USD/JPY Price Forecast: Slips below 150.00 on USD weakness

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

USD/JPY drops 0.53%, closing below 150.00 as broad USD weakness pressures pair.

Price action below Ichimoku Cloud signals renewed bearish bias; key support seen at 149.35/42.

Break below support may target 148.18 low, while reclaiming 150.00 reopens path toward 151.72 SMA confluence.

The USD/JPY trimmed some of Monday’s gains, losing over 0.53% on Tuesday and dropping below the 150.00 figure as the US dollar weakened across the board. As Wednesday’s Asian session begins, the pair trades at 149.90, virtually unchanged.

USD/JPY Price Forecast: Technical outlook

USD/JPY made a U-turn on Tuesday, achieving a daily close below 150.00, which opened the door to hit a daily low of 149.55, slightly above the confluence of the Tenkan and Kijun-sen near 149.35/42. As price action stood below the Ichimoku Cloud (Kumo), the downtrend has resumed, but a decisive break below the 149.35/42 range could open the door to challenge the March 20 swing low of 148.18.

On the other hand, buyers reclaiming 150.00, the USD/JPY could be poised to test weekly highs of 150.94, which, if surpassed, could pave the way to test the confluence of the 50-day and 200-day Simple Moving Averages (SMAs) at 151.53/72.

USD/JPY Price Chart – Daily

Japanese Yen PRICE This week

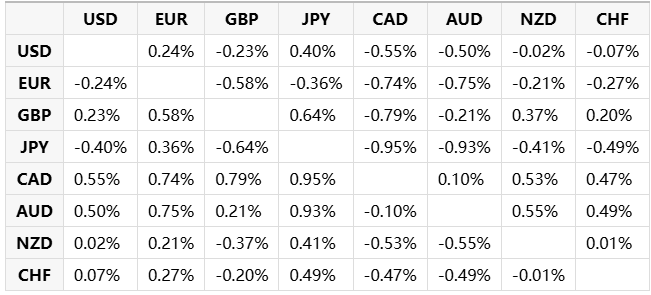

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.