Australian Dollar remains subdued following RBA Meeting Minutes, Retail Sales data

The Australian Dollar remains under pressure as the RBA’s February Meeting Minutes highlight downside risks to the economy.

Australia’s Retail Sales rose by 0.3% MoM in January, recovering from a 0.1% decline in December.

The US Dollar weakened after European leaders voiced support for security guarantees for Ukraine, improving risk sentiment across global markets.

The Australian Dollar (AUD) retreats against the US Dollar (USD) on Tuesday, giving up recent gains. The AUD/USD pair remains under pressure following the release of the Reserve Bank of Australia (RBA) Meeting Minutes and Retail Sales data.

The RBA’s February Meeting Minutes highlighted downside risks to the economy. While the Board acknowledged the labor market's strength as a key reason to maintain rates, it noted that the current tightness was inconsistent with a 2.5% inflation target. Ultimately, the Board saw a stronger case for cutting rates.

Australia’s Retail Sales, a key indicator of consumer spending, increased by 0.3% month-over-month in January, rebounding from a 0.1% decline in December. However, the ANZ-Roy Morgan Australian Consumer Confidence Index dropped to 87.7 from 89.8 the previous week, when it had reached its highest level since May 2022.

The AUD also faces downward pressure after the White House confirmed that US President Donald Trump signed an order raising tariffs on Chinese imports to 20%. Notably, Trump has yet to finalize similar orders for Mexico and Canada. Given China’s role as a major trading partner for Australia, any economic shifts in China could significantly impact the Australian Dollar.

The Australian Financial Review Business Summit 2025 kicks off on Tuesday, featuring industry leaders. David Solomon, Chairman and CEO of The Goldman Sachs Group, is scheduled to speak on Tuesday, while Andrew Hauser, Deputy Governor of the Reserve Bank of Australia, will address attendees on Wednesday.

Australian Dollar weakened after Trump signed order raising 20% tariffs on Chinese imports

The US Dollar Index (DXY), which measures the USD against six major currencies, remains subdued around 106.50 at the time of writing. The Greenback faces downward pressure as optimism over a potential Ukraine peace deal dampens demand for safe-haven assets. European leaders have expressed support for security guarantees for Ukraine, boosting risk sentiment across global markets.

United States (US) economic data on Monday presented mixed signals. The ISM Manufacturing PMI came in at 50.3, slightly below the 50.5 forecast and down from January’s 50.9. In contrast, S&P Global’s final Manufacturing PMI for February surpassed expectations at 52.7, improving from its preliminary reading.

The US PCE inflation report met expectations, with the monthly headline PCE holding steady at 0.3%. Core PCE rose slightly to 0.3% from December’s 0.2%, while the annual headline PCE stood at 2.6%, slightly exceeding projections but unchanged from December’s figure. Core PCE eased to 2.6%, down from a revised 2.9% in December.

According to Bloomberg, citing a defense official, the US has "paused" all current military aid to Ukraine. The official stated that all US military equipment not yet in Ukraine would be halted, including weapons in transit via aircraft and ships, as well as those waiting in transit areas in Poland. The pause was reportedly ordered by President Trump, with Defense Secretary Pete Hegseth directed to implement the decision.

Tensions escalated between US President Donald Trump and Ukrainian leader Volodymyr Zelenskyy during peace deal negotiations on Friday. Zelenskyy was expected to sign an agreement granting the US greater access to Ukraine's rare earth minerals and participate in a joint press conference, but the plan was abandoned after a heated exchange between the leaders in front of the media. Following the confrontation, in which Trump openly expressed his disdain, top advisers asked Zelenskyy to leave the White House.

The S&P Global Australia Manufacturing Purchasing Managers Index (PMI) was revised down to 50.4 in February from an initial estimate of 50.6 but remained above January's 50.2. This marked the second consecutive month of improvement in manufacturing conditions and the strongest growth since February 2023.

Australia’s TD-MI Inflation Gauge fell by 0.2% month-over-month in February, reversing a 0.1% rise in January. This marked the first decline since last August and followed the Reserve Bank of Australia's (RBA) decision to cut its cash rate by 25 basis points to 4.1% during its first monetary policy meeting of the year, reflecting a continued slowdown in underlying inflation. However, on an annual basis, the gauge rose by 2.2%, slightly below the previous 2.3% increase.

China's Caixin Manufacturing Purchasing Managers' Index (PMI) rose to 50.8 in February from January’s 50.1, exceeding market expectations of 50.3. NBS Manufacturing PMI improved to 50.2 in February versus 49.1 prior. This figure came in stronger than the 49.9 expected. Meanwhile, the NBS Non-Manufacturing PMI climbed to 50.4 in February from 50.2 in January, beating the estimation of 50.3.

Australian Dollar maintains position above 0.6200 support despite ongoing bearish pressure

AUD/USD is trading near 0.6210 on Tuesday, remaining under pressure as it hovers below the nine-day Exponential Moving Average (EMA). This positioning signals weakening short-term momentum. Additionally, the 14-day Relative Strength Index (RSI) remains below 50, reinforcing the bearish outlook.

Despite the downward pressure, the pair is holding above key support at the psychological level of 0.6200. A break below this level could push the price toward 0.6087, its lowest level since April 2020, recorded on February 3.

On the upside, initial resistance is at the nine-day EMA of 0.6266, followed by the 50-day EMA at 0.6304. A decisive break above the latter could strengthen short-term momentum, potentially leading to a retest of the three-month high of 0.6408, reached on February 21.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

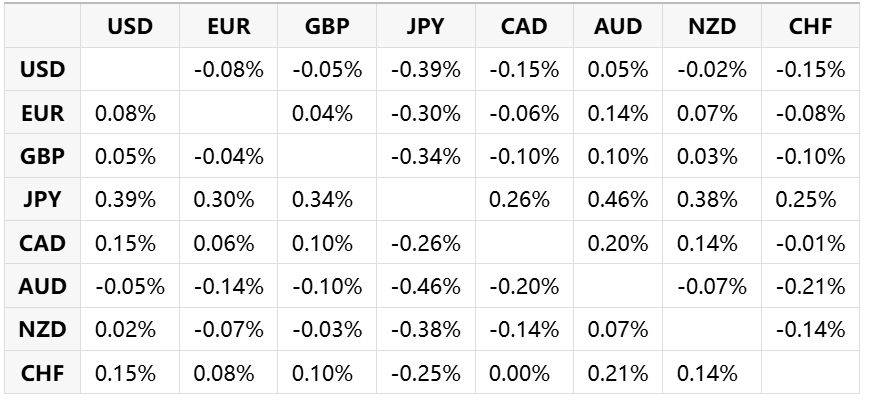

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.