Australian Dollar holds losses following employment data release

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Australian Dollar stagnated as Employment Change came in at 32.2K, against the consensus forecast of 40K.

Australia’s Unemployment Rate rose to 4.1% in March, slightly below the market forecast of 4.2%.

The US Dollar received support due to stronger consumer spending in March.

The Australian Dollar (AUD) is trading lower against the US Dollar (USD), snapping a six-day winning streak. The AUD/USD pair remains under pressure following the release of Australia’s employment data on Thursday, which showed the Unemployment Rate rising to 4.1% in March, slightly below the market forecast of 4.2%. Meanwhile, Employment Change came in at 32.2K, against the consensus forecast of 40K.

The AUD found some support from improved global risk sentiment after US President Donald Trump announced exemptions for key technology products from newly proposed “reciprocal” tariffs. These exemptions, which include smartphones, computers, semiconductors, solar cells, and flat-panel displays, largely benefit goods produced in China, Australia’s largest trading partner and a major buyer of its commodities.

Markets remain cautious amid ongoing uncertainty surrounding US trade policy. The Trump administration is now considering tariffs on imports of semiconductors and pharmaceuticals. On the domestic front, the Reserve Bank of Australia's (RBA) April policy Meeting Minutes suggested uncertainty about the timing of the next interest rate adjustment.

While the RBA hinted that the May meeting could be an appropriate time to reassess monetary policy, no firm decision has been made. Markets are currently pricing in a 25-basis point rate cut in May, with expectations of around 120 basis points of easing over the next year. Attention now turns to Thursday’s employment report, which could offer crucial labor market insights and guide the RBA’s next policy move.

Australian Dollar depreciates as US Dollar rebounds due to stronger consumer spending

The US Dollar Index (DXY), which tracks the USD against a basket of six major currencies, is trading higher at nearly 99.60 at the time of writing. The US Building Permits, Housing Starts, the Philly Fed Manufacturing Index, and the weekly Initial Jobless Claims will be published later on Thursday.

US Retail Sales rose by 1.4% in March, followed by the 0.2% increase seen in February. This figure came in better than the estimation of 1.3%.

A recent consumer sentiment survey by the Federal Reserve Bank of New York shows a sharp increase in the number of households expecting higher inflation, weaker job prospects, and worsening credit conditions in the coming months.

Atlanta Fed President Raphael Bostic remarked during early Tuesday’s market session that the US central bank still has a long road ahead to achieve its 2% inflation target, casting doubt on market expectations for additional interest rate cuts.

The US Consumer Price Index (CPI) inflation eased to 2.4% year-over-year in March, down from 2.8% in February and below the market forecast of 2.6%. Core CPI, which excludes food and energy prices, rose 2.8% annually, compared to 3.1% previously and missing the 3.0% estimate. On a monthly basis, headline CPI dipped by 0.1%, while core CPI edged up by 0.1%.

Australia’s Westpac Leading Index’s six-month annualised growth rate, which forecasts economic momentum relative to the trend over the next three to nine months, eased to 0.6% in March from 0.9% in February.

China’s economy grew at an annual rate of 5.4% in the first quarter of 2025, matching the pace seen in Q4 2024 and surpassing market expectations of 5.1%. On a quarterly basis, GDP rose by 1.2% in Q1, following a 1.6% increase in the previous quarter, falling short of the forecasted 1.4% gain.

Meanwhile, China’s Retail Sales surged 5.9% year-over-year, beating expectations of 4.2% and up from February’s 4%. Industrial Production also outperformed, rising 7.7% compared to the 5.6% forecast and February’s 5.9% print.

Australian Dollar tests immediate support at 0.6350 despite bullish bias remaining intact

The AUD/USD pair is trading near the 0.6360 level on Thursday, with technical indicators on the daily chart suggesting a bullish bias. The pair remains above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) holds above the neutral 50 level, reinforcing the positive momentum.

On the upside, key resistance is seen at the psychological 0.6400 level, followed by the four-month high of 0.6408, last reached on February 21.

Initial support is located at the 9-day EMA around 0.6285. A break below this level could undermine the short-term bullish trend and potentially expose the pair to further downside toward the 0.5914 region—its lowest since March 2020—and the critical psychological level at 0.5900.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

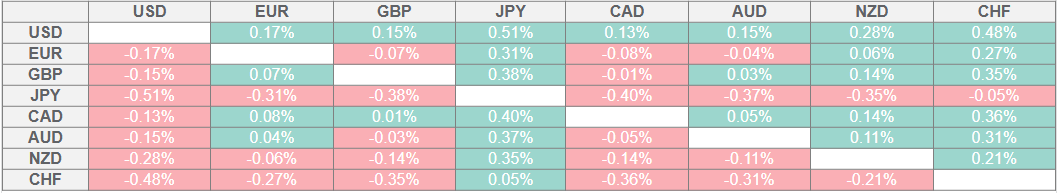

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.