U.S. February Nonfarm Payroll Commentary: Awaiting the Optimal Timing to Short the Dollar and Go Long on Treasuries

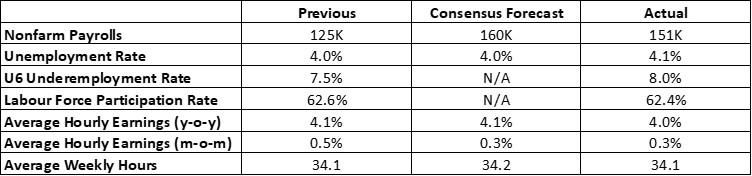

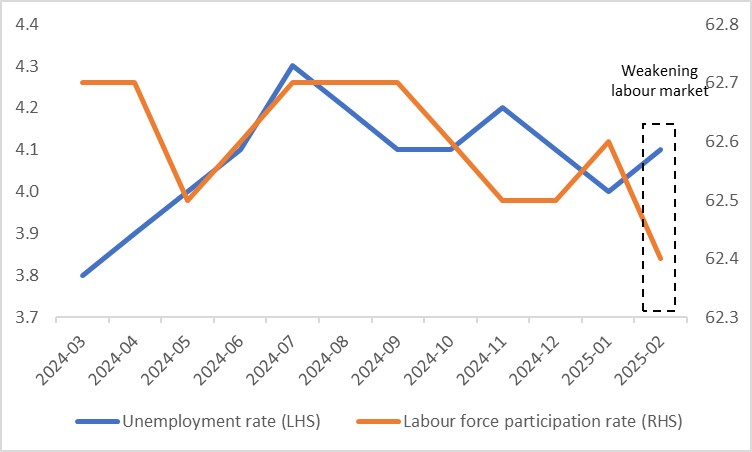

On 7 March 2025, the United States released the Nonfarm Payroll data for February. Nonfarm employment grew by 151,000 jobs, falling short of the market consensus expectation of 160,000 (Figure 1). This shortfall was primarily driven by weaknesses in sectors such as leisure and hospitality as well as retail trade. Additionally, other data released on the same day—including the Unemployment Rate, Labour Force Participation Rate and Average Hourly Earnings—further underscored the softening of the U.S. labour market (Figure 2).

Looking ahead, a reduction of 10,000 federal government jobs in February will be reflected in the March figures. This suggests that next month’s nonfarm payroll report could face additional downward pressure.

Figure 1: Latest U.S. labour market data

Source: Refinitiv, Tradingkey.com

Figure 2: U.S. unemployment rate and participation rate (%)

Source: Refinitiv, Tradingkey.com

By integrating labour market data with other economic indicators, we can gain a more comprehensive perspective on the overall picture of the U.S. economy. The February ISM Manufacturing PMI showed declines in both employment and new orders, signalling a slowdown in U.S. manufacturing activity. Against the backdrop of disruptions from Trump-era tariffs and the Federal Reserve’s recent pause on rate cuts, a rapid recovery in manufacturing appears unlikely in the short term. Combined with emerging signs of fatigue in the service sector, concerns about a potential "U.S. recession" are resurfacing. Therefore, the Atlanta Fed’s GDPNow model has sharply revised its forecast for first-quarter GDP downward by 6.7 percentage points to -2.8%.

