The Australian Dollar holds steady after the release of key domestic economic data.

Australia’s trade surplus increased to 5,620M in January, exceeding the forecast of 5,500M and improving from the previous 4,924M.

The US Dollar remains subdued as risk sentiment improves following President Trump’s tariff strategy shift.

The Australian Dollar (AUD) holds ground for the fourth consecutive day on Thursday. However, the AUD/USD pair gains ground as the US Dollar (USD) remains subdued amid improved risk sentiment, following another shift in US President Donald Trump’s tariff strategy.

The White House announced on Wednesday that President Trump is temporarily exempting automakers from newly imposed tariffs on Mexico and Canada for one month. Additionally, Trump is considering excluding certain agricultural products from tariffs on Canada and Mexico, according to a Bloomberg reporter on X late Wednesday.

Australia’s trade surplus rose to 5,620 million in January, surpassing the expected 5,500 million and improving from the previous 4,924 million (revised from 5,085 million). Exports climbed 1.3% month-over-month from the prior month, reaching an 11-month high driven by non-monetary gold. Meanwhile, imports declined by 0.3% MoM, following a sharp 5.9% increase in the previous month, according to the Australian Bureau of Statistics.

Building permits in Australia surged 6.3% month-on-month in January, significantly accelerating from an upwardly revised 1.7% growth in December. This marks the second consecutive month of expansion and the fastest pace since last July.

Meanwhile, geopolitical tensions remain a concern. A spokesperson for the Chinese foreign ministry stated late Wednesday that China is prepared to fight "any type" of war in response to President Trump’s escalating trade tariffs, per BBC. This could weigh on the Australian Dollar, given China’s status as Australia’s largest trade partner.

Australian Dollar appreciates as US Dollar struggles amid US growth concerns

The US Dollar Index (DXY), which measures the USD against six major currencies, trades around 104.30 at the time of writing. The Greenback faced downward pressure amid concerns over slowing US economic momentum.

The US ADP Employment Change for February reported just 77K new jobs, falling significantly short of the 140K forecast and well below March’s 186K figure. Traders are now closely watching Friday’s US Nonfarm Payrolls (NFP) report, which is expected to show a modest rebound in job growth. Projections suggest net job additions will rise to 160K in February, up from January’s subdued 143K.

The Federal Reserve’s (Fed) Beige Book for March carries added significance as concerns grow over the economic impact of President Trump’s trade policies. Signs of strain are emerging within the US economy, even before the full implementation of his trade measures.

US Commerce Secretary Howard Lutnick stated in a televised interview on Fox News that President Trump may reconsider his tariff policy less than 48 hours after its implementation. Lutnick indicated that if the USMCA rules are followed, Trump is considering offering relief. President Trump's 25% tariffs on goods from Canada and Mexico took effect on Tuesday, alongside a doubling of duties on Chinese imports to 20%.

US ISM Manufacturing PMI came in at 50.3, slightly below the 50.5 forecast and down from January’s 50.9. In contrast, S&P Global’s final Manufacturing PMI for February surpassed expectations at 52.7, improving from its preliminary reading.

Australia's Gross Domestic Product (GDP) expanded by 0.6% quarter-over-quarter in Q4 2024, surpassing the 0.3% growth in Q3 and exceeding market expectations of 0.5%. On an annual basis, GDP grew by 1.3% in Q4, up from 0.8% in the previous quarter.

The Judo Bank Composite Purchasing Managers’ Index (PMI) declined to 50.6 in February from 51.1 in January, marking the fifth consecutive month of growth in business activity, albeit at a slower pace. The Services PMI also eased to 50.8 from 51.2, reflecting continued expansion for the thirteenth straight month, though at a moderated rate.

Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser highlighted that global trade uncertainty is at a 50-year high. Hauser warned that uncertainty stemming from US President Donald Trump's tariffs could prompt businesses and households to delay planning and investment, potentially weighing on economic growth.

China’s Services Purchasing Managers’ Index (PMI) unexpectedly rose to 51.4 in February from 51.0 in January, exceeding market expectations of 50.8.

Chinese authorities announced early Wednesday that they are setting a target of approximately 5% economic growth for 2025, with a 2% goal for the Consumer Price Index (CPI). Additionally, China plans to implement a proactive fiscal policy while ensuring stability in both the real estate and stock markets.

Australian Dollar holds position above 0.6300, nine-day EMA support

AUD/USD is trading near 0.6330 on Thursday, with technical analysis of the daily chart showing an upward movement within a newly formed ascending channel pattern, indicating a bullish bias. The 14-day Relative Strength Index (RSI) remains above 50, further supporting the bullish outlook.

On the upside, the first resistance is around the upper boundary of the ascending channel at 0.6380, followed by the three-month high of 0.6408, recorded on February 21.

The immediate support is at the 50-day Exponential Moving Average (EMA) of 0.6310, followed by the nine-day EMA at 0.6296. Additional support is found at the lower boundary of the ascending channel at 0.6270. A break below this level could lead to further declines toward the four-week low of 0.6187, recorded on March 5.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

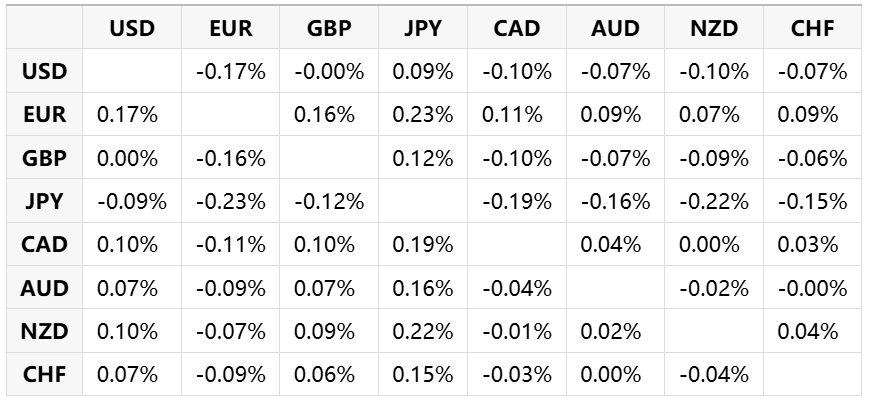

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.