Bank of Japan Interest Rate Decision Preview: Pause on Rate Hikes Already Priced In, Minimal Market Movement Expected on the Day

On 19 March 2025, the Bank of Japan (BoJ) will announce its March interest rate decision. The market widely expects the central bank to maintain its policy rate unchanged at 0.5%. We align with this consensus forecast.

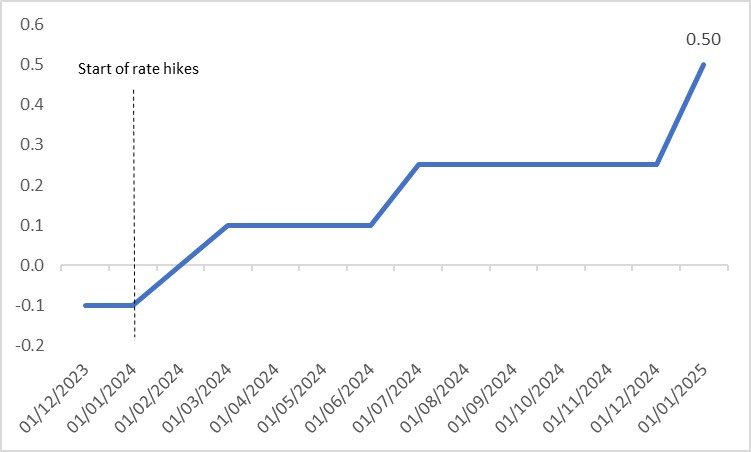

In March of last year, the BoJ ended its long-standing negative interest rate policy and implemented its first rate hike in over a decade (Figure 1). This marked a turning point in the BoJ’s monetary policy and the beginning of normalization. Looking ahead, we believe the central bank has momentum for further rate hikes this year, though the path will remain cautious. As such, a pause in March appears reasonable.

Figure 1: BoJ policy rate (%)

Source: Refinitiv, Tradingkey.com

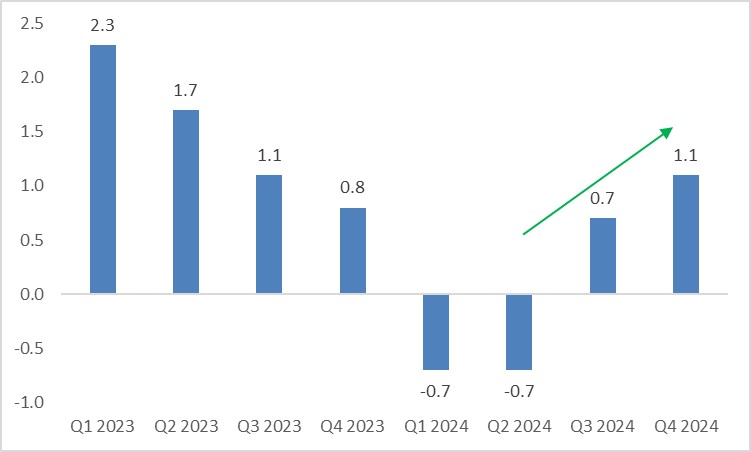

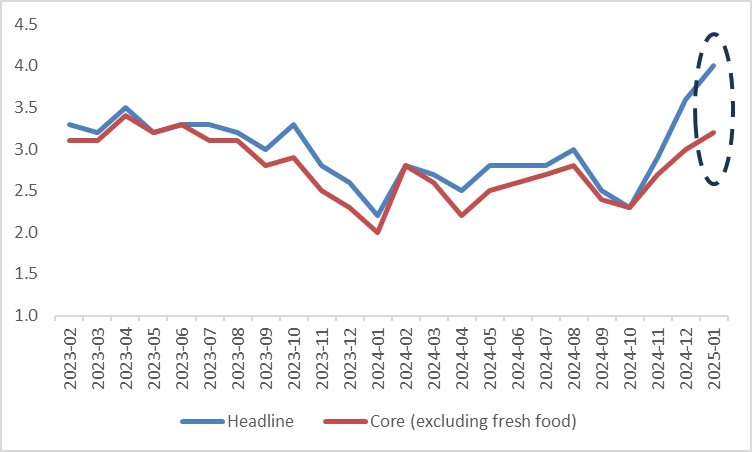

Japan’s economy began recovering in the second half of last year (Figure 2) and with persistent tightness in the labour market, headline CPI has steadily risen from a low of 2.3% year-on-year in October last year to 4% in January this year. Meanwhile, core CPI (excluding fresh food) climbed to 3.2% (Figure 3). Elevated inflation suggests that the BoJ’s monetary policy will continue to normalize throughout 2025.

Figure 2: Japan's real GDP growth (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Figure 3: Japan inflation (%)

Source: Refinitiv, Tradingkey.com

Nominal wages in Japan have grown for 37 consecutive months, with a year-on-year increase of 2.8% in January. However, in an environment of high inflation, real wages remain negative. Declining real wages have constrained consumption growth, supporting the BoJ’s decision to pause rate hikes in the near term.

Moreover, external uncertainties—particularly the unpredictability of Trump’s tariffs—add complexity to Japan’s economic growth, inflation and the BoJ’s rate hike trajectory. Recently, BoJ Governor Kazuo Ueda expressed “significant concern” in parliament about uncertainties surrounding overseas economic and political developments.

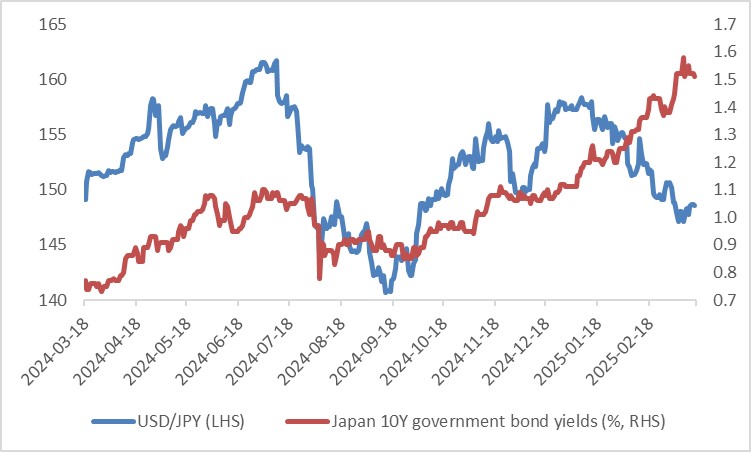

In summary, we anticipate the BoJ will implement one to two additional rate hikes in the second half of this year. Since the decision to maintain the current policy rate in March has already been priced into markets, we expect minimal market reaction following the announcement. However, if the BoJ unexpectedly raises rates on 19 March, we anticipate a subsequent rise in both the yen and Japanese government bond yields (Figure 4).

Figure 4: USD/JPY and Japan government bond yields

Source: Refinitiv, Tradingkey.com

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.