GBP/JPY gains over 1% as Yen continues to underperform across major FX pairs.

Technicals show bullish momentum, with RSI rising and price nearing key resistance at 195.00.

Break above 195 could open path toward 198.24 and December’s multi-month high at 198.94.

The GBP/JPY rallied on Monday, climbing past the 193.00 and 194.00 figures on an over 200 pip daily gain, as the Japanese Yen remains the laggard in the FX space. At the time of writing, the cross-pair post gains of over 1%, trading near the 194.70 area after bouncing off daily lows of 192.52.

GBP/JPY Price Forecast: Technical outlook

After clearing key resistance levels, the GBP/JPY surpassed the 200-day Simple Moving Average (SMA) of 194.11, extending its gains shy of challenging the March 18 daily high of 194.89. This could pave the way for buyers to test 195.00. If those levels are taken out, the next ceiling would be the January 7 swing high of 198.24, ahead of the December 30 high at 198.94.

Momentum remains bullish as depicted by the Relative Strength Index (RSI), carving a new higher peak as an indication of a strong trend.

On the other hand, if sellers would like to push prices lower, the GBP/JPY must clear the top of the Ichimoku Cloud (Kumo) at 193.00 before targeting the Tenkan-sen at 192.81, ahead of the 50-day SMA at 191.29.

GBP/JPY Price Chart – Daily

British Pound PRICE This week

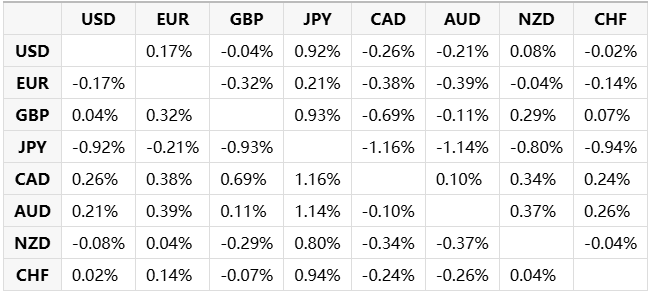

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.