Australian Dollar edges lower as US Dollar appreciates due to easing global trade tensions

The Australian Dollar remains under pressure amid expectations that the RBA will deliver another 25-basis-point rate cut in May.

Chinese Foreign Minister Wang Yi emphasized that dialogue is essential for resolving US-China trade tensions.

The US Dollar struggled due to weakened investor confidence stemming from Trump’s unpredictable trade policies.

The Australian Dollar (AUD) is edging lower on Tuesday after registering more than 0.50% gains against the US Dollar (USD) in the previous session. The AUD/USD pair depreciates as the US Dollar appreciates amid easing global trade tensions.

US President Donald Trump signaled openness to reducing Chinese tariffs, while Beijing exempted certain US goods from its 125% levies. This move has fueled hopes that the prolonged trade war between the world's two largest economies might be drawing to a close. Chinese Foreign Minister Wang Yi said on Tuesday that making concessions and retreating would only embolden the bully, emphasizing that dialogue is key to resolving differences.

President Trump said that there has been progress, and he has talked with China’s President Xi Jinping. However, a Chinese embassy spokesperson on Friday firmly denied any current negotiations with the US, stating, "China and the US are not having any consultation or negotiation on tariffs." The spokesperson urged Washington to "stop creating confusion."

Traders are now turning their attention to Australia’s upcoming inflation report, set for release on Wednesday, which could influence expectations for Reserve Bank of Australia policy. The RBA is widely expected to implement another 25-basis-point rate cut in May as policymakers prepare for potential fallout from the newly imposed US tariffs.

Australian Dollar may recover as confidence in American assets weakens

The US Dollar Index (DXY), which measures the USD against six major currencies, is trading higher at around 99.00 at the time of writing. However, the US Dollar faced challenges as Trump’s unpredictable trade policies have shaken confidence in American assets, prompting investors to turn to the shared currency as an alternative. Any further escalation in the US-China trade war could put additional pressure on the Greenback.

According to the Wall Street Journal, President Trump intends to lessen the impact of his automotive tariffs by ensuring that duties on foreign-made cars do not stack with other tariffs and by reducing levies on foreign parts used in car production.

US Treasury Secretary Scott Bessent said on Monday that he interacted with Chinese authorities last week but did not mention tariffs. Bessent stated that while the US government is in communication with China, it is up to Beijing to make the first move to ease the tariff dispute, given the trade imbalance between the two countries.

Reuters reported on Sunday that US Agriculture Secretary Brooke Rollins said that the Trump administration is holding daily discussions with China regarding tariffs. Rollins emphasized that talks were ongoing and that trade agreements with other countries were also "very close."

Michael Hart, President of the American Chamber of Commerce in China, remarked that it's encouraging to see the US and China reviewing tariffs. Hart noted that while exclusion lists for specific categories are reportedly in the works, no official announcements or policies have been released yet. Both China’s Ministry of Commerce and the US Department of Commerce are currently gathering input on the matter.

Westpac forecasted on Thursday that the Reserve Bank of Australia (RBA) would lower interest rates by 25 basis points at its upcoming May 20 meeting. The RBA has adopted a data-driven approach in recent quarters, making it difficult to predict its actions beyond the next meeting with confidence.

China's Finance Ministry stated on Friday that global economic growth remains sluggish, with tariffs and trade wars continuing to undermine economic and financial stability. The ministry urged all parties to enhance the international economic and financial system through stronger multilateral cooperation, per Reuters.

Australian Dollar trades near 0.6400 after pulling back from levels near four-month highs

The AUD/USD pair is trading around 0.6420 on Tuesday, with the daily chart indicating a bullish bias. The pair remains above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) stays well above the 50 mark, signaling continued upward momentum.

On the upside, immediate resistance is located at the recent four-month high of 0.6439, recorded on April 22. A clear break above this level could open the door for a rally toward the five-month high at 0.6515.

The initial support is seen at the nine-day EMA of 0.6387, with stronger support near the 50-day EMA at 0.6312. A sustained move below these levels would undermine the bullish outlook and could trigger deeper losses, bringing the March 2020 low near 0.5914 into focus.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

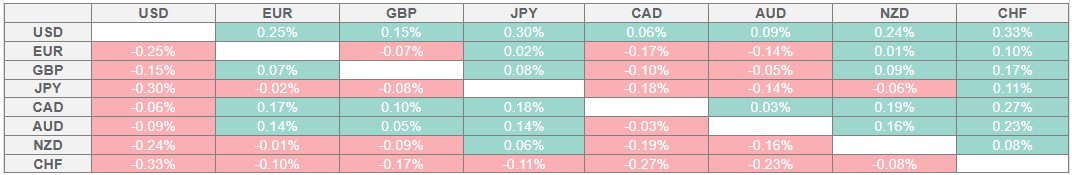

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.