Australian Dollar holds losses as global trade concerns rise over impending US tariffs

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Australian Dollar depreciates as global trade concerns intensify ahead of potential US tariffs.

A Reuters poll suggests the Reserve Bank of Australia (RBA) will keep rates steady in April.

The US Gross Domestic Product (GDP) Annualized grew by 2.4% in Q4 2024, exceeding the 2.3% forecast.

The Australian Dollar (AUD) weakens against the US Dollar (USD) on Friday, erasing gains from the previous session. The AUD/USD pair declines amid heightened risk aversion, driven by concerns over impending US auto tariffs.

US President Donald Trump signed an order on Wednesday imposing a 25% tariff on auto imports, further escalating global trade tensions. These aggressive trade measures are likely to strain relations with key trading partners, even ahead of his planned reciprocal tariffs set for April 2.

A Reuters poll on the Reserve Bank of Australia (RBA) indicates that the central bank will hold rates steady in April. All 39 economists surveyed expect the RBA to maintain the cash rate at 4.10% on April 1. However, the median forecast predicts two rate cuts in 2025, with 25 basis point reductions in May and September, bringing the rate down to 3.60% by Q3.

The RBA is expected to ease rates gradually due to persistently high core inflation at 3.2%, low unemployment, and recovering economic growth. The potential May rate cut hinges on Q1 inflation data, with approximately 75% of economists anticipating a reduction.

Westpac economists believe the RBA will keep the cash rate unchanged at its April 1 policy meeting, describing it as a “dead rubber” in the broader monetary policy context. However, they maintain their forecast for a rate cut in May.

Australian Dollar struggles as US Dollar steadies amid increased risk aversion

The US Dollar Index (DXY), which tracks the USD against six major currencies, hovers around 104.30, facing pressure due to lower US yields, standing at 3.99% for the 2-year bond and 4.35% for the 10-year bond at the time of writing.

US Gross Domestic Product (GDP) Annualized expanded at a rate of 2.4% in Q4 2024, surpassing the 2.3% forecast, according to data released on Thursday. Investors now await the US Personal Consumption Expenditures (PCE) Price Index, set for release later on Friday.

Moody’s has warned that increased tariffs and tax cuts could significantly widen government deficits, potentially leading to a US debt rating downgrade and rising Treasury yields.

S&P Global cautioned that policy uncertainty in the US could dampen global economic growth, while Fitch Ratings highlighted that current tariffs may severely impact smaller economies such as Brazil, India, and Vietnam, making it more challenging for them to afford US goods.

Federal Reserve (Fed) Bank of Boston President Susan Collins stated on Thursday that the Fed faces a difficult decision between maintaining a restrictive policy stance or acting pre-emptively in anticipation of deteriorating economic conditions.

Meanwhile, Federal Reserve Bank of Richmond President Thomas Barkin warned that economic uncertainty stemming from the Trump administration’s trade policies could force the Fed into a more cautious, wait-and-see approach than markets are expecting.

St. Louis Fed President Alberto Musalem made strong remarks on Wednesday, joining a growing number of Fed policymakers warning about the Trump administration’s tariff policies. Musalem cautioned that these measures are disrupting the stable US economy, increasing uncertainty, and driving inflation higher.

President Trump announced plans on Wednesday to reduce tariffs on China to facilitate ByteDance's sale of TikTok's US operations. While he emphasized that the tariffs hold greater value than TikTok itself, he suggested that a minor tariff reduction could aid in finalizing the deal. Trump also hinted at the possibility of extending the deadline for the TikTok sale once again.

On Wednesday, Trump suggested plans to impose tariffs on copper imports within weeks, although the Commerce Department initially had until November 2025 to decide on the matter. This development, however, provided some support for the AUD, as Australia is a key copper exporter.

Australian Treasurer Jim Chalmers presented the 2025/26 budget on Tuesday, outlining key economic forecasts and tax cuts totaling approximately A$17.1 billion across two rounds. The budget deficit is projected at A$27.6 billion for 2024-25 and A$42.1 billion for 2025-26. GDP growth is expected to reach 2.25% in the fiscal year 2026 and 2.5% in 2027. The tax cuts appear to be aimed at strengthening political support.

Australian Dollar hovers around 0.6300, nine-day EMA, descending channel’s upper boundary

AUD/USD hovers near 0.6290 on Friday, with technical indicators suggesting a potential bullish shift as the pair challenges its descending channel pattern. However, the 14-day Relative Strength Index (RSI) remains just below 50, signaling persistent bearish pressure.

The nine-day Exponential Moving Average (EMA) at 0.6304 acts as immediate resistance. A breakout above this level could strengthen short-term momentum, opening the door for a test of the monthly high at 0.6391, last reached on March 18, followed by a three-month high at 0.6408.

On the downside, failure to hold gains may push the AUD/USD pair back into its descending channel, reinforcing the bearish outlook. In this scenario, the pair could drop toward the seven-week low of 0.6187, recorded on March 5, followed by the channel’s lower boundary at 0.6170.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

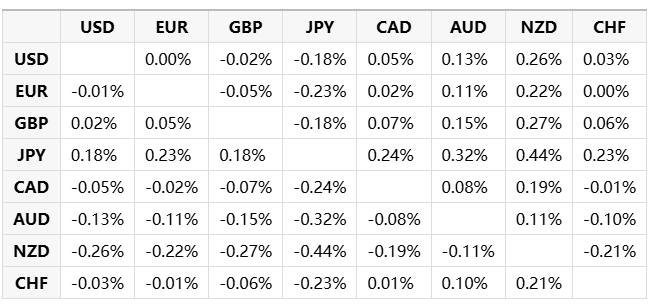

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.