- Gold Price Forecast: XAU/USD drifts higher above $4,200 as Fed delivers expected cut

- Gold Price Steady Climb and the Sudden Surge of Silver and Copper: Will Their Bull Run Extend Into 2026?

- Gold Price Forecast: XAU/USD climbs above $4,250 as Fed rate cut weakens US Dollar

- Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

- Silver Price Forecast: XAG/USD refreshes record high, looks to build on move beyond $61.00

- AUD/USD holds steady below 0.6650, highest since September ahead of China's trade data

The Australian Dollar struggles amid broad risk aversion and ongoing economic concerns in China.

Australia’s strong economic data last week lowered expectations of further rate cuts by the Reserve Bank of Australia.

The US Dollar struggled amid growing concerns over a potential US economic slowdown.

The Australian Dollar (AUD) weakens against the US Dollar (USD) on Wednesday, weighed down by broad risk aversion. Concerns intensified due to policy shifts by US President Donald Trump, particularly tariffs that increased the likelihood of a prolonged trade war.

The AUD also faces pressure from ongoing economic uncertainties and persistent deflationary risks in China, Australia’s largest trading partner, as traders await key policy announcements from Beijing.

Market participants remain focused on the Reserve Bank of Australia’s (RBA) policy outlook, especially after last week’s strong economic data reduced expectations of further rate cuts. Economic growth surpassed forecasts, marking its first acceleration in over a year.

The latest RBA Meeting Minutes signaled a cautious stance on monetary policy, emphasizing that February’s rate cut does not indicate a commitment to continued easing.

Investors are now turning their attention to February’s US Consumer Price Index (CPI) release on Wednesday for further insights into inflation trends.

With the Federal Reserve in its blackout period ahead of the March 19 meeting, central bank commentary will be scarce this week.

Australian Dollar struggles as escalating global trade tensions weigh on market sentiment

The US Dollar Index (DXY), which tracks the US Dollar against six major currencies, inches higher and is hovering around 103.50 at the time of writing. However, the Greenback faced challenges due to the likelihood of a US economic slowdown.

President Trump reversed his decision to double tariffs on Canadian steel and aluminum to 50%, a move he announced late Tuesday. However, the White House confirmed to Reuters that new 25% tariffs on all imported steel and aluminum will still take effect on Wednesday, impacting allies and key US suppliers, including Canada and Mexico.

Trump characterized the economy as being in a "transition period," hinting at a potential slowdown. Investors took his remarks as an early signal of possible economic turbulence in the near future.

Last week, Fed Chair Jerome Powell reassured markets that the central bank sees no immediate need to adjust monetary policy despite rising uncertainties. San Francisco Fed President Mary Daly echoed this sentiment, noting that increasing business uncertainty could dampen demand but does not justify an interest rate change.

RBA Deputy Governor Andrew Hauser highlighted that global trade uncertainty is at a 50-year high. Hauser warned that uncertainty stemming from US President Donald Trump's tariffs could prompt businesses and households to delay planning and investment, potentially weighing on economic growth.

Bloomberg reported on Tuesday, citing sources familiar with the matter, that trade and other negotiations between the US and China remain at a deadlock. Chinese officials state that the US has not provided clear steps regarding fentanyl measures needed for tariff relief. Meanwhile, a source familiar with White House discussions indicated that no plans are currently underway for an in-person meeting between the two leaders.

China announced on Saturday that it will impose a 100% tariff on Canadian rapeseed oil, oil cakes, and peas, along with a 25% levy on aquatic products and pork from Canada. The move comes as retaliation against tariffs introduced by Canada in October, escalating trade tensions. This marks a new front in a broader trade conflict driven by US President Donald Trump's tariff policies. The tariffs are set to take effect on March 20.

Technical Analysis: Australian Dollar tests nine-day barrier near 0.6300

The AUD/USD pair is trading near 0.6290 on Wednesday, with technical analysis of the daily chart showing the pair remaining below the nine-day Exponential Moving Average (EMA), signaling weakening short-term momentum. Additionally, the 14-day Relative Strength Index (RSI) is positioned slightly below 50, reinforcing a bearish bias.

On the downside, the AUD/USD pair could navigate the region around the five-week low of 0.6187, recorded on March 5.

The AUD/USD pair tests immediate resistance at a nine-day EMA of 0.6294, followed by the 50-day EMA at 0.6306. A break above this level could strengthen short-term momentum, potentially pushing the pair toward the three-month high of 0.6408, last reached on February 21.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

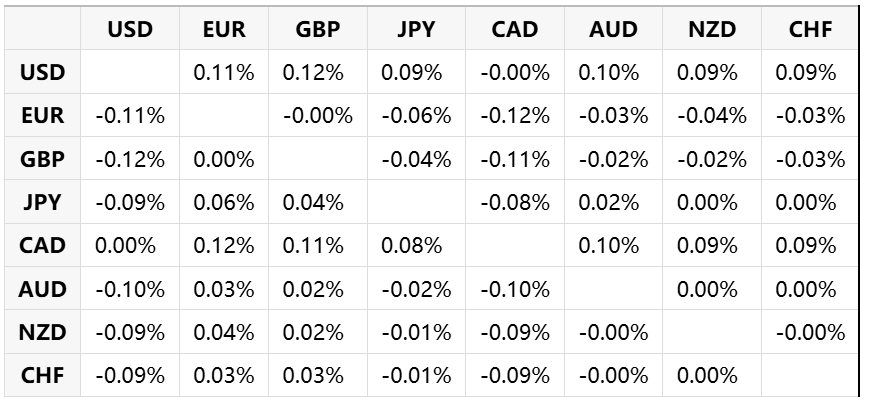

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.