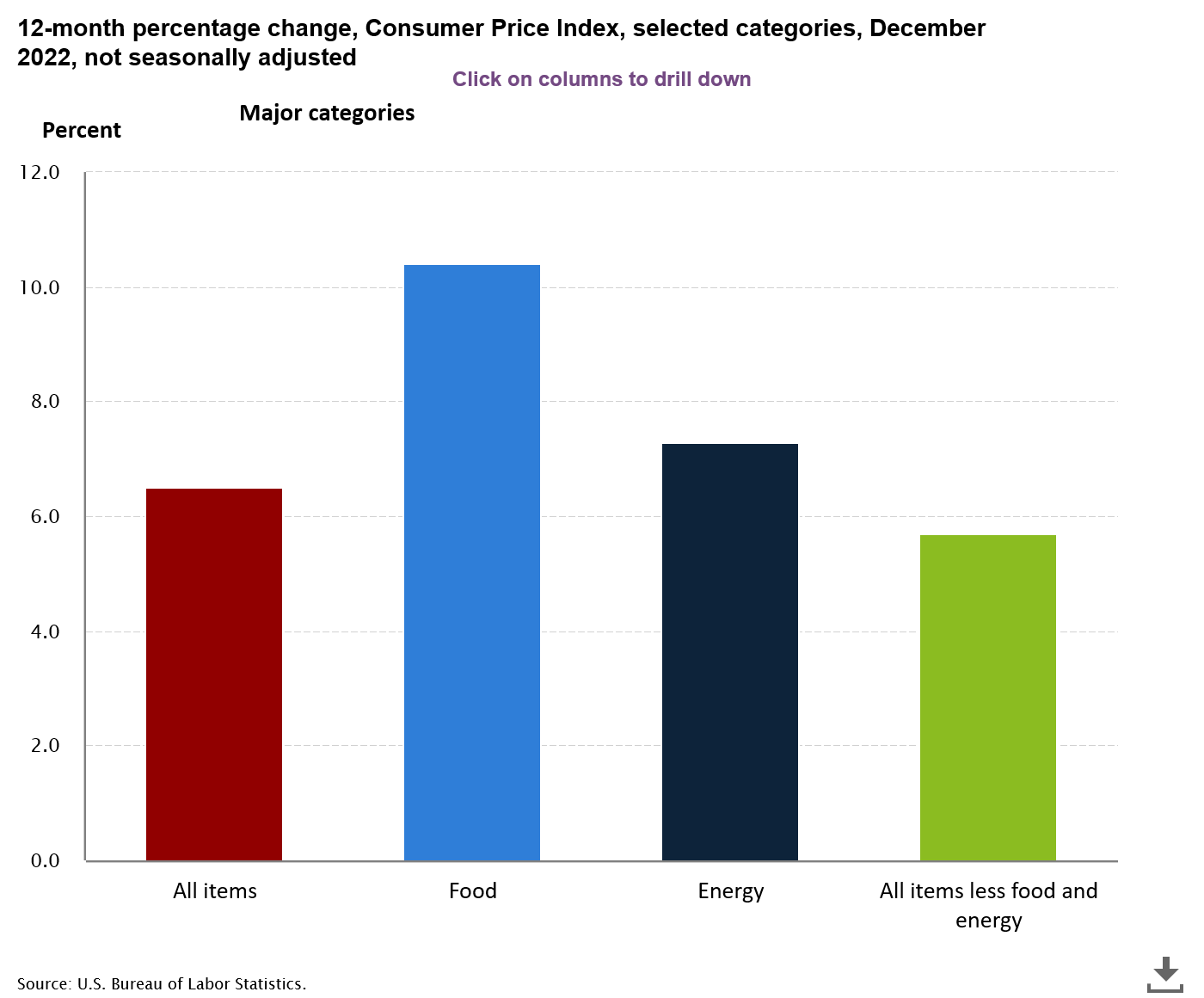

The expected pace of US inflation may have long-term consequences for the US dollar. Although a high inflation environment has been associated with 2022 USD's dominance, early signals of declining inflation have been observed. Better-than-expected US CPI (consumer price index) numbers can give the Australian dollar some relief vs. the USD.

US CPI data

According to the IMF, US inflation would fall to 3.5% in 2023 and 2.2% in 2024. Although lower inflation may lessen the greenback's strength, future weakening will be determined by how it compares to Australian inflation as well as the country's economic prospects.

As a result, more dollar strength is still anticipated in 2023, but at a lesser magnitude than in 2022.

The Fed's halt should give the dollar a break. Furthermore, unlike in 2022, lower-yielding currencies such as the Euro are projected to be more protected as central banks suspend rises and shift their attention to tackling the slowing economy, but this makes high-beta currencies such as AUD riskier.

What drives Australian dollar's price in 2023?

The key factors driving the AUD/USD down this year will largely stay in place. These factors include:

RBA’s stance

Fed’s stance

Reopening of China

Global economic crises

Australia’s exports

AUDUSD price predictions

Many financial institutions and banks weigh in on the AUD/USD yearly forecast. Here we’ll look at what experts and analysts say about the AUD/USD 2023 price prediction.

