Australian Dollar declines following employment figures, China’s rate decision

The Australian Dollar depreciated as Employment Change declined by 52.8K in February, missing the consensus forecast of a 30.0K increase.

The PBOC kept its Loan Prime Rates (LPRs) unchanged, with the one- and five-year rates at 3.10% and 3.60%, respectively.

The Fed reaffirmed its expectation of two rate cuts later this year but highlighted uncertainty arising from Trump’s tariff policies.

The Australian Dollar (AUD) weakens against the US Dollar (USD) on Thursday, reversing gains from the previous session. The AUD/USD pair declines as the AUD receives downward pressure following the release of domestic employment data.

Australia’s Employment Change dropped by 52.8K in February against the 30.5K increase in January (revised from 44K), falling short of the consensus forecast of 30.0K rise. Meanwhile, the seasonally adjusted Unemployment Rate remained steady at 4.1% in February, aligning with market expectations.

In China, the People’s Bank of China (PBOC) kept its Loan Prime Rates (LPRs) unchanged on Thursday, with the one-year rate at 3.10% and the five-year rate at 3.60%.

The Federal Reserve maintained the federal funds rate at 4.25%–4.5% in its March meeting, as widely expected. The Fed reaffirmed its outlook for two rate cuts later this year but cited uncertainty stemming from US President Donald Trump’s tariff policies.

Australian Dollar could find support as US Dollar struggles following Fed decision

The US Dollar Index (DXY), which measures the USD against six major currencies, is trading lower near 103.40. The Greenback faced pressure as yields on US Treasury bonds declined, with the 2-year yield at 3.97% and the 10-year yield at 4.24%.

However, the US Dollar found some stability after hawkish remarks from Fed Chair Jerome Powell, who stated, “Labor market conditions are solid, and inflation has moved closer to our 2% longer-run goal, though it remains somewhat elevated.”

President Trump and Russian President Vladimir Putin, on Tuesday, agreed to an immediate pause in strikes targeting energy infrastructure in the Ukraine war. In a Truth Social post following his call with Putin, Trump stated that both sides had committed to a 30-day halt on attacks against each other's energy infrastructure, mirroring statements from the Kremlin.

Putin declined to endorse a broader month-long ceasefire negotiated by Trump’s team with Ukrainian officials in Saudi Arabia, signaling continued tensions despite the temporary agreement on energy targets.

Trump reaffirmed plans to impose reciprocal and sectoral tariffs on April 2. Trump confirmed that there would be no exemptions for steel and aluminum and mentioned that reciprocal tariffs on specific countries would be implemented alongside auto duties.

According to Reuters, Trump’s proposal to boost US shipbuilding by imposing steep fees on China-linked vessels entering American ports is causing a buildup of US coal inventories and increasing uncertainty in the already struggling agriculture sector.

Treasurer Jim Chalmers addressed trade tensions in a speech on Tuesday, rejecting a "race to the bottom" on tariffs. Chalmers criticized the Trump administration’s trade policies as "self-defeating and self-sabotaging," emphasizing Australia’s need to focus on economic resilience rather than retaliation. He also condemned the US decision to exclude Australia from steel and aluminum tariff exemptions, calling it "disappointing, unnecessary, senseless, and wrong," as per "The Guardian".

On Monday, Reserve Bank of Australia (RBA) Assistant Governor (Economic) Sarah Hunter reiterated the central bank’s cautious stance on rate cuts. The RBA’s February statement signaled a more conservative approach than market expectations, with a strong focus on monitoring US policy decisions and their potential impact on Australia’s inflation outlook.

Australian Dollar breaks below 0.6350, ascending channel’s lower boundary

AUD/USD is trading near 0.6330 on Thursday, with technical analysis suggesting a weakening bullish bias as the pair breaks below the ascending channel pattern. However, the 14-day Relative Strength Index (RSI) remains above 50, indicating that bullish momentum is still in play.

The pair may attempt to surpass the immediate resistance at the nine-day Exponential Moving Average (EMA) of 0.6337, which aligns with the lower boundary of the ascending channel. A return to the channel could reinforce the bullish outlook, potentially leading AUD/USD to retest its three-month high of 0.6408, last reached on February 21. Further resistance is seen at the upper boundary of the channel near 0.6490.

On the downside, immediate support lies at the 50-day EMA at 0.6312. A decisive break below this key level could weaken the medium-term price momentum, exposing the AUD/USD pair to further downside pressure toward the six-week low of 0.6187, recorded on March 5.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

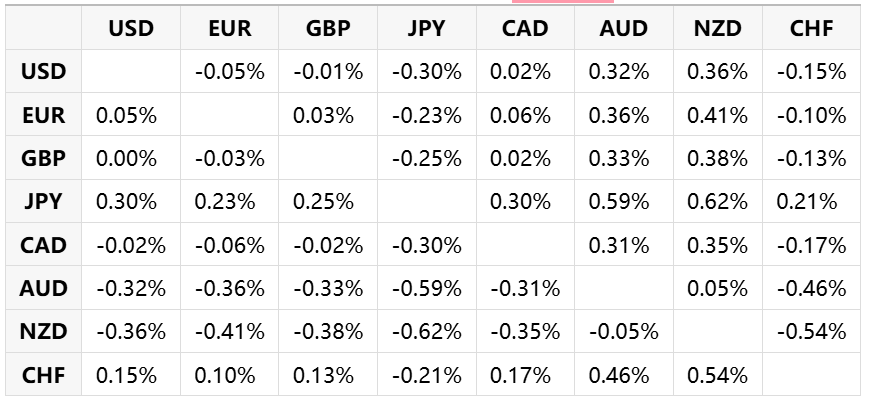

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.