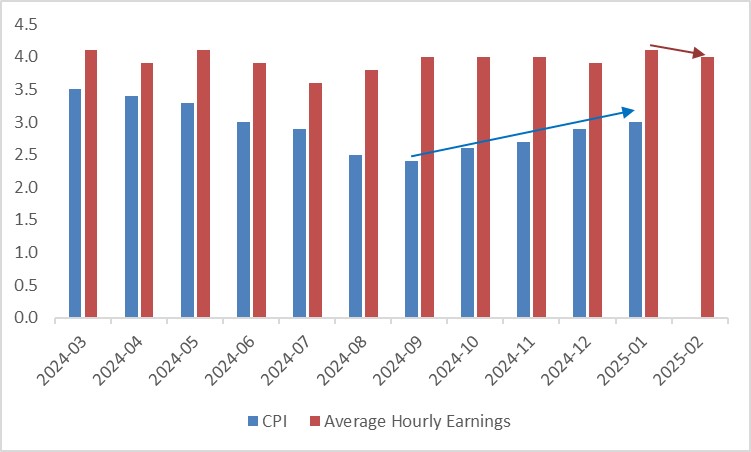

Although U.S. inflation has been rising since hitting a trough in September last year, the weakening labour market and a declining growth rate in Average Hourly Earnings (Figure 3) suggest that the Federal Reserve may accelerate its rate-cutting path beyond current expectations. We project 4 to 5 rate cuts by the end of this year, exceeding the market consensus of 3 cuts.

Figure 3: U.S. CPI and average hourly earnings (y-o-y, %)

Source: Refinitiv, Tradingkey.com

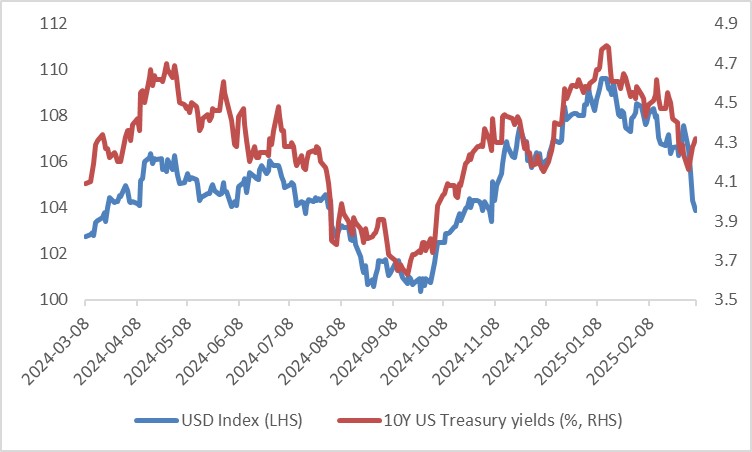

More aggressive rate reductions over the medium term (3-12 months) are likely to depress the USD Index and Treasury yields (Figure 4). This could create opportunities for investors to profit from shorting the dollar and going long on Treasuries.

Figure 4: USD Index and 10Y US Treasury yields

Source: Refinitiv, Tradingkey.com

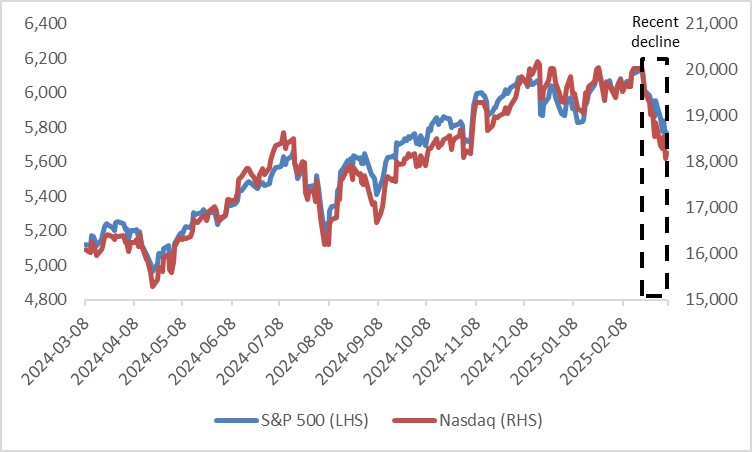

Recently, U.S. equities have experienced a downward adjustment, driven by growing investor concerns over a potential recession, spillover effects from Deepseek, the impact of Trump’s tariffs and seasonal factors (Figure 5). Looking forward, we believe the likelihood of a technical recession in the U.S. remains low. However, sustained disinflation provides the Fed with greater room to cut rates. On balance, we expect U.S. equities to resume an upward trajectory starting in the second quarter.

Figure 5: U.S. stocks

Source: Refinitiv, Tradingkey.com

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.