Reuters Survey

It is uncertain when the US Federal Reserve, like the RBA, will stop hiking interest rates. According to a Reuter survey of US experts on whether the Fed Reserve should pause, the majority stated the central bank should not pause until inflation falls to roughly half its current level.

According to the study, CPI inflation will halve in the second quarter of 2023, with annual rates averaging 8.1%, 3.9%, and 2.5% in 2022, 2023, and 2024, respectively.

ANZ Research

ANZ predicts that the AUD/USD will rise in the second half of 2023. According to ANZ, the AUDUSD exchange rate will reach 73 cents by June 2023. The AUD/USD is expected to hit 0.70 by mid-2024, according to ANZ.

Westpac

Westpac forecasts an AUD/USD exchange rate of 67 cents by June 2023 and 0.74 cents by June 2024.

NAB

According to NAB, the AUDUSD rate will be approximately 70 cents by mid-year 2023. According to NAB, the AUD will reach 0.72 to the US dollar by June 2024.

According to the research group, the AUD will outperform commodity currencies in 2023, with the dollar dominance fading as global inflation controls.

ING

ING’s Australian dollar forecast for 2023 saw the AUD/USD exchange rate at 0.71 by the fourth quarter of the year.

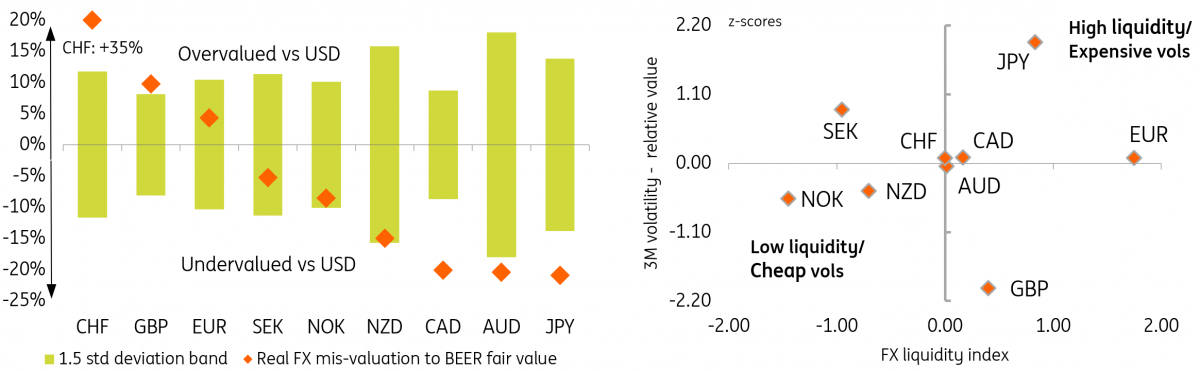

The ING says that commodity currencies appear undervalued to the US dollar. But, risk sentiment must stabilize before the misvaluation gap can be closed. An improvement in China's medium-term outlook is also key for the Australian and New Zealand currencies.

Wallet Investor

According to Wallet Investor's algorithmic Australian dollar projection for 2023, the AUD/USD exchange rate ended the year at 0.7031.

TradingEconomics

Trading Economics predicted that the Australian dollar would be valued at about 0.62741 per US dollar one year from 9 January 2023.

Long Forecast

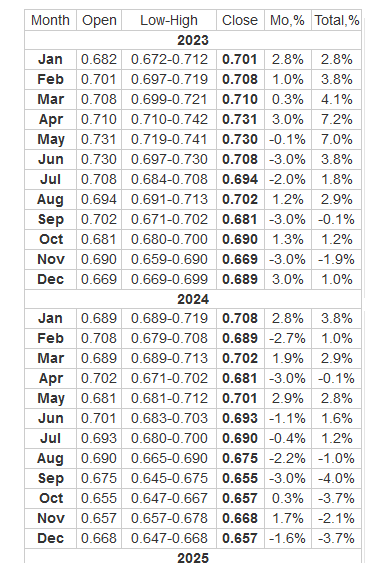

Conclusion

Many analysts say that the Australian dollar has come under pressure after a surprise contraction in employment in December, which endorses the recent cautious stance by the Reserve Bank of Australia.

Inflation, China’s reopening, Australia’s exports, and the global economic crises will continue to drive the AUD against the USD in 2023.

------------------

Start your First trade

Register a demo account for free and level up your trading skills. At the same time, enjoy a sum of $50,000 virtual money to practice and formulate your best strategies before switching to a live account.

Forex 丨 Gold 丨 Shares 丨Commidities丨More Strictly regulated0 commission, low spreadsDaily Forex Signals with analysisNegative Balance Protection

Forex 丨 Gold 丨 Shares 丨Commidities丨More Strictly regulated0 commission, low spreadsDaily Forex Signals with analysisNegative Balance Protection

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.