Australian Dollar appreciates as US Dollar loses ground amid US growth concerns

The Australian Dollar gains momentum as investors react to concerns over a potential slowdown in the US economy.

The AUD finds support from stronger-than-expected GDP growth and robust trade data from Australia.

San Francisco Fed President Mary Daly noted that rising uncertainty among businesses could dampen demand in the US economy.

The Australian Dollar (AUD) rebounded on Monday, recovering losses from the previous two sessions against the US Dollar (USD). The AUD/USD pair's upward movement was primarily driven by concerns over a potential slowdown in the US economy.

The Aussie Dollar also received support from stronger-than-expected GDP growth and trade data from Australia released last week. On the monetary policy front, the latest Reserve Bank of Australia (RBA) Meeting Minutes indicated caution regarding further interest rate cuts, clarifying that February’s rate reduction does not signal a commitment to continued easing.

However, the AUD may have faced downward pressure following disappointing Chinese Consumer Price Index (CPI) data for February, given China’s role as Australia’s largest trading partner, released on Saturday.

Moreover, China announced on Saturday that it will impose a 100% tariff on Canadian rapeseed oil, oil cakes, and peas, along with a 25% levy on aquatic products and pork from Canada. The move comes as retaliation against tariffs introduced by Canada in October, escalating trade tensions. This marks a new front in a broader trade conflict largely driven by US President Donald Trump's tariff policies. The tariffs are set to take effect on March 20.

Australian Dollar appreciates as US Dollar declines amid concerns over US economy

The US Dollar Index (DXY), which measures the US Dollar against six major currencies, is losing ground for the fifth consecutive day, trading around 103.80 at the time of writing. However, the downside of the Greenback could be limited as the US Treasury yields rise.

The US Bureau of Labor Statistics (BLS) showed on Friday that Nonfarm Payrolls (NFP) increased by 151,000 in February, falling short of the expected 160,000. January’s job growth was also revised downward to 125,000 from the previously reported 143,000.

San Francisco Fed President Mary Daly stated late Sunday that increasing uncertainty among businesses could weaken demand in the US economy but does not warrant a change in interest rates. Daly noted that business leaders in her district are expressing growing concerns about the economy and policy, which research indicates could dampen demand.

US Commerce Secretary Howard Lutnick stated on Sunday that the 25% tariffs, imposed by President Donald Trump in February, on steel and aluminum imports, set to take effect on Wednesday, are unlikely to be postponed, according to Bloomberg. While US steelmakers have urged Trump to maintain the tariffs, businesses reliant on these materials may face increased costs.

President Trump stated on Sunday that he anticipates a positive outcome from the US discussions with Ukrainian officials in Saudi Arabia. Trump also mentioned that his administration has considered lifting an intelligence pause on Ukraine, is evaluating various aspects of tariffs on Russia, and is not worried about military exercises involving Russia, China, and Iran, according to Reuters.

Australia’s GDP grew by 0.6% quarter-over-quarter in the fourth quarter of 2024, surpassing Q3’s 0.3% expansion and beating market expectations of 0.5%. On an annual basis, GDP climbed to 1.3% in Q4 from 0.8% in the prior quarter.

Australia’s trade surplus rose to 5,620 million in January, surpassing the expected 5,500 million and improving from the previous 4,924 million (revised from 5,085 million). Exports climbed 1.3% month-over-month from the prior month, reaching an 11-month high driven by non-monetary gold. Meanwhile, imports declined by 0.3% MoM, following a sharp 5.9% increase in the previous month, according to the Australian Bureau of Statistics.

Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser highlighted that global trade uncertainty is at a 50-year high. Hauser warned that uncertainty stemming from US President Donald Trump's tariffs could prompt businesses and households to delay planning and investment, potentially weighing on economic growth.

China’s Consumer Price Index fell by 0.7% year-over-year in February, exceeding market expectations of a 0.5% decline and reversing the 0.5% increase recorded in the previous month. This marks the first instance of consumer deflation since January 2024, driven by weakening seasonal demand after the Spring Festival in late January. On a monthly basis, CPI inflation stood at -0.2% in February, down from January’s 0.7% and softer than the expected -0.1%.

China's Producer Price Index (PPI) declined by 2.2% year-over-year in February, slightly exceeding market expectations of a 2.1% drop. This follows a 2.3% decrease in the previous two months and represents the slowest decline since August 2024.

Technical Analysis: Australian Dollar tests nine-day EMA near 0.6300

AUD/USD is trading near 0.6320 on Monday, with technical analysis of the daily chart indicating the pair remains slightly above the nine-day Exponential Moving Average (EMA), suggesting strengthening short-term momentum. Additionally, the 14-day Relative Strength Index (RSI) stays above 50, reinforcing a bullish outlook.

On the upside, the first resistance appears at the psychological level of 0.6400, followed by the three-month high of 0.6408, recorded on February 21.

The immediate support for AUD/USD is at the nine-day EMA of 0.6301. A break below this key level could trigger further declines, potentially retesting the five-week low of 0.6187, recorded on March 5.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

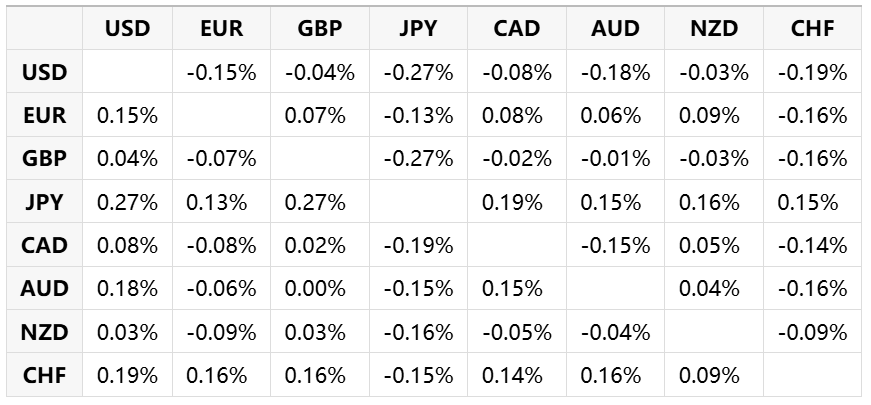

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.