Here is what you need to know on Monday, April 28:

Major currency pairs trade in relatively tight ranges early Monday, following the previous week's highly volatile action. The US economic calendar will feature Dallas Fed Manufacturing Business Index for April on Monday. Later in the week, key growth and employment data from major economies will be watched closely.

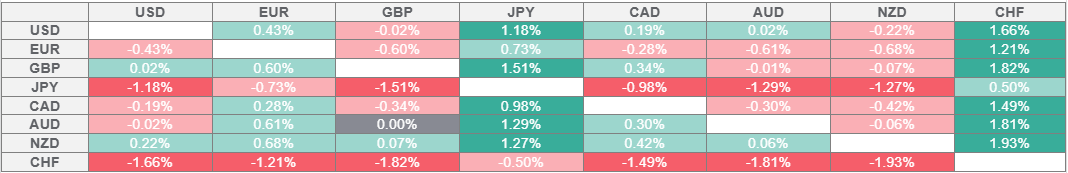

US Dollar PRICE Last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) Index registered small gains last week and snapped a three-week losing streak. In the European morning, the USD Index edges higher toward 99.80, while US stock index futures trade in negative territory. Markets remain cautious to start the week amid a lack of new developments pointing to a de-escalation of the US-China trade conflict.

Over the weekend, the Financial Times reported that the Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting May 4 to be a third lower than a year before. Meanwhile, a spokesperson for China's Foreign Ministry noted on Monday that they have not engaged in any trade talks with the US.

EUR/USD struggles to gain traction and trades in the red at around 1.1350 after closing the previous week marginally lower. Citing six sources familiar with discussions, Reuters reported on Saturday that the European Central Bank policymakers are becoming increasingly confident about lowering key rates again in June but they see no reason to consider a big 50 basis points (bps) cut.

GBP/USD fluctuates in a narrow band near 1.3300 to begin the European session on Monday.

USD/JPY rose more than 0.7% on Friday and climbed above 144.00 for the first time in over a week before correcting lower heading into the weekend. The pair holds its ground on Monday and trades comfortably above 143.50. Atsushi Mimura, Japan’s Vice Finance Minister for International Affairs and top foreign exchange official, said early Monday that it is "completely untrue" about the media report that US Treasury Secretary Scott Bessent said a stronger Japanese Yen is preferable.

Gold managed to end the previous week above $3,300 but came under renewed bearish pressure on Monday. XAU/USD was last seen losing more than 1% on the day near $3,280.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.