GBP/USD fell another third of a percent of Monday.

Market sentiment is due for another knockback as fresh tariff threats surface.

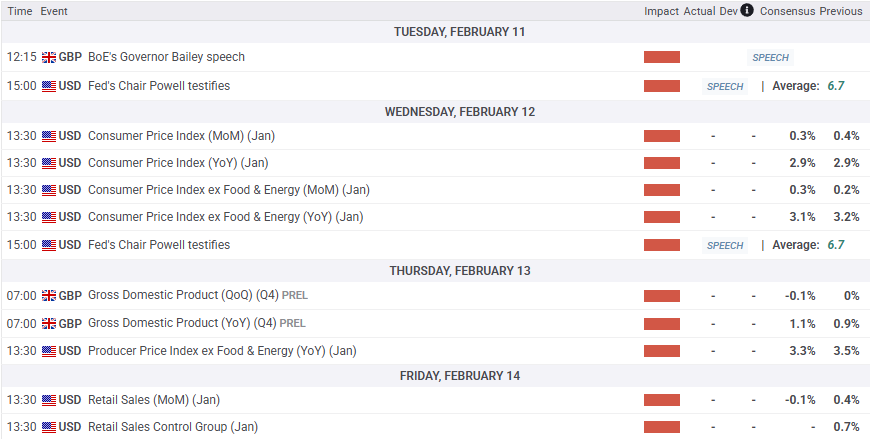

BoE Bailey, Fed Powell, US CPI inflation, and UK GDP all on the docket.

GBP/USD sunk for a third straight trading day on Monday, kicking off the new trading week on the backfoot and slipping back below the 1.2400 handle, shedding one-third of one percent in the process. US President Donald Trump renewed his vigor to kick off a US vs everybody else trade war late Monday, slapping a 25% tariff on all imported steel and aluminum into the US.

Read more: US President Donald Trump signs off on 25% tariffs on steel and aluminum

Bank of England (BoE) Governor Andrew Bailey is due to give a keynote speech on Tuesday. Cable traders will be keeping an eye on the BoE head following the UK central bank’s rate cut last week, looking to nail down any hints of forward guidance on where the BoE could be heading next. Federal Reserve (Fed) Chair Jerome Powell follows up with an appearance of his own, testifying before the US Senate Banking Committee on Tuesday.

The key datapoints this week will be US Consumer Price Index (CPI) inflation slated for Wednesday, as well as UK Gross Domestic Product (GDP) and US Producer Price Index (PPI), both due on Thursday.

GBP/USD price forecast

GBP/USD has chalked in a second straight rejection from the 50-day Exponential Moving Average (EMA) near 1.2500, setting the stage for a continued decline. Price action is tilting back toward the 1.2300 handle, and near-term momentum has shifted firmly bearish. Cable has printed three straight down days after failing to recapture the 1.2500 level, and the bullish recovery from January’s lows near 1.2100 has officially run out of steam.

GBP/USD daily chